Holly's Blog: Bye Bye BoJo

8 July, 2022

Another quiet news week as groping hands were slapped, swords were sharpened, letters crafted and Boris toppled. As Dominic Cummings squealed with Gollum-like glee.

At times like this, financial markets are actually the place to look if you want to know what people REALLY think. Behind all the “Dear Prime Minister” and “with deep regret” and “I am heartbroken” and “very best wishes” guff. Money doesn’t lie. I always think this when a share price moves down in response to the appointment of a new CEO. 👎That is the most direct 360 degree feedback you can ever get!

As Boris Johnson resigned (or more precisely, promised to resign in the Autumn), the pound lifted against the dollar – which means that people generally think Britain looks like a better bet without him at the helm. However this temporary respite is just one tiny bump in a road full of hardcore potholes.

The next PM will have to battle the ugly cost of living crisis. How to keep inflation under control against a backdrop of strikes, demands for higher wages and painful energy price hikes? On the agenda for the new Chancellor is how to respond to the cost-of-living crisis (short-term popular tax cuts versus a painful soldiering through this), a potential look at cutting fuel duty and also what he does about the proposed hike in corporation tax. The balance that he and the incoming PM take between making people feel happy today, versus making people feel happier in the long-term will be key.

And so now we brace ourselves for the leadership battle. Pass the popcorn. (Or press Snooze!?)

What are markets up to?

The FTSE 100 has been relatively stable over the last 6 months, compared to global markets. Helped by its exposure to oil and mining stocks. Over the last 6 months, it is ‘only’ down about 3% compared to the tech-heavy Nasdaq which is off a blistering 29%. Interestingly, despite this, all the flows data from the industry show that retail investors are still taking money out of the UK and buying US and global share funds.

Our key index was 1% higher yesterday so no tears being shed there as we wave goodbye to BoJo. The S&P and Nasdaq were also up, led in part by higher tech stocks. Generally the mood music from Central Banks is that they will fight inflation aggressively and relentlessly with their available tools – largely higher interest rates. And the market seems to like what it’s hearing from these besuited inflation assassins.

Global financial giant BlackRock sent out an email yesterday about an upcoming webinar to talk about the outlook. Their invite said, “We believe we have entered a new regime that will be shaped by higher macro and market volatility – and higher risk premia.” Huh!? What does this mean in human language?

It means the good old days of a monkey being able to throw a dart at the S&P 500 board and make money pretty easily are over. Markets are likely to keep jumping up and down as people respond to news on things like growth rates and inflation rates. Higher risk premia is a posh way of saying that we’re going to have to look a bit harder to find things which stand a chance of going up by interesting amounts. Because no-one believes that mainstream vanilla ‘boring things’ like bonds and Big Shares are going to do that much over the next few years – especially if we compare them to the interest rate we can get from the bank.

This is why lots of fund managers are looking at things like infrastructure and private equity (think crowdfunding from very rich people for institutions) for sexier returns. Reining in our expectations over the short-term on how much we might make every year from mainstream investments is something we all need to do.

And what about crypto….

Talking of risky stuff, we held an interesting webinar this week with eToro – watch on catch-up - on crypto. What next for this now almost mainstream asset? (This week HMRC reported that 1 in 10 UK adults has, or has held, crypto). It’s damn risky. And it’s fallen from a high of about $68,000 per Bitcoin to about $21,000 today. Gulp.

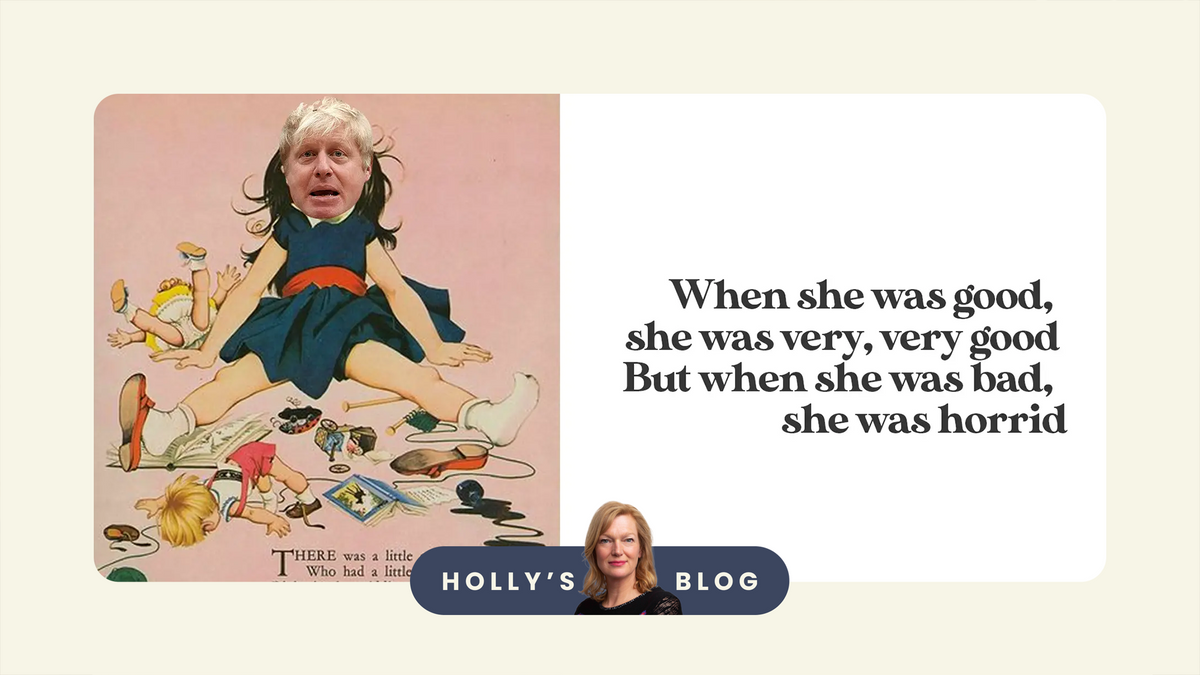

For something so nebulous which still has a whiff of the Emperor’s New Clothes for many, it seems strangely linked (correlated) to mainstream markets. When mainstream markets are happy and trotting up, Bitcoin soars. But when they are tanking, and gloom abides, Bitcoin plummets. It’s like the girl in the nursery rhyme – “When markets were good, Bitcoin was very, very good. But when they were bad, she was horrid.” The main consensus seems to be that Bitcoin and Ethereum are here to stay. But expect a bit more pain ahead – and don’t expect them to rise at a time when other things are not.

Over and out for this week. Have a lovely weekend.

Holly

Stay up to date!

Already have an account? Login