Holly's Blog: Tax whammy

10 Sep, 2021

The nation reeled in shock this week as our principled leader, Champion Of Honesty and Beacon Of Truth, broke a promise. Yes, pretty much everyone working will pay more tax from April next year as National Insurance goes up by 1.25%.

This blog’s all about practical tips. For those who are super angry about these increases, one potential way I can see around it is to become an ocean-going mariner or a deep-sea fisherman – which gives you some different NI rules to play with. For anyone who went back to an office on a standing-room only train this week, this lifestyle choice could of course offer some welcome solitude? You’re welcome.

National Insurance Hike

Just stepping back in time for a second, National Insurance was born in 1911 when the National Insurance Act introduced the idea that employees and their employer would pay for future potential benefits.

Employees bought special stamps from a Post Office and stuck them on a contribution card. These rather delightful Miss-Marple-y-looking cards were proof of your entitlement to benefits such as health, pension and unemployment payments.

Today the money still conceptually covers the NHS, benefits and the State Pension and the extra money is a levy for health and social care. But arguably this money is just income tax by another name and not as ringfenced as its separate name makes it sound. I don’t think Rishi has two purses – just a pot of money and stuff to pay for.

How am I taxed?

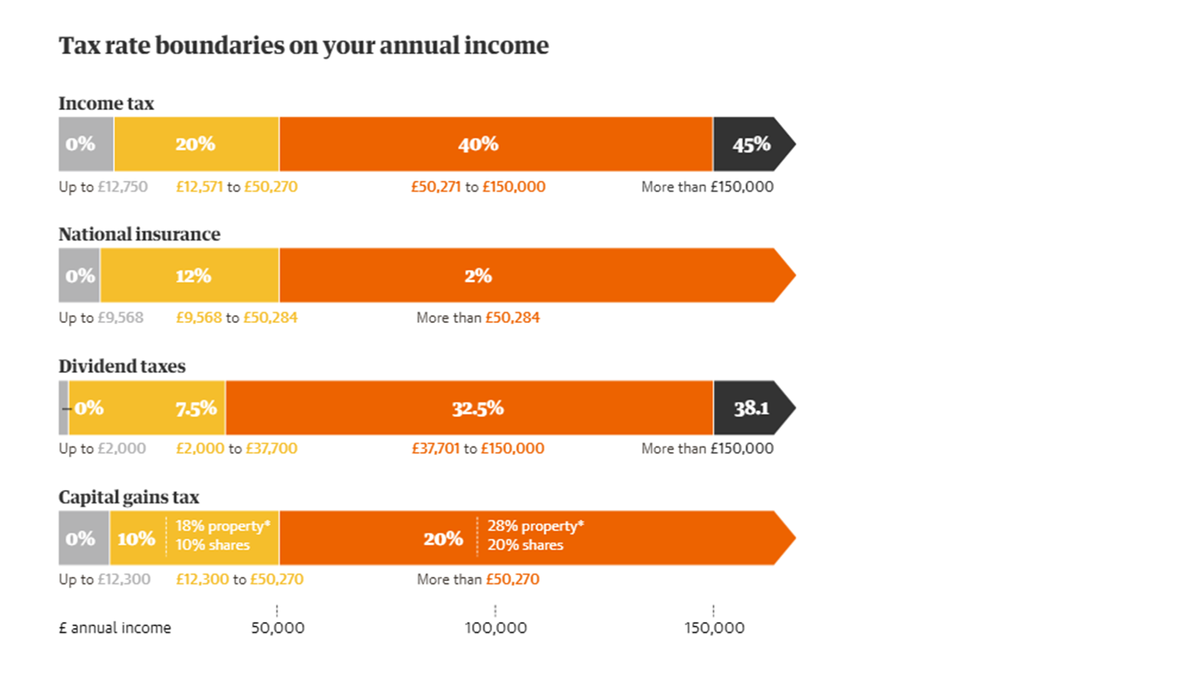

The following useful graphic (courtesy of The Guardian) shows how we are taxed today – and why a hike in National Insurance impacts those on lower earnings proportionately much harder than higher earners. In a nutshell, if you earn £30,000 a year today, you’ll pay £255 a year more from next April, taking it to a total of £2,707. £50,000 - £505 a year more taking it to a total of £5,357. And if you earn £100,000, NI payments will increase by £1,130 making the revised hit on your purse £7,009.

So people on £100k pay about 2.6 times as much as someone on 30 grand.

This is of course fuel to the fire of ongoing arguments about inter-generational fairness. Are younger people excessively hammered today whilst older people reap the economic privileges of a former kinder, softer world where houses were affordable, education free and health care not so stuffed? (I know this is emotive so don’t all shout at me, 50+ers, and tell me how you broke the ice to swim across the river to get to school after a breakfast of coal! I’m just asking the question!)

One MP was reported to have said, “We are asking people on low incomes to pay more tax so that privileged kids can inherit expensive houses.” Discuss that over a gentle family Sunday lunch!……..

The Triple Lock Got Picked

Amidst all the National Insurance Hoo Ha another broken promise hardly got a mention.

The so-called ‘Triple Lock’ means that pensions will go up every year by the biggest of the following numbers – 2.5%, the % rise in wages, or inflation. After the pandemic which has skewed everything (did you like that complex analysis of the last 18 months?) wages have gone up by about 8% from May to July this year. Basically there were fewer lower-paid jobs around so the average wage went up. This is a wonky one-off and no-one can really make a case that pensions should go up by 8% or more. So – for this year only apparently (or is it…) – the Triple Lock won’t apply.

In case anyone is wondering, the full, new flat-rate state pension today (for those who reached state pension age after April 2016) is a princely £179.60 a week.

Can we rely on the Government?

If we look around, we can see taxes going up, pensions under strain and a Government which breaks its manifesto promises. Slow economic growth for July reported this morning. And a Budget coming up! I don’t think you need to be a sceptic or a genius to think you might be better off to start to take matters into your own hands.

If you are one of the millions with pensions-fear and inertia, it’s not a bad time to look at DIY pension options which don’t have to be expensive, tricky or cumbersome. Honestly! Check out our pages for some options which might suit you. Younger self-employed peeps in particular – there are some good apps which let you start with small monthly amounts. Have a look.

Or ask an expert??

A reminder that over the summer we launched the new advice side of our site, helping you to find the right financial advice for your wealth and needs. Take the 1 minute quiz to see what might suit you? As part of this development we have a panel of 65 advisers and growing, on standby to answer your questions. So if you are struggling with something – see who you think looks nice/smart/approachable and ask them your question….

That’s it for this week folks. For anyone interested, I can report that – as raised in last week’s blog – wearing a sumo suit and attempting to wrestle young people with a belly full of champagne, is hot, heavy and mildly claustrophobic! Not an experience I would rush to repeat 😊🤢

Have a great weekend!

Holly