Holly's Blog: Time to get overweight?

12 Nov, 2021

Some thought-provoking news this week. US powerhouse JP Morgan came out and said that they think the UK stock market is worth a look. According to them, the FTSE is at ‘near record cheap’ levels.

They have now raised UK stocks to ‘overweight’ in both European and global portfolios. Being overweight anything is a bit like stuffing a fantasy football team full of players from one team. You like something’s chances and so you hold a disproportionately high amount of it. This is notable because it’s the first time that JP Morgan have felt upbeat about the UK since the Brexit vote back in 2016.

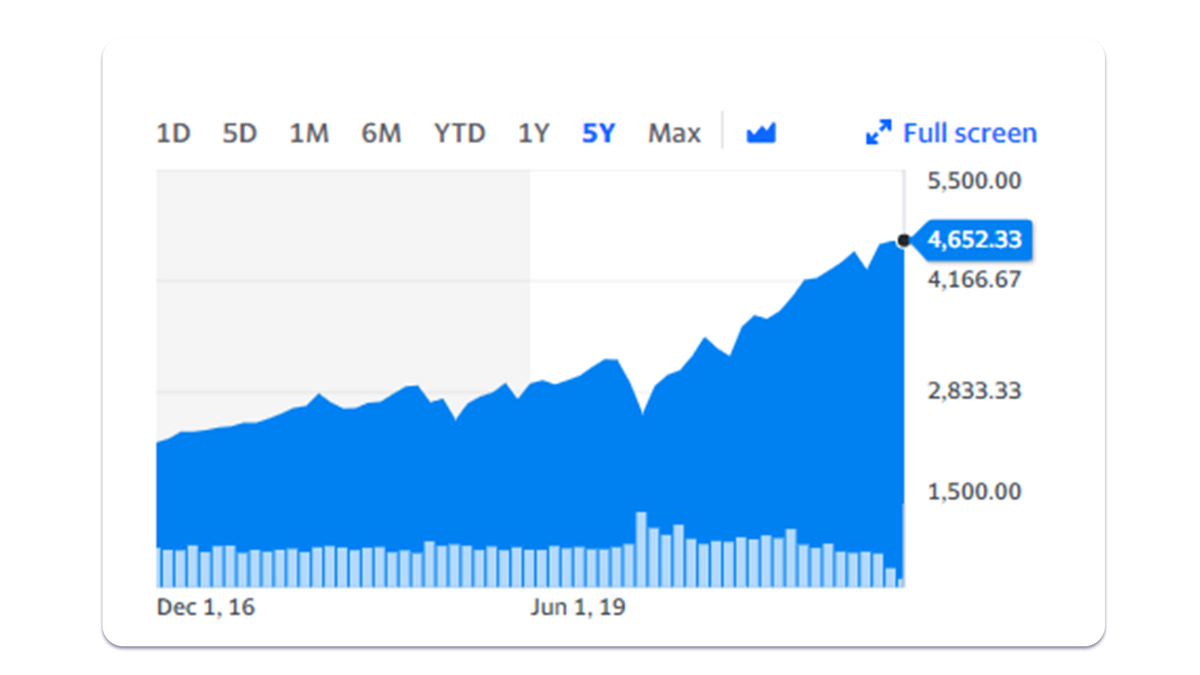

So why do they think we should become overweight and gobble up the FTSE 100? I think these 2 charts tell quite a powerful story. A tale of two cities, if you will. Compare the FTSE 100 to the US S&P 500 over the last 5 years.

Blighty (FTSE 100)

America (S&P 500)

Although I’m sure that the boffins at JP Morgan did lots of very hard sums to inform their observations, you don’t have to have a degree in Economics to work out that basically “Not Much” has happened with the FTSE over the last 5 years. And “Loads” has happened with the S&P500. So in terms of future potential, the UK market looks interesting.

Last night, out of curiosity, I showed my 11-year-old these charts and asked which one of the two things she would buy. She said that everyone was “rushing to America” so she would buy Blighty because “you’d get better quality stuff, and it would be cheaper because not so many people want it”. Precisely. I found this hugely exciting – it means Boring Money can basically hire her as our Chief Economist, she will say the same things that JP Morgan will, and I’ll only have to pay her £10 a week in Star Stable gaming credits and sherbet lemons.

As always, it’s worth a sense-check of your investments. If you have a robo adviser, a workplace pension or a ‘multi-asset’ fund you don’t have to bother. With these options you pay someone else to worry about ‘asset allocation’. If you are a DIY portfolio holder, your US stuff will probably be worth twice as much as it was 5 years ago. More if you’ve backed the tech frat pack. So the chances of us all being disproportionately overweight to the US and tech are high. If this is on purpose – great. If not – time to rebalance?

UK exposure

If you do decide to look closer to home, the simplest way to get exposure to the (actually quite global) FTSE100 is using an easy, ready-made and low-cost ‘tracker’ fund. Or an ‘ETF’ – an exchange traded fund, which you buy and sell like a share. I use BlackRock’s iShares FTSE100 which is an ETF– but there are lots of alternatives out there. If you prefer a fund, then Vanguard has a FTSE100 Index fund.

(Just think about how your platform charges fees – some such as Hargreaves Lansdown and AJ Bell cap admin charges on ‘ETFs’ or shares so those with much bigger accounts may find it more cost-effective to use ETFs and not tracker funds. On the other hand, if you have less than about £50,000 in your portfolio, it’s probably better to use a fund because you won’t typically pay a transaction fee to buy a fund, whereas they’ll sting you a tenner to trade a share or an ETF.)

If sustainability is your thing and you prefer an ‘ESG’ variant, then L&G has the Future World ESG UK Index fund – a collection of 376 companies listed in the UK today. Or check out the FTSE4Good Index. Alternatively you can take our sustainable savers quiz to see some funds which might map to your personal criteria.

And a thank you

A final and extremely sincere thank you to the 1,300+ readers who have pre-registered an interest in our upcoming crowdfund. I’m always quite genuinely touched by your interest and backing.

We open the doors for our readers and existing shareholders mid-morning on Monday, so do make sure you are ready to do your thing when we’re open. I know we’re not the Harrods sale or a Beyonce concert (oh how I wish…) so I don’t mean to suggest that you should camp out in your sleeping bag on the digital pavements outside Boring Money. But every fundraise has a maximum amount so first in, best dressed and all that. If you’d like to pre-register over the weekend, then you can do so here.

As always a reminder that investing in small businesses, at an early stage, is risky so please don’t do it if you can’t really afford to, or don’t want the risk. I’d much rather anyone in doubt invested in something a whole lot more boring! And of course our site is packed with ideas and tips to help you choose :0)

Have a great weekend everyone!

Investments of this nature carry risks to your capital. Please Invest Aware.

Holly