Guide to Financial Advice: Help With Big Money Matters

By Boring Money

27 May, 2025

The basics of financial advice

Traditional financial advice is a personalised, regulated service delivered by a qualified human adviser. It goes beyond general suggestions (like financial guidance) or digital algorithms (like digital advice) – it’s about building a long-term financial plan tailored to your individual goals, life circumstances, and risk tolerance.

The process usually starts with a fact-finding meeting – either in person or online – where your adviser gathers detailed information about your current finances. This may include:

Your income, savings, and spending habits

Existing pensions, investments, and debts

Family circumstances, dependents, and long-term goals

Attitude to risk and investment preferences

From this, financial advisers build a plan and recommend specific products or strategies tailored to your needs. For example, if you're seeking help with pension planning, your adviser may be able to suggest strategies to help you maximise your savings, providers which offer the best pension for you, and whether you should opt for drawdown or annuity when you retire.

Unlike lighter-touch services such as financial guidance and digital advice, fully-fledged financial advice firms and advisers must be authorised and regulated by the Financial Conduct Authority (FCA). If your chosen firm or adviser is not on the FCA register, they're not legally authorised to give you financial advice and you have fewer protections should things go wrong and you lose money as a result.

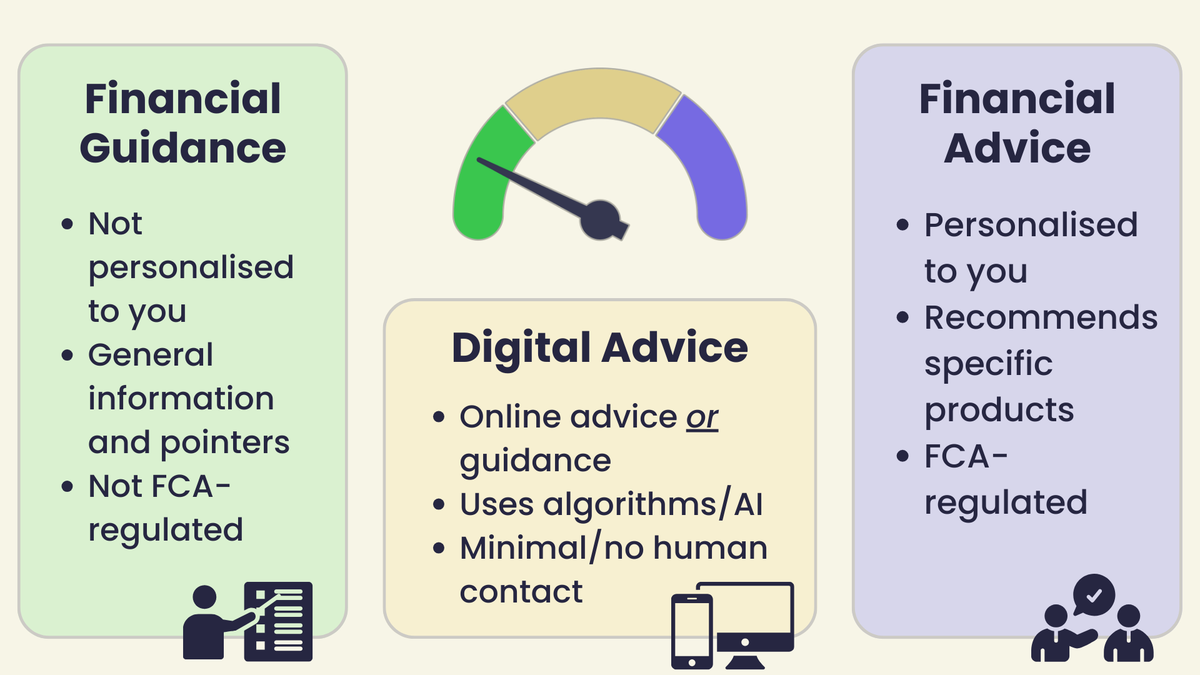

Advice vs digital advice vs guidance

Not all money help is created equal - and not all of it is regulated. There are several terms related to financial advice you may come across, and knowing the difference between them can save you from costly confusion.

| Financial advice | Digital advice | Financial guidance |

Personalised | Yes | Sometimes | No |

FCA-regulated | Yes | Only if offering full advice | No |

Legal protection | Yes | Only if regulated | No |

Delivered by | Qualified, regulated human financial advisers | Algorithms or hybrid human+tech models | Websites and apps |

Best for | People with complex finances or large portfolios | People with simpler needs | People with general questions about money |

Financial advice is fully regulated, tailored to your individual needs, and ideal for more complex financial planning.

