Holly's Blog - Wobblyville

22 July, 2022

Hello people and Welcome to Wobblyville. This week, leadership is wobbly. Our confidence is wobbly. Markets and currencies are wobbly. And as a final sign of the current instability even the 2 hour delivery window notification text system at John Lewis is broken today. My friends, this is BAD.

Wobbly ‘leaders’

Some insightful political analysis to start off this week. I need to get something off my chest. The Conservative Party has a choice which I can loosely summarise as follows. Would you rather have:

a) someone who wears £95 sliders in a photo opportunity whilst claiming fiscal and financial prudence? Although Maggie (strangely reincarnated this week as the one to emulate) would not have been seen dead in a pair of sliders, she might have observed that M&S have a lovely pair for £12.

OR

b) a politician who grabs photo ops of themselves in military gear in a bloody tank. If someone applied for a job as the MD of your company and you found a picture of them in a tank on social media with no trace of irony, nor pulling a silly face, would you think “Oh great, let’s hire them!!” Or would you call in a security guard?

Not to worry, people. We have the House of Lords to oversee things, and I was much relieved to hear that Boris Johnson’s outgoing list of so-called ‘honours’ could include Nadine Dorries. Lady Dorries will look after us humble serfs. It will all be absolutely fine.

Wobbly confidence

This week we published our latest research conducted with 1,500 fund investors at the end of June/early July. Confidence about the outlook for markets is lower than it was during the pandemic’s darkest hours. Now before you all run for the hills, take a moment to reflect that some will say this is a buying opportunity and historically a good time to increase holdings. I would not go that far – hard to feel that 2023 is going to be a great year financially – but I would observe that ‘drip feeding’ in to portfolios, and topping up little and often (a monthly direct debit) is generally a pretty sensible approach to building an ISA or a pension up.

If you do not need to sell now, and are a long-term investor, I certainly wouldn’t be (and in fact am not) bailing at this stage.

Wobbly markets

Right now, it’s hard to know what the future holds and so we’re more naturally curious about what other people are doing. I thought it would be an interesting time to dive into three of our test accounts with ready-made portfolios, so you can all see what a diversified portfolio managed by professionals looks like.

Last week I touched on the subject of ‘hedging’. This is using complicated financial gizzwozzery to remove the risk of something, and in this case we are talking about currency risk. With exchange rates leaping around in response to the frequent and significant interest rate hikes around the world, currency can make a huge impact on our investments. Here’s why.

This week, a $100 investment in Tesla would be worth £83. This time last year it would have been worth £73. So the simple fact that the dollar gives you more bang for your buck today, means that your Tesla shares have gone up by a tenner. Even thought the actual share price hasn’t moved in the hypothetical world of Wobblyville.

Understanding whether your investments are hedged or not is important in today’s environment. If DIY investors have a strong view on this, you can also look for hedged ‘ETFs’ for most of the largest global indices.

Another thing which makes a material impact is where you are invested geographically. Over the last 6 months, a simple FTSE 100 fund has returned -0.6% compared to a simple S&P 500 fund which has returned 3.8%. Over the last 5 years, the gap jumps to 18.5% (UK) versus 89% (US).

Here are some examples of how collections of investments in 3 major ready-made portfolios which sound similar can be rather different once you dive under the bonnet.

