Holly's Blog: Nerd alert - this blog contains a very ugly formula!

13 May, 2022

After a few weeks of password malfunction I finally braved the call centre this morning, sorted it out, and logged on to my accounts only to see that a large chunk of my pension has temporarily evaporated!

One of the security questions I was asked was to name a holding in my account and to say how much I had in it. Which is quite a silly question in these markets because a) that’s precisely what I want to know and why I want to log on in the first place and b) God knows but probably 20% less than it was a month ago if it has any US tech near it.

The tech-heavy Nasdaq index in the US is down 26% since January and the S&P 500 is down about 18%. Popular DIY investor picks Fundsmith and Scottish Mortgage are down about 17% and 42% respectively. It ain’t pretty out there.

There’s been a lot for investors to worry about since 2020. Once we accepted the initial fear of lockdown, we responded to uncertainty with a certain amount of greed. Shares in high growth cash-strapped businesses such as Peloton and Zoom soared, and it was all about tomorrow’s growth rather than today’s cash.

Fast forward to 2022, and we are responding to the uncertainty caused by war and by inflation with fear, not greed. Once again it has become cool to focus on cashflow today, and profits today, rather than on growth tomorrow. Because when inflation is heading to 10% tomorrow, of course it makes future earnings seem a bit less sexy.

How do people work out what a company is worth?

I think the simple answer is it’s worth as much as you can persuade anyone to pay for it! But the actuaries and economists don’t like this approach because it makes that Maths degree redundant, and so they weave numbers and methodologies around it.

One approach is to apply a revenue multiple. So, for example, if your bakery sells £10,000 worth of cakes every year, you say your business is worth 5 times the annual revenues, and it’s worth £50,000. If your business is very young and full of potential and untapped growth, you cheekily ask for a higher revenue multiple because you argue that your revenues today are not a fair reflection of what they will be tomorrow.

Take Zoom, for example. It is now trading at less than six times this year’s expected sales – back in lockdown 2020 as everyone from Jackie Weaver to Prince William lived on Zoom, its revenue multiple peaked at about 85. That is technically known as ‘nuts’.

The more scary the outlook becomes, the more we value what is a known today. A bird in the hand is worth two in the bush. This is what the nerds are talking about when they reference the ‘inverted yield curve’ which we can see in the US right now. It just means you get a higher interest rate for lending someone money for 3 months, than you do for lending them money for 10 years. And this ‘inverted yield curve’ has predicated every single US recession since 1955. Oh good.

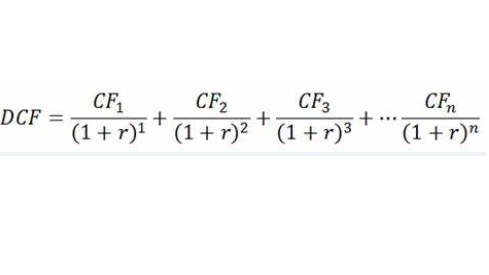

Another way in which people value companies is to look at ‘discounted cashflow’….

This gets a bit head-bangy but bear with me. The basic idea is this. If you know you can stick money in the bank and get returns of 5%, then money today is worth more than money tomorrow.

Let’s say my bakery is forecast to bring in £1 million in 2023. I make lovely brownies. So what is that worth to someone today? If interest rates are 5%, you would do some funky Maths and say that is worth about £950,000 to you today. The following year, in 2024, it is forecast to bring in another £1 million. That’s worth about £907,000 today. And then we go nuts in 2025 and bring in £4 million- that’s worth about £3.5 million today. So you add those 3 years up and say the bakery is worth £950,000 + £907,000 + £3.5m = £5.4 million today. Based on what it will make tomorrow.

Now if interest rates shoot up to 10%, all of that future lolly is a bit less shiny and so I’ll pay you less for it today. This my friends is largely why your pensions and ISAs have evaporated. Because all those tech firms and growth businesses with big promises about tomorrow are less appealing. Blame inflation and actuaries and discounted cashflow modelling!

Holly’s Insomnia cure

If anyone is having trouble sleeping, here is the formula for you to play with! Don’t mention it. R is the interest rate. CF is cashflow in various years. Hours of fun.

So what?

I don’t hold anything too faddy and odd, and I don’t need to sell my investments right now, so I’ll probably lose my password again. I have a bit of cash in my accounts, and at some point it will be a decent buying opportunity for all those good companies and funds which have been overly hammered. But I think we have some more volatility and short to medium term pain ahead so I’m not in any hurry to do much. Our need for action to make ourselves feel better is the investor’s worst enemy. IMHO.

Have a great weekend everyone,

Holly

PS Dear Actuaries. I know I have rounded up numbers and used arguably imprecise language to illustrate the vibe. Please don’t email me your corrected calculations! And apologies if this mail induces Actuary Rage. I am just a flawed Arts graduate.

Stay up to date!

Already have an account? Login

Post a comment:

This is an open discussion and does not represent the views of Boring Money. We want our communities to be welcoming and helpful. Spam, personal attacks and offensive language will not be tolerated. Posts may be deleted and repeat offenders blocked at our discretion.