Digital advice can be either guidance or actual advice, depending on the platform you choose. Some use algorithms only; others offer hybrid models that include human input. Always check if it's FCA-regulated.

Financial guidance gives you general info and suggestions, but no personalised advice or recommendations. It’s great for learning but offers no legal protection if you act on it.

Is financial advice right for me?

Do you have a complex financial situation and/or significant amounts of capital to invest, with tax planning and investment management being a high priority? Or do you need help navigating big future life events like retirement, a career change, or generally trying to find a better balance between your time and your money?

The pros of financial advice

✅ Personalised and holistic

A good adviser gets to know you – not just your numbers. This means advice that fits your life goals, emotional comfort with risk, and the quirks of your situation. It's ideal for things like retirement planning, tax optimisation, or navigating major life changes like divorce, inheritance, or selling a business. Advisers often work with your accountant or solicitor if needed, and can spot gaps or risks you wouldn’t find on your own. It’s a joined-up approach to your money.

✅ Regulated and protected

Traditional advice comes with proper FCA oversight. You’re protected if something goes wrong, and advisers are held to strict standards around suitability, transparency, and professionalism. If you receive bad advice and suffer a financial loss, you may be eligible for compensation through the Financial Services Compensation Scheme (FSCS). You also have the right to complain to the Financial Ombudsman Service. That’s peace of mind you don’t get with guidance or many digital tools.

✅ Long-term relationship and support

You can build an ongoing relationship with your adviser, checking in yearly or when your life changes. This continuity helps keep your plan on track and your goals front of mind. Many people value the emotional support too - someone to talk to when markets wobble or life takes an unexpected turn. An adviser can act as a sounding board and stop you from making knee-jerk decisions that hurt in the long run.

The cons of financial advice

❌ Typically expensive

Traditional financial advice isn’t cheap, but it’s not meant to be. You’re paying for tailored expertise, face-to-face support, and regulated service, which naturally costs more than app-based tools or generic guidance. While some advisers offer competitive pricing, others may charge more depending on their experience, firm size, or client base.

The structure of fees can also feel complex or opaque, especially when charges are based on percentages of your assets. That can make it tricky to compare costs across different advisers or to understand the total amount you'll pay over time. It’s important to ask for clarity upfront – not just how much you're paying, but what you're getting for it.

❌ High minimum thresholds

Many advisers won’t take on clients with less than £50,000 to invest. This can make traditional advice feel out of reach for those just starting out or with smaller savings pots. Some advisers are more flexible, so it’s worth shopping around. But if your needs are simple, you may be better served by digital tools or guidance.

❌ Slower and less flexible

You’ll usually need to book meetings, fill out paperwork, and wait for reports. It’s not instant, and may feel slower compared to the click-and-go style of digital advice. Also, if your adviser is old-school, you might find yourself posting documents or signing things by hand. Not always ideal in an age of apps and instant messaging.

Top questions on financial advice

How much does financial advice cost?

The cost of financial advice can vary widely depending on what service you need, who you go for and the charging model they offer. Financial advice can be charged as any of the following:

An hourly rate (typically between £150 - £250 per hour)

A set fee according to the work involved (e.g. £900 inc. VAT)

An annual or monthly retainer (typically 0.5% - 2.25% per year)

A percentage of the money invested (e.g. 3% of your total assets)

Generally speaking, financial advisers can range from as little as £150 an hour or they can stretch into the thousands of pounds, depending on the value of your assets.