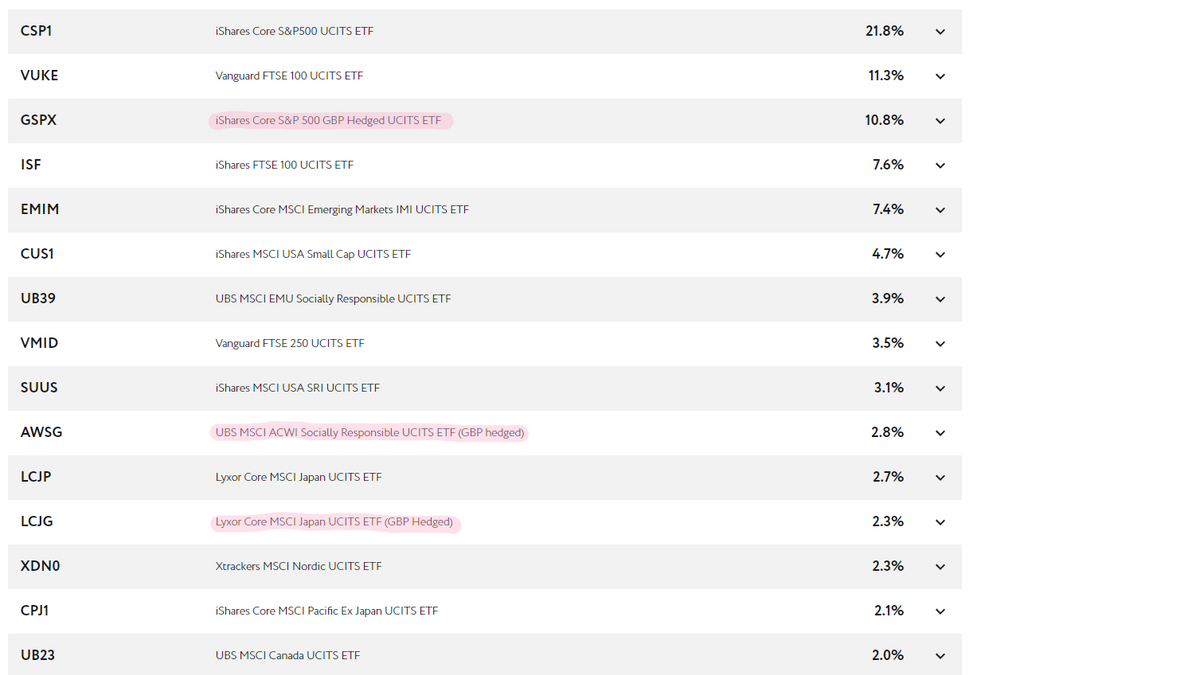

Nutmeg – 10/10 fully managed

This portfolio has 47% in the US and 23% in the UK

About 20% of the overall portfolio is hedged

33% of the portfolio’s exposure to the S&P 500 is hedged

Over the last 18 months, from Jan 2021 – June 2022, this portfolio has returned 3.6% net of fees

Relative Summary: Lots in America. Average UK. Moderate overall hedging. Good 18 month performance.

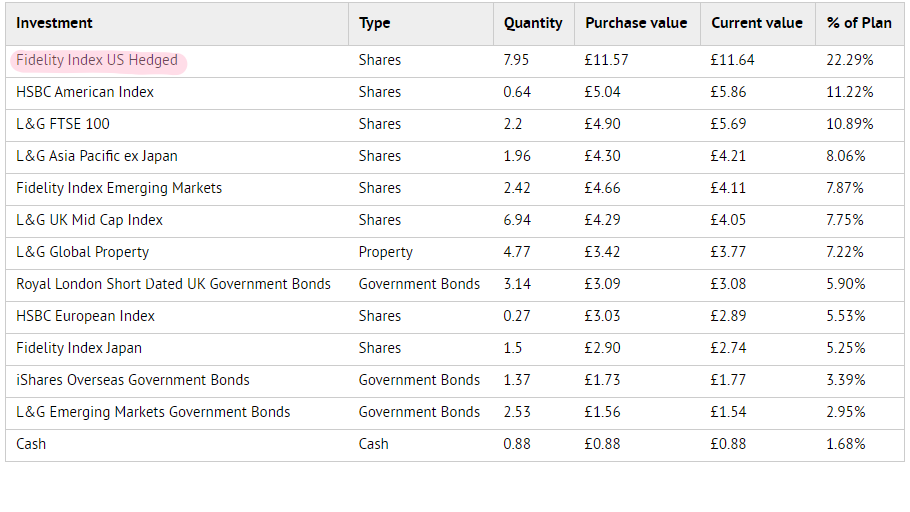

Wealthify – Adventurous (5/5)

This portfolio has about 34% in the US and 26% in the UK

About 22% of the overall portfolio is hedged

Roughly 67% of the US exposure in this portfolio is hedged

Over the last 18 months, from Jan 2021 – June 2022, this portfolio has returned 2.3% net of fees

Relative Summary: Modest US. Average UK. High US hedging. Decent 18 month performance.

