Holly's Blog - Big Macs and Tighter Belts

29 July, 2022

This week, in a piece of bleak economic news, it was confirmed that a McDonald's cheeseburger is to go up by 20p. Holy Cow! (geddit?) The first increase in 14 years. I haven’t had a McDonald's since a 3am foray to a drive through in Melbourne back in 2003…..that was a good night….…

Amazing how much correlation there is between burgers and economics. The “Big Mac Index” is what happens when you leave a bunch of boffins at The Economist to HobNob over some fast food. The basic idea is that the natural resting point of a currency should be somewhere which means that the same basket of goods costs about the same in every country around the world. This is known as Purchasing-Power Parity. Or PPP.

PPP basically means that if the exchange rate is perfectly pitched, your Big Mac should cost the same in every country. So if the exchange rate is £1 to $2 (humour me on this), a Big Mac should cost £1 in London and $2 in New York. If it doesn’t, the exchange rate in a country is either too feeble or too overcooked.

Brainfry…

As The Economists got increasingly animated, someone smart pointed out that a McAloo Tikki burger flipper in Delhi is paid less than a burger flipper in San Francisco. So you would expect the burger to be cheaper in India and any price difference is not just down to the exchange rate, but differences in labour costs.

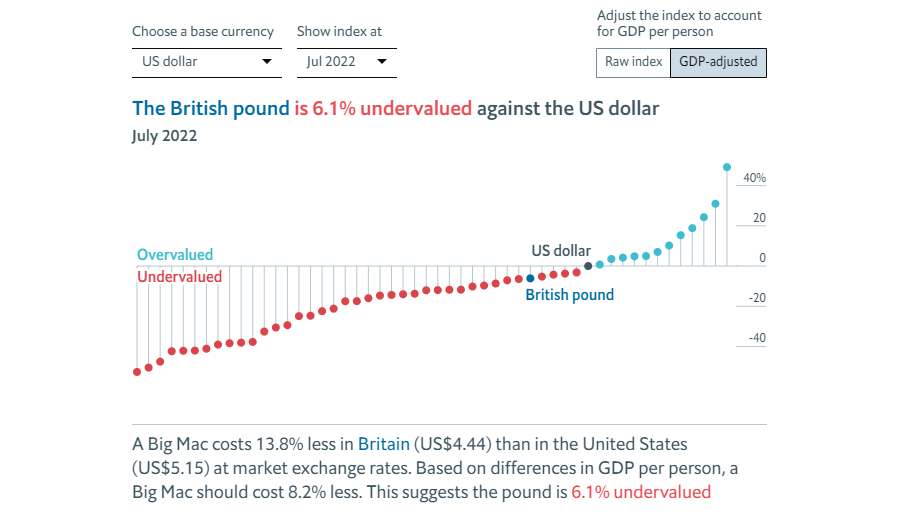

Shrieking with excitement, the boffins then cooked up the “GDP-adjusted” index which says that even after factoring in said burger flipper cost variables, there are STILL some differences which MUST mean that the currencies are out of whack.

If we take this index and look at the poor old British pound in July, the GDP-adjusted Big Mac index shows that the pound is over 6% undervalued.

As a final fact, people without much of a social life may care to know that according to the Big Mac Index, the most overvalued currency in the world today is the Uruguayan peso which is 49% overvalued against the US dollar. A peso-mistic outlook indeed.

Appetite suppressants in the US

There’s a fair chance the pound may well look even more limp against the dollar soon, as the Fed put up interest rates in the US again this week, by another 0.75%, in an attempt to stop everyone from stuffing their financial faces! New data released this week confirmed that the US has technically now entered a recession after 2 consecutive quarters of negative growth (even though most will argue that consumer spending and the labour market remain so strong it’s not really a recession….yet…) The Fed’s balancing act is to put Americans on a diet without starving them in the process.

These higher interest rates make the US and its currency more appealing for global investors looking for good returns on their cash. So money flows in and the dollar gets stronger.

Although these hikes may not bode well for the long-term economic health of the US, the markets love them. The tech-heavy Nasdaq index gobbled up the news and is up about 5% since Wednesday’s announcement.

Belt-tightening closer to home

Back in the UK, the pundits anticipate yet more interest rate hikes as well. That said, I’m not sure how many increases we’ll face moving forward, given the brutal jumps in energy bills looming. Analysts forecast the average domestic customer will pay £3,244 a year from October, rising to £3,363 a year from January. Or to put it into perspective for you, a bill which costs £100 today will cost £165 from October. Bloody hell.

That has such a serious dent on any household’s spend, it will naturally put the economy on a massive diet.

If you are lucky enough to be sitting on cash savings, some higher rates are starting to trickle through. Investec has launched a new 90-day rate of 2.1% - for balances between £5,000 and £250,000 - which is a good halfway house if you want more than an easy access account, without tying things up for too long.

Ladies – a final shout out

We have been quietly working away, supported by 400+ women readers in their 40s, 50s and early 60s, on a new project we’re launching in the Autumn. We’re about to come back out to this audience for some final help, input, critiques etc. If you fall into this group and are willing to share an opinion, tell us what you want to hear and be a (free) Founder Member of this fantastic new community, please join us. Founder Members will get first dibs on our learning programmes, webinars, Q&As and adviser-run meet-ups so get onboard! You can find out a little more here, and I’ll be writing to you this coming week with an update.

Have a great weekend everyone.

Stay up to date!

Already have an account? Login

Post a comment:

This is an open discussion and does not represent the views of Boring Money. We want our communities to be welcoming and helpful. Spam, personal attacks and offensive language will not be tolerated. Posts may be deleted and repeat offenders blocked at our discretion.