Dodl - a new low-cost investment app

22 April, 2022

AJ Bell Youinvest has announced the launch of Dodl, a low-cost investment app aimed at a younger audience who are starting out their investment journey.

The app is very simple. Users have three choices. You can either buy:

A Ready-Made mixed bag of investments, curated for you by the investment team at AJ Bell – with a range of risk profiles to meet your requirements

A range of low-cost ‘tracker funds’ – so you can access big global markets such as the UK’s FTSE100 with minimum hassle

A collection of big brand shares sorted into themed collections such as Travel, Shopping, Food and Raw Materials.

Anyone who wants some active funds, a broader choice of investments, fancier research and report or indeed a Junior ISA will need to look elsewhere.

But it’s a pretty low-cost way to manage your money. A good choice for people who want to start investing in a sensible, diversified low-cost way, and don’t get off on the idea of constant tweaking, trading and fiddling.

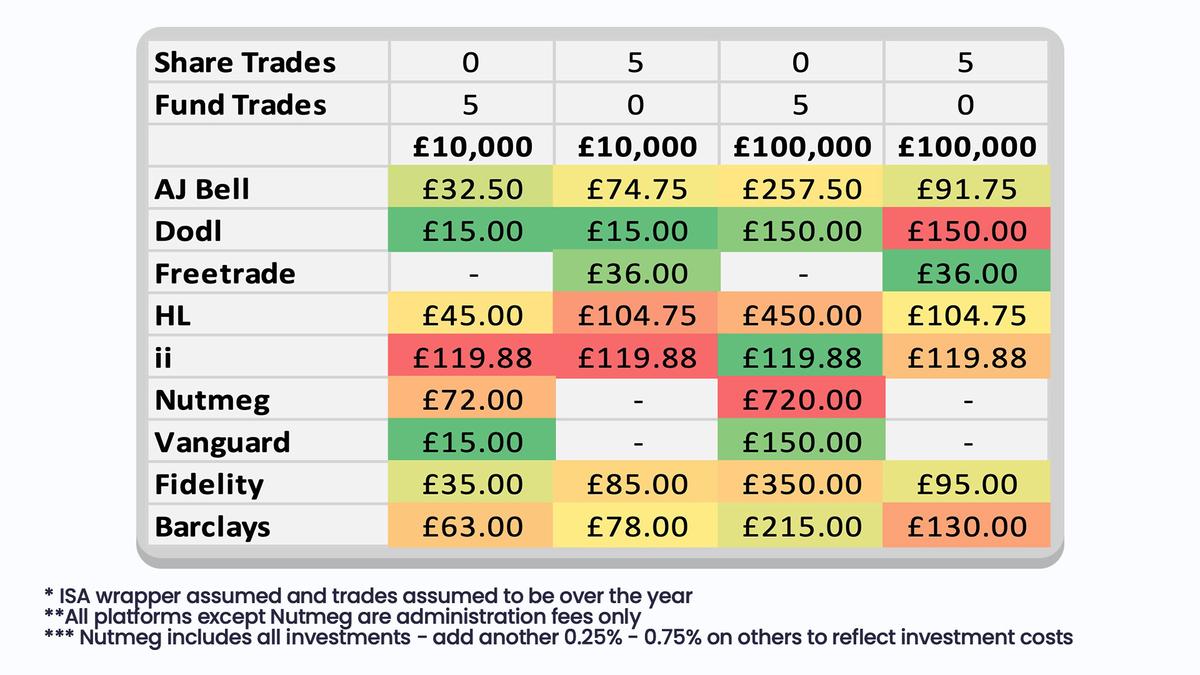

Here’s a comparison table of how Dodl stacks up against other competitors when it comes to cost. We’ve picked a selection of providers from robo advisers (eg Nutmeg), trading apps (eg Freetrade) and full-service investment options (eg Hargreaves Lansdown). Nutmeg is a robo-advisor which means that the costs shown for them include all investments because these are all packaged up. All other provider costs just show administration costs – you will need to add the costs of whichever investments you choose and add them in for a fair comparison. For a £10,000 ISA these investment costs would likely be another £25 - £80 depending on what you pick. And for the £100,000 example, another £250 - £800.

Dodl costs shown for £10k and £100k portfolios

And finally we’ll leave you with a quiz.

Which of these is an actuary and the CEO of AJ Bell? And which one is a fluffy monster!? :0)