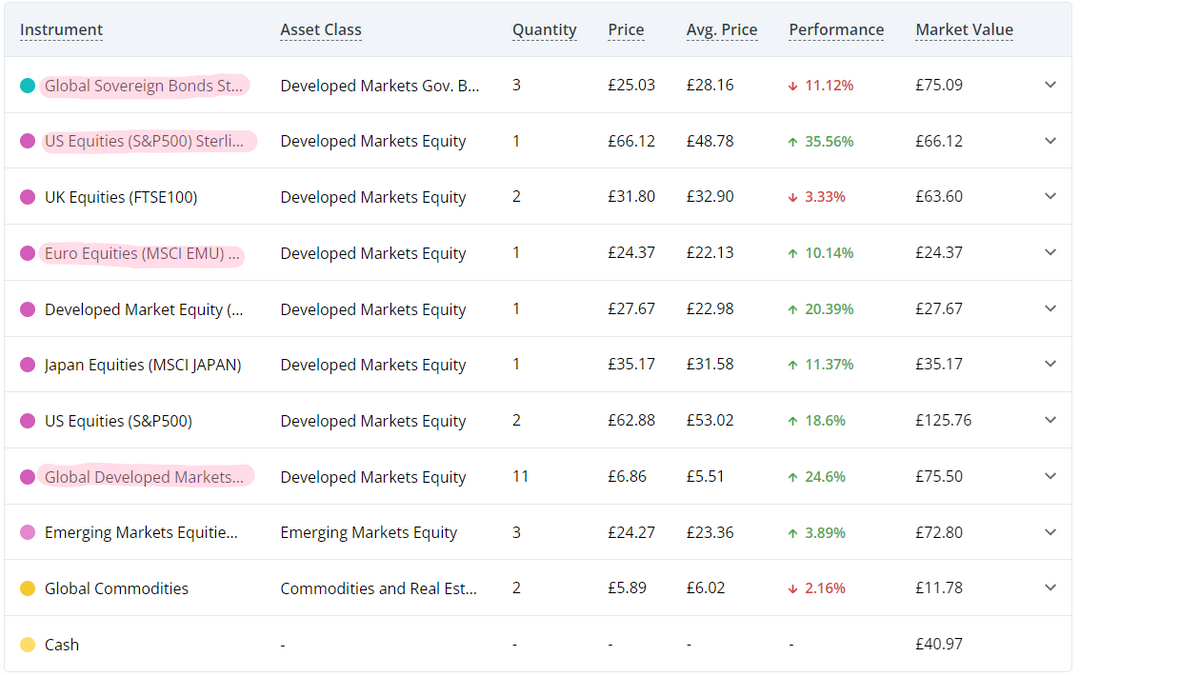

Moneyfarm – Portfolio 6 (out of 7)

This portfolio has roughly 41% in the US and 11% in the UK

About 39% of Moneyfarm’s overall portfolio is hedged.

34% of the portfolio’s exposure to the S&P 500 is hedged

Over the last 18 months, from Jan 2021 – June 2022, this portfolio has returned 0.97% net of fees

Relative Summary: High US. Low UK. Quite a lot of overall hedging. Lower performance over 18 months.

Note: Before my Inbox piles up, these numbers are based on our test accounts. The summaries are relative to each other, not some wizard’s text book of what is ‘correct’. And performance of 18 months is not long enough to evidence skill but is the track record we can cover based on having funded accounts so looking at what has happened to our actual real ££s, after all charges, and not just numbers on a chart. Phew.

So What?

More confident investors may take a view on currency and just make sure that any ‘home bias’ to the UK is intentional.

Less confident investors – don’t freak out. You are best off with a diversified portfolio and you are probably better off leaving it to others to manage. Drip feeding in smaller amounts more regularly is sensible. And maybe just check that your investment portfolio is not too far out of line with the consensus. A bit of currency hedging and the largest chunk of your money being in the US is to be expected. But too much might be reason to ask some questions. You can read more in our ready-made portfolio guide here.

Have a great weekend everyone.

Stay up to date!

Already have an account? Login