How do I know if an adviser is regulated by the FCA?

You can check the FCA Register online to confirm if a financial adviser or firm is authorised. If they’re not on the register, they’re not allowed to give regulated financial advice – and you won’t have access to legal protections like the Financial Ombudsman or the Financial Services Compensation Scheme (FSCS).

What’s the difference between restricted and independent advice?

Independent financial advisers (IFAs) and firms recommend products from the whole of the market, while restricted advisers only offer advice on a limited range – sometimes just their own company's products. Neither is necessarily "better", but it’s crucial to ask which one you’re dealing with, as it affects the scope of the advice you're getting.

For example, a restricted adviser could still be experienced, well-qualified, and perfectly suitable for your needs – especially if their panel includes strong, competitive products. But if you want access to the widest possible range of options, or want peace of mind that you're seeing everything the market has to offer, independent advice is likely the better fit.

How do I find a financial adviser I can trust?

When choosing a financial adviser, it’s worth checking out client reviews and online feedback to get a sense of their reputation. Look them up on platforms like Twitter or LinkedIn; What kind of tone do they use, and do they seem approachable and professional? Trust your instincts here; your gut feeling can be a useful guide.

Make sure to check their qualifications too. Titles like Certified Financial Planner (CFP) or Chartered Financial Planner indicate that the adviser has completed rigorous exams and meets high technical standards.

Transparency is also key. Are they open and honest when discussing fees and charges? If you find percentages confusing, ask them to break down the likely costs in pounds and pence so you know exactly what to expect – and make sure this includes everything, not just the headline fees.

Finally, consider how they interact with your partner or family. Do they make your spouse feel included? Could you see them being a steady, reliable support if something ever happened to you? A great adviser isn’t just good with money - they’re someone you trust to be part of your family’s long-term financial journey.

What will your client/adviser relationship look like? Will you meet in person or virtually? How often can you contact them outside of scheduled meetings? How much help can they give you on other personal finance questions? It's important you have an open and easy relationship with your adviser; asking these questions will give you a good feel on how the relationship will develop over time.

Can I switch advisers if I'm not happy?

Absolutely. You’re not tied in for life, and you shouldn’t feel stuck with a financial adviser who isn’t meeting your needs or expectations. If the relationship isn’t working - whether that’s due to poor communication, lack of transparency, high fees, or just a general mismatch - you have every right to take your business elsewhere.

Most advisers will help facilitate a smooth transfer of your records, investments, and any ongoing plans to your new adviser. You may need to fill out some paperwork, and depending on how your fees are structured, there could be exit charges (especially if you're in certain investment products or platforms). That’s why it’s a good idea to review your agreement and ask for a breakdown of any costs before switching.

If you’re unhappy due to poor advice or feel that something has gone wrong, you can also complain to the firm directly, or escalate to the Financial Ombudsman Service if it’s not resolved.

Key takeaways on financial advice

✅ Best for complex, long-term planning

Traditional financial advice is best suited to people with significant assets, multiple financial goals, or complicated family or tax situations. If you’re navigating things like pensions, property, inheritance, or business ownership, having a dedicated adviser can make a big difference. They take a deep dive into your full financial picture and build a long-term strategy that evolves with you, not just a one-off recommendation.

🌐 Make sure it's regulated and reliable

With traditional advice, you’re getting a regulated service with built-in protections. Advisers are authorised by the Financial Conduct Authority (FCA) and must act in your best interests. If something goes wrong, you may be covered by the FSCS or have access to the Financial Ombudsman. You’re not left to decipher generic blog posts or trust a robot to understand your goals – this is expert help, with accountability.

💸 Worth it if you can afford it

Let’s not sugar-coat it: traditional advice can be expensive. You might pay an hourly rate, a flat fee, or a percentage of the money invested - and in some cases, that can run into the thousands every year. But for the right person, it’s money well spent. A good adviser can save you from costly mistakes, improve your tax position, and help your investments work harder. If you’ve got enough assets to benefit from that level of optimisation, the value can far outweigh the cost over time.