Holly's Blog - Hey Gringo - welcome to the Wild West

6 May, 2022

It’s pretty ugly out there this week. We have rising interest rates. UK inflation heading to an estimated 10%. And looming recessions.

Despite the looming storm clouds it’s not all (immediately) bad. On Wednesday this week, interest rates went up by 0.5%. But importantly, this was less than some had expected AND the Big Cheese at the Fed hinted that interest rates might not go up so much this year as some anticipated.

Markets don’t like rises in interest rates because it makes it harder for companies to borrow, invest and grow. It has a knock-on effect on the valuations of companies. Whilst inflation hammers margins because everything costs more.

Ooh Thank Gawd, swooned the stock market in response to hints of lower rises ahead – the market has a quirky ability to love bad news as long as it’s less bad that they expected. And up soared the S&P 500, posting its biggest gain since 2020.

Stock markets are psychologically geared in such a way that they could hold a party to celebrate losing one £10 note, if they had been told that they were going to lose two. Hooray, we’ve lost £10!! What a relief!!

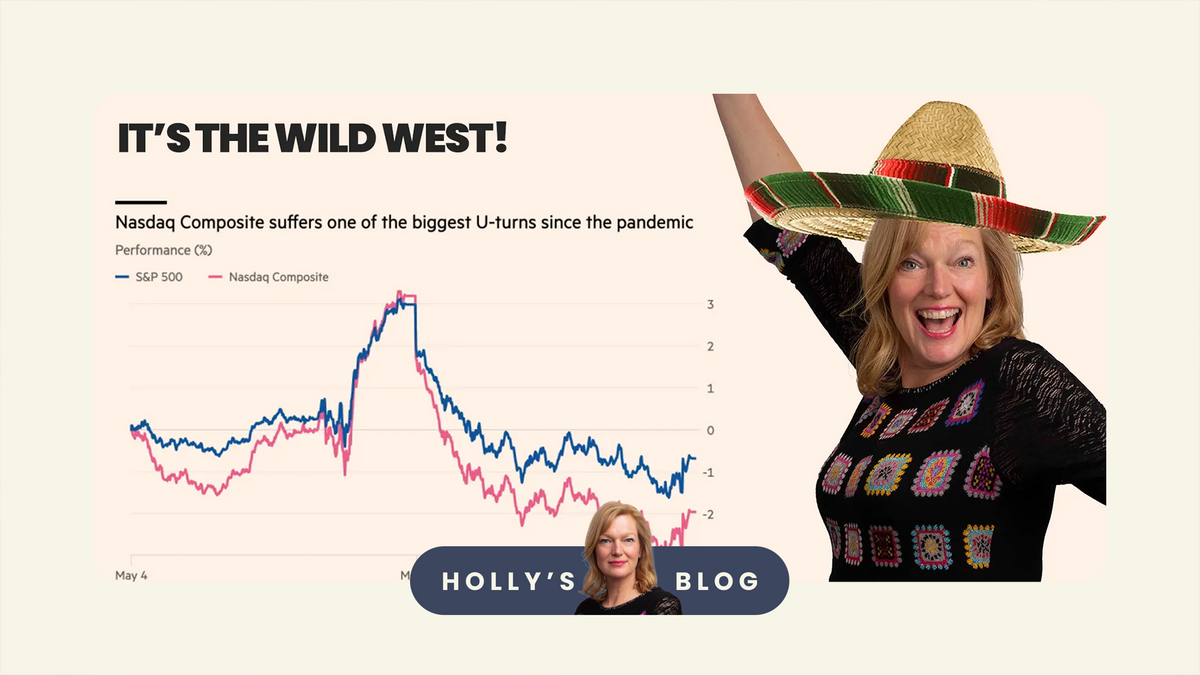

As always it’s a tussle between greed and fear. On one side of the scales, greed that says it will be OK and inflation is only temporary and interest rates won’t be as high as we thought and there will be pockets of opportunities. Against fear – fear exacerbated by lower growth forecasts, higher inflation forecasts and higher interest rates. On Thursday the voices of the Fear side drowned out the Greed side, and markets slumped again. Making this week’s charts look like a Mexican hat.

Not a good time for cool investments and Amazon fell by over 7%, Tesla by over 8% and bitcoin by over 8%.

So where do I look?

Gawd knows is one answer. There’s no textbook argument to be made for shares or bonds. Large markets are volatile and off highs. It does feel like a time to consider cherry picking and seek out pockets of opportunities.

I hosted a webinar with Roland Arnold, manager of BlackRock’s Smaller Companies Trust last night, which you can watch on catch-up here.

Small cap shares normally get hammered when interest rates go up and we slide towards potential recession. (Small cap is short for small capitalisation – and capitalisation is just a posh way of saying what a company is worth. Market cap = number of shares x share price). But despite the headwinds, Roland is a stock picker which means he chooses the (currently) 104 shares in his trust on their individual merits – not because they are in any one sector or do any one thing. He actually just picks the companies he likes the most. And he argues that smaller companies can be nimbler and more adaptive to rocky times than the big guns.

Digging into what lies under the bonnet for some examples. His second biggest holding is Watches of Switzerland. Over 20% of the trust today is in Consumer Discretionary. (Stuff which people buy because they like it, not because they need it). Come on Roland I said, Who is going to buy a posh watch after they open their latest energy bill? His observation was that many firms have waiting lists of years for watches - and the sorts of people who can spend £5,000 on a watch won’t change their mind because the Country Pile Aga costs more than a small spaceship to run. (My words). Interesting point and from now on I will split Consumer Discretionary into 2 camps. Fat Cat Consumer Discretionary. And Prole Discretionary!

The point is that we can still look for companies which will do well in hard times – as Ocado and Zoom showed us so clearly during lockdown.

For those seeking out diversification away from more mainstream markets, Emerging Markets are worth considering as a garnish to the main dish. They typically march to the beat of a different drum. There’s an interesting piece on these markets here from M&G Investments.

Investment trusts are generally seen as offering managers more flexibility than funds, and many think they’re better to access less liquid markets such as small caps and emerging markets. If you want to find out more, or to see which trusts are the best-sellers across all major platforms, you can learn more here.

Over and out

Thanks to all our women readers who have offered help with a new service we’re building. We’re asking female readers in their 40s, 50s (and now early 60s after feedback!) to help us shape this – please join us online at 6pm next Thursday if you can, for a Do You Hate It or Love it webinar to channel your inner Strictly judge vibe and let the feedback roll!

Have a lovely weekend all. The sun has got his hat on…..

Stay up to date!

Already have an account? Login