Holly's Blog: Financial Ode to Joy

24 June, 2022

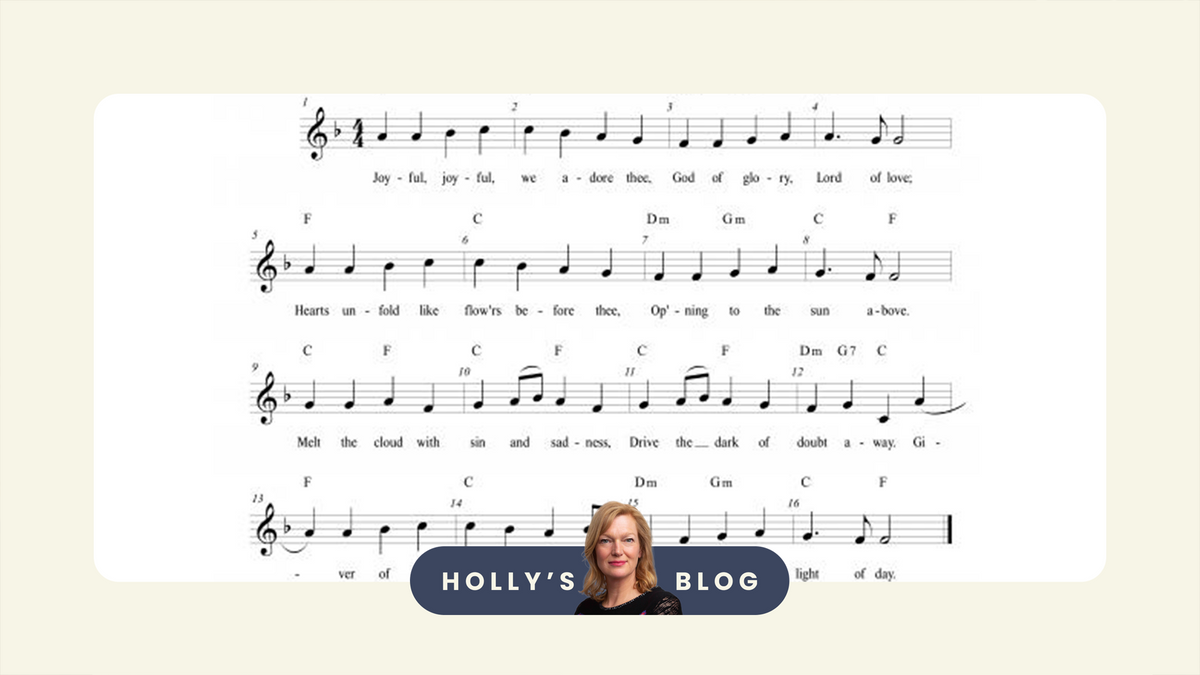

Let’s start with a poem, like all good financial blogs! Here is my Financial Ode to Joy.

No trains. No summer planes.

Disappointing blockchains.

Logging into Hargreaves fries my brain

as global markets feel the pain.

Inflation marching up the food chain

(But pensioners can pop the champagne*)

Our energy bills are progressively insane

As Boris orders some more……..OK let’s stop this here!

The State Pension will go up next year….

*Champagne was an exaggeration but sherry didn’t rhyme. Pensioners may not be happy, but are possibly not unhappy this week, as the return of the ‘Triple Lock’ for next year is confirmed.

The Triple Lock sees the State Pension increase in line with whatever is the biggest number out of price inflation, wage growth or 2.5%. The inflation number is taken from September data – so if inflation is 10% in September, that is what the State Pension will go up by next April. Unfair, you shout? Well, the logic is that pension income is not a factor in the cost of delivery of goods or services. So, unlike higher wages, higher pensions do not feed higher inflation.

But pretty much everything else is going down..or is it??

Bitcoin fell beneath $20,000. Disappointing data in Europe hit stock markets there. Global shares are however on course for their first weekly rise this month. Why??

There seems to be a bit of a guessing game going on. Global data indicates slowing growth. Which is kind of obvious, when you consider how cash strapped everyone feels. We’re spending less and you don’t need an economist to tell you that.

If the economy whizzes out of control on a caffeine high (inflation), things either calm down because we naturally stop spending and adopt decaf. Or because the Central Banks shove up interest rates and make coffee more expensive.

All the data around on slowing growth lends weight to the school of thought that we might need less intervention than was feared. Because if we all naturally stop spending (drinking double shots) they don’t need to forcibly curb our caffeine intake with levers like interest rates.

And if they DON’T put up interest rates so much, then the environment is kinder to companies who spend money to grow – and whose future valuations are higher when interest rates are cheap – and everyone feels more relaxed and stock market valuations go up. So for example, the S&P 500 technology index – very sensitive to interest rates – is up over 3% this week.

That’s the view on Jolly Street. But over on the equally busy Gloomy Street, inflation is still worrying everyone. Over in Oslo, Norges Bank increased borrowing costs by 0.5% to 1.25% this week, becoming the latest country to follow the global monetary stampede.

So we might expect ongoing volatility as the guessing game about the outlook for interest rates and inflation continues, with lots of people scurrying from Jolly Street to Gloomy Street and back again.

So where to look?

It’s hard to know where to look for returns. This week’s sponsor Invesco share a view from their Head of Global Equities, Stephen Anness.

Our readers who enjoy the research might be interested in a recent report from Pictet which looks at the next 5 years in its oddly named Secular Outlook (which is about money, not Martin Luther). It could use a few more jokes and some pictures, but for geeks, it’s a good read. They are fairly upbeat on the potential for Emerging Markets (noting Latin America and China), private equity gets a tick, so do alternatives (“no longer an optional extra”), they are positive on UK shares, a bit ho-hum on the States and don’t bother with bonds. I clearly paraphrase but you get the gist.

The headline view is that they think investors should expect lower than historical returns from mainstream asset classes. For those with greater appetite for risk, Pictet suggests putting almost a quarter of a portfolio into alternatives, leaving a bit less than 30 per cent in bonds and about 50 per cent in equities, with 13 per cent in emerging market stocks.

For those who think that alternatives are the gang of goths that loiter outside McDonalds – don’t panic – I’ll write more on this next week.

And a final note on crypto

As we see crypto seemingly implode, the FT’s Gillian Tett observes that “just as no one in 2001 expected that Amazon would be a global giant two decades later, or that Silicon Valley’s power would keep expanding, so the crypto world in 2042 could be radically different from what we see now. Therein lies the future promise of Web3 — and the current peril.” In other words, digital currencies are not all toast. There just might be some different winners in the pack.

We have a webinar coming up at 6pm on 5th July with eToro to dig into this. Is crypto facing a Lehman moment? Or just having a fairly substantial wobble!? Join us for what should be a fascinating discussion.

Have a lovely weekend everyone,

Holly

Stay up to date!

Already have an account? Login