Holly's Blog - Interest rate pain...but for how long??

5 Aug, 2022

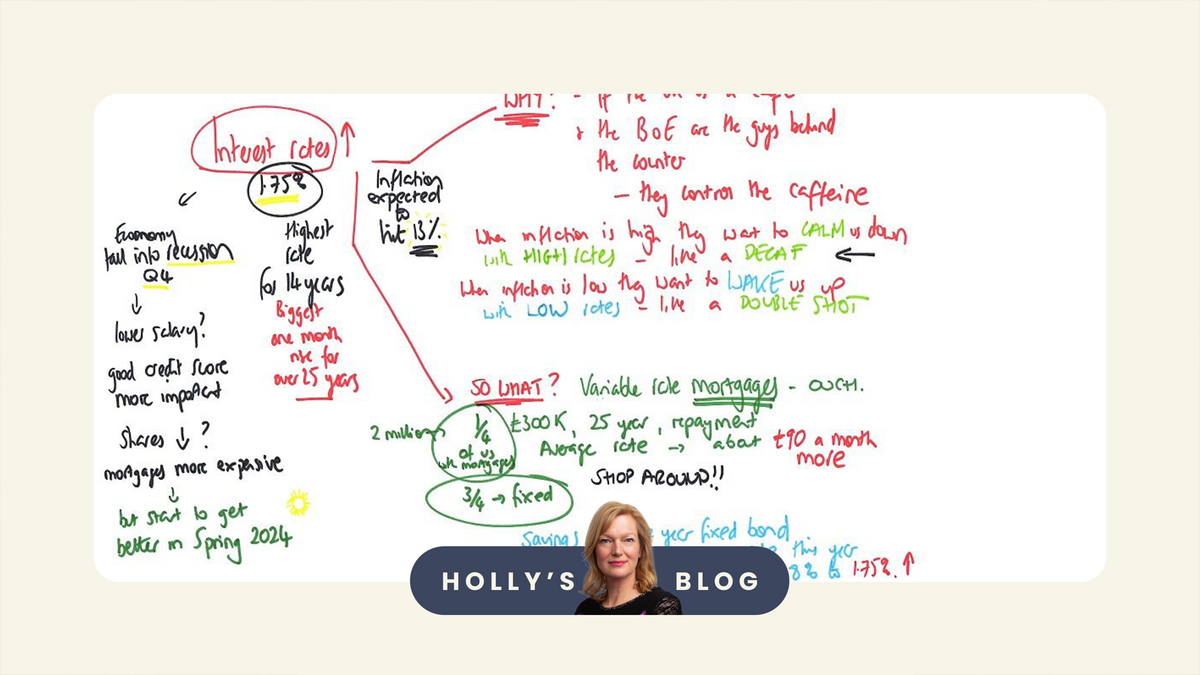

With the biggest monthly jump in interest rates for 27 years, the Bank of England yesterday raised rates by 0.5% to 1.75%. Perhaps more striking was the supporting rhetoric – fairly unusually the Guv’nor of the Bank specifically forecast the recession and told us it would be bleak until Spring 2024.

Oh brilliant….so what’s on the cards?

Mortgages

The 2 million people on a variable rate will probably already have had triumphant messages from their bank. For example, a 25 year repayment mortgage for £300,000 will go up by circa £90 a month.

I’m in the middle of selling a flat, my lovely fix came to an end 2 months ago and I’m on the “Scr3w You Loyal Customer” ‘special’ variable rate until completion happens. It took my bank 29 minutes after the announcement to text me with a "ha ha you’re gonna pay us more" message yesterday.

If you have a fixed rate, it’s worth checking when this is coming to an end. If it’s over the next 12 months, then just check what your repayments might go up next year.

I checked a big bank’s rates today. On a £500,000 property, with a mortgage of £400,000, a 2 year fix now is 3.4% which is £1,980 a month on a repayment basis.

There are loads of mortgage calculators online – it’s worth just having a look so you know what’s coming down the line.

A key message as always is that LOYALTY DOESN’T PAY with most financial services providers so always shop around and see if there are better alternatives.

Cash savings

If you have cash savings, do not just leave them in your current account!! I honestly know a (very clever!) entrepreneur who sold his business and left millions of pounds in his current account for months! 😱

One-year fixed rates are looking a bit more interesting – they have risen from an average rate of about 0.8% at the start of the year to about 1.75% today. OakNorth Bank are currently offering 2.85% for a one year fix.

If you have an account with Hargreaves Lansdown, I think one of the best features they offer is the connected Active Savings service which lets you pick the best cash rates for savings and put any cash here with minimum hassle. The best 1 year rate available here today is Aldermore’s 2.75%. Or someone called blme which is a silly name (what is the new obsession with spending millions on brand people with an aversion to vowels?) but we can forgive this as they offer 2% for a 6-month fix.

My Interest Rate Brain Dump!

Debt

If you have expensive debt and are falling behind or getting really worried, then there is help available. Credit card debt can bite so do set up monthly repayments or check out a 0% balance transfer. If it’s a bigger problem and chewing you up, then the Government-backed Money Helper site has some really helpful ideas and resources – and people to talk to who can help.

Pensions

Coming up to retirement? Like flares, annuities are back in fashion. Annuities are a way for us to lock in an annual retirement income in exchange for an initial lump sum of cash.

I used a calculator this morning on the Money Helper site – I lied and said I was 66, healthy but then I did also lie again and said I drank 14 units of alcohol a week 🤪 – and got a quote of £5,800 a year in exchange for a lump sum of £100,000 today.

Importantly, we have 2 choices with our retirement money – annuities (swap a lump sum today for a guaranteed annual income in the future) or drawdown (invest a lump sum today in the markets which can go up and down and you can take out what you want, when you want). But this is NOT an either or choice and you can blend the two.

If you are 55+, trying to get your head around retirement, and could use some advice, Destination Retirement is a nice, easy to use and low-cost digital option for those with £30,000 of pension savings more. If you want a more human being approach, Netwealth is an interesting low-cost full advice service with humans, best suited to those with slightly more money who don’t want to pay for mahogany boardrooms and faff.

Alternatively is the Government-backed scheme which will help anyone over 50 to talk through their pension questions and choices. A very good and free service.

Markets

On a final note, there’s something quite interesting going on here.

According to the FT this morning, “UK government bond yields fell as traders shifted their expectations that the world’s largest central banks would prioritise tracking inflation ahead of economic growth.” Huh?

This is basically people trying to second guess what will drive the Powers That Be on interest rates.

Are they MORE worried about inflation? In which case they will keep on sticking rates UP to give us all an economic chill pill.

Or MORE worried about a hoofing big recession? In which case they will eventually stick rates DOWN to give us all an economic kick up the bum.

If we see oil and commodities continuing to fall. And recession-fuelled demand falls just as supply comes back up. And if we see longer-term Government bond yields (interest payments) going down. This all means that the markets don’t believe that interest rates are going to keep on going up longer-term. They think a growth slump is more worrying than inflation.

So one view which we’ll hear more of over coming weeks is that – if you believe markets and the wisdom of the trader crowd, above the wisdom of a handful of individuals at the Bank of England – then actually you’re not in La La Land if you think interest rates will actually start to fall from next year.

Over and out for this week, have a lovely weekend everyone,

Holly

Stay up to date!

Already have an account? Login

Post a comment:

This is an open discussion and does not represent the views of Boring Money. We want our communities to be welcoming and helpful. Spam, personal attacks and offensive language will not be tolerated. Posts may be deleted and repeat offenders blocked at our discretion.