Holly's Blog: Q. Where Be That Blackbird To? A. In the South West

1 July, 2022

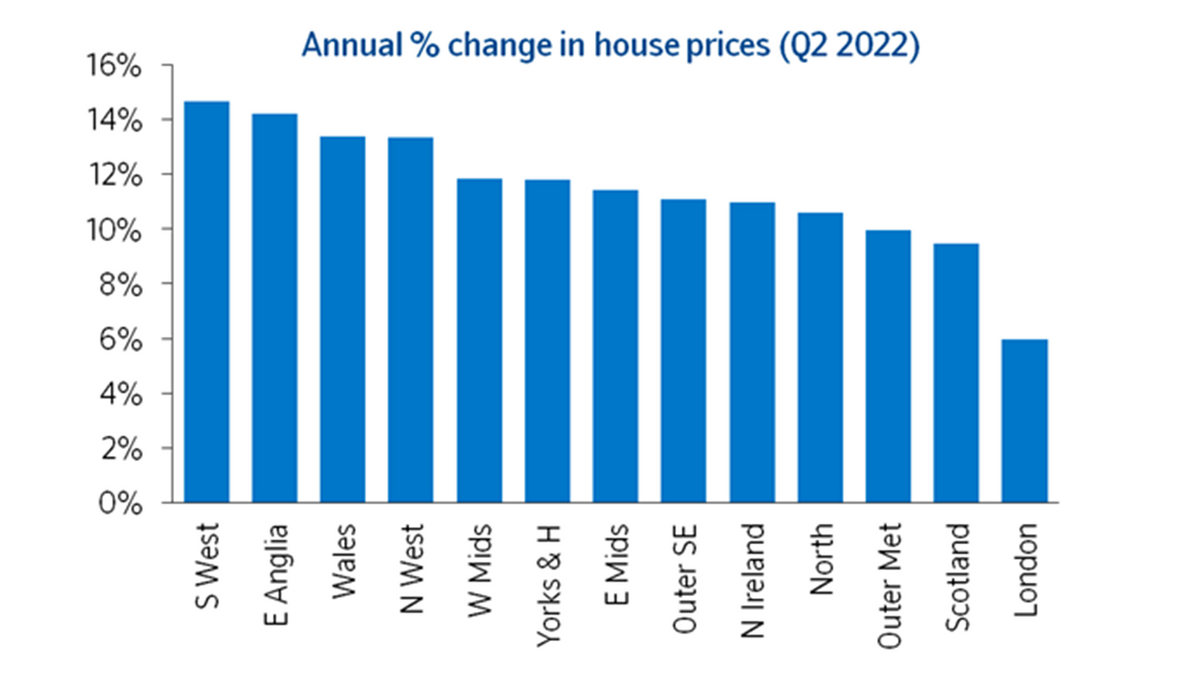

Nationwide published their latest house price index yesterday, revealing a slowing market…but still a market showing over 10% growth.

The average property in the UK rose by £26,000 over the last year and now costs £272,000. The South West (14.7%) grew the most and London was the weakest (6%), as WiFi empowered City Rats ran for the home working, the country air and the soundtrack of The Wurzels. (Yes – as a happy South Wester, I know all the words to The Blackbird , best sung after three pints of cider, and no party is complete without it.)

This chart shows the annual increase in house prices by region.

This story shows how you can use the same stats to tell two entirely different stories. One headline could be “Housing Market Slams On The Brakes!” as growth cools from 11.2% in May to 10.7% in June. Or another headline could be “Roof Blown Off Hot UK Housing Market!” as rampant double-digit growth persists. You choose.

The general takeout from the property boffins is that higher interest rates, cash-strapped households and more expensive mortgages will cool the housing market, but we’re looking at a gradual slowdown not a crash.

Things may also get a small boost this summer. Last week the Bank of England announced it will remove the ‘stress test’ in August. This test was brought in after the financial crisis to protect people from taking on too much debt. Borrowers had to evidence they could still afford their mortgage repayments if rates were to go up to 3% above the lender’s standard variable rate. This is being scrapped so it will theoretically be easier for people to borrow more, just as interest rates are rocketing………

Do you know your State Pension entitlement?

Helpful new website alert. If you are starting to vaguely plan for and contemplate retirement, then the State Pension – currently £185.15 a week if you qualify for it all – is obviously a fundamental part of your retirement income. Anyone can get a State Pension forecast here.

Do you know what you are due?

You have to have paid a certain amount of National Insurance to get the full amount. So, for example, if I work for another 8 years, I will get the full amount which will be due to me in 2038. (Immediately makes me feel like I need to go for a lie down!). If you have not – and have had career breaks – then it can make financial sense to top up your National Insurance payments in return for a higher State Pension every year. These calculations can seem head-bangingly dull and complicated but there is a new, credible and independent website to help you work this out. Launched by actuaries Lane Clarke Peacock (whose name now sounds like a Wurzels song to me!) and the brain child of former Pensions Minister Steve Webb, this is a very helpful resource for anyone trying to get their head around this.

And from houses to pensions to crypto

As we conclude our dizzying hurtle across money matters this week, for anyone trying to work out if this is the beginning of the end for crypto – or still an early stage opportunity to get on board – join me on Tuesday next week, 6pm, as I host a webinar with eToro to explore crypto markets. As always we’ll start with a bit of What the Hell Is It!? Why are there so many different currencies? What gives crypto its value? Why has everything tanked? What lies ahead? Please watch on catch-up.

That’s it from me this week. Wish me luck this weekend – the kids and I are entering the cut-throat competitive world of the Village Show. Tensions are running high. Will my potatoes make the grade? Can I find any sage leaves which haven’t been munched by bugs? Will the sweet peas come out today? It’s hardcore ‘round here.

Stay up to date!

Already have an account? Login