Holly's Blog: Reasons to LOOOOVE January!

By Holly Mackay founder and CEO at Boring Money

7 Jan, 2022

Hi everyone

Welcome back. Isn’t January always so marvellous? EDF Energy could not even wait until the first working day back, emailing me triumphantly about how much I owed them on the 3rd. Join the January queue, Monsieur EDF!

My bank balance is looking especially disappointing today as I was one of those who received a double payment on Christmas Day, courtesy of Santander’s monumental cock-up. Some poor person had a very bad Christmas, as the bank mistakenly deposited a lazy £130 million into 75,000 accounts on Christmas Day, as duplicate payments were made. Paid from their own reserves. So things looked pretty rosy for a while with my double salary for December whee-heee until they rudely took it back without any communication whatsoever. Cheers.

Things are set to bite this year and April will see increases in fuel bills which could be hikes of around 50%. And taxes will go up in that same jolly month. There was an unusual hint of kindness from the taxman yesterday as HMRC confirmed that we would not be fined for missing the 31stJanuary filing deadline. We now have until the end of February to file, and until 1 April to pay or set up a Time To Pay arrangement. Before you think that this rare display of softness from HMRC means the world really has truly and finally gone mad, take comfort from the fact that there is a difference in tax speak between “We won’t fine you” and “We won’t charge you late payment interest”. The mean old whatsits will still charge 2.75% on late payments. They just won’t fine you as well.

In other cheery news inflation is on the march. So cash in any accounts is becoming less powerful by the day, which means investments are our best line of long-term defence. How is your portfolio looking?

What portfolio!?

If you are one of our many readers who at this point is mumbling, “Portfolio…..what portfolio!?” then help is at hand. Next Tuesday at 6pm I’m hosting a webinar for beginner investors which will help anyone to get their head around the basics and get going. More established readers – please feel free to share this with your friends/kids.

If you are already up and running, how was 2021 for you?

Our Boring Money reader picks

At the beginning of 2020 we asked our readers to help us make the Boring Money portfolio. What sectors should we pick? We updated this and rebalanced according to your feedback in January 2021.

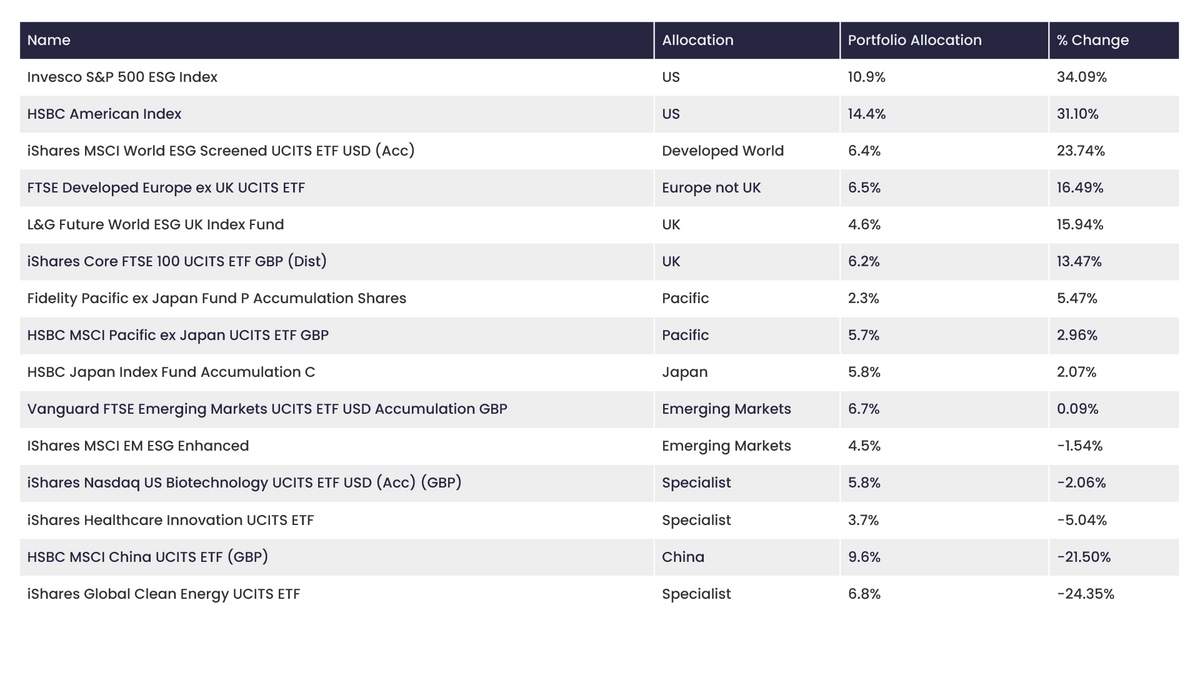

You can see the summary of what we hold and how it did here.

Annual returns of 5% are OK. But let’s be honest. Not that brilliant compared to funds with a more mainstream asset allocation! You wanted a good allocation to the US and that served us well. But the enthusiasm for China and the super volatile Clean Energy fund was painful last year. We’ll be coming back to you next week for your 2022 re-allocations.

What did well?

More broadly, the top performing funds for UK retail investors last year were TB Guinness Global Energy fund (46%) and Liontrust India (37%). If we look at the top 10 it was all about India, the US and large (mostly American) tech firms.

At the other end of the spectrum, China and gold were the laggards. You can see a fuller list of the top and bottom fund performers here.

And what might do well this year?

Ah the million-dollar question. We asked 5 fund experts from a range of platforms and advice firms, and you can read our full predictions piece here. As well as general forecasts, we asked them for 3 fund or investment trust picks each so you can digest at your leisure.

In a nutshell, they favour broad-brush global funds. There’s some dissent about whether it’s another US year, or does the poor old UK-based FTSE get a look in? More favour smaller UK companies which suggests a broader index such as the FTSE250. Emerging markets also get a nod and some question whether China is a buy as it had such a bad time last year. Mr Mackay Senior says he would not “touch China with a bargepole” and he likes Vietnam. But my friends if I wrote a blog with my very savvy Dad’s picks there would be more risk disclaimer than blog! So let’s stop there.

That’s quite enough for our first week back! Beginner investors – do join us for our webinar next week and register to watch live or on catch-up.

Have a great weekend everyone. Hats off to anyone doing dry January. I have never quite understood the sense in tackling this most miserable of months without the odd glass of Gavi. This is particularly the case for next Monday, the official most miserable day of the year. Oooof.

Cheers!

Holly