Investing in Financials: The Case for Active Management in 2025

By Boring Money

12 Aug, 2025

This section is a paid promotion created in partnership with Polar Capital. The views and information presented reflect the sponsor’s messaging and may not represent the independent opinions of Boring Money. While we aim to ensure accuracy and relevance, this content should not be considered impartial advice.

Despite long-held scepticism from UK investors, the financials sector is proving yet again its relevance and resilience amidst a deluge of macroeconomic disruptions. So what’s the story behind the success? We dig into why financials might be one of the smartest sectors to invest in and how the team at the Polar Capital Global Financials Trust have used their expertise to navigate the choppy waters of 2025 so far.

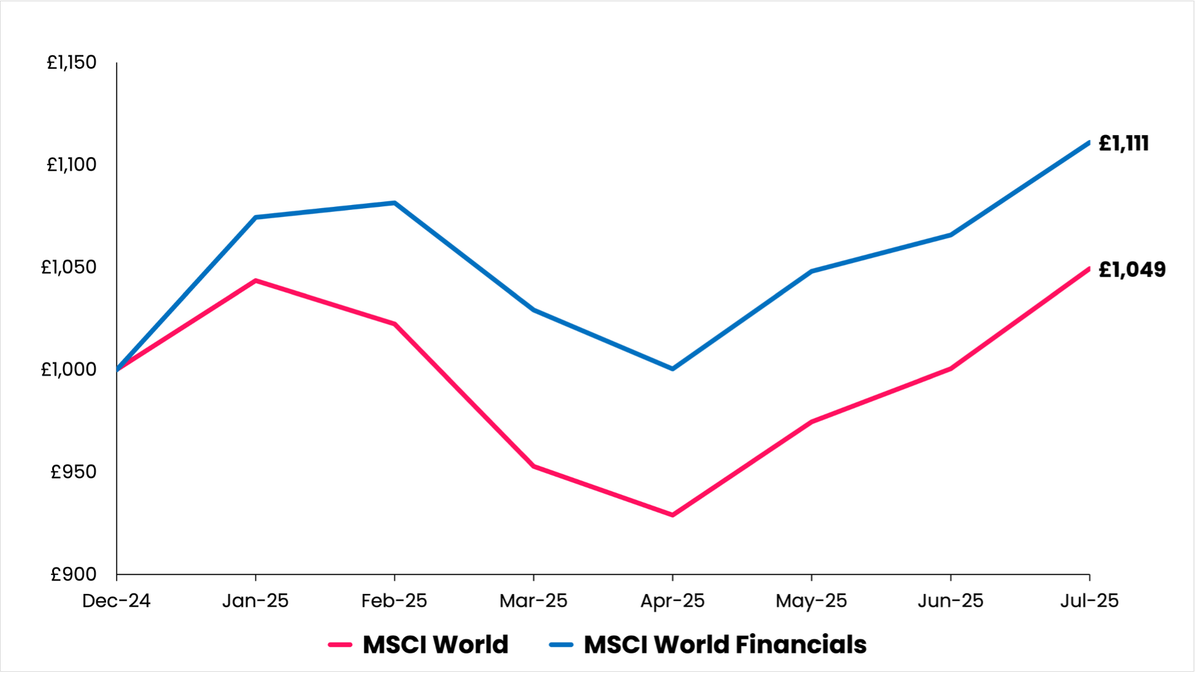

Financials: A surprising edge over global equities in 2025

Financials are quietly stealing the show. While tech stocks continue to sit front-and-centre, the financials sector has subtly shrugged off trade spats, policy wobbles, and geopolitical jitters to outperform global equities.

In fact, by the end of H1, the sector was up over 11% in sterling terms so far this year, compared with under 5% for global equities.[1] It’s not just another fifteen minutes of fame either – financial stocks have beaten global markets in three out of the last four years.

Financials vs global equities, GBP net returns YTD

Source: FE FundInfo, July 2025

The reasons for this are myriad, but many are rooted in the diverse and nimble nature of the sector as a whole – something which is often not fully appreciated by UK investors. For example, despite common misconceptions, banks do not represent the be-all-and-end-all for financials stocks; banks make up only 43% of the MSCI ACWI Financials Index, with the rest split across various subsectors such as payment processors, asset managers, trading platforms, and insurance firms.[3]

This diversity is one of the core reasons why the sector has outperformed global equities so far in 2025. The current combination of competing macroeconomic factors – significant uncertainty, both economically and geopolitically, as well as cautious (albeit slowly loosening) monetary policy from central banks – in fact plays right into the hands of some of financials’ strongest players. For example, banks benefit from the higher interest rate environment, whilst trading platforms thrive in the face of market volatility as investors reassess and juggle their holdings.

“Financials are more varied than many realise,” says Nick Brind, Co-Manager at the Polar Capital Global Financials Trust, emphasising that the trust’s variety of underlying holdings have helped it to capitalise on the sector’s success.

Polar Capital Global Financials Trust, subsector exposure (%)

Source: Polar Capital, August 2025

“Our conversations with clients often focus on banks, and whilst they’re clearly important, they represent less than 40% of our portfolio. We also have significant investments across a range of exciting sub-sectors like insurance, diversified Financials, asset managers, data providers, exchanges, and payment businesses. As active stock pickers, the diversity of opportunity set allows us to allocate capital where we see the most attractive returns.”

Navigating Trump’s tariff wars: The power of active management

It’s precisely this active stock-picking strategy that enabled Polar Capital to assess and respond to the impact of the rapid-fire changes to US trade policy. While global equities got the jitters, the team behind the Global Financials Trust reviewed their existing holdings and siphoned exposure away from the market segments they expected to be most affected.

“We reduced exposure to US financials and took steps to de-risk our regional allocation. Specifically, we trimmed holdings in US banks, to reflect a potentially tougher macroeconomic backdrop and the risk of rising loan losses, albeit from currently benign levels,” explains Co-Manager Tom Dorner. “We also cut exposure to consumer finance companies, including American Express, given the likelihood that corporates will pass higher input costs onto consumers.”

Polar Capital Global Financials Trust, top 10 holdings (%)

Source: Polar Capital, August 2025

Market volatility is not just cause to reduce exposure to problem areas, but also to increase it where it appears an opportunity may arise. Polar Capital dialed up their exposure to trading platforms in Europe, where they anticipated an uptick in activity as retail investors sought to shuffle their portfolios around the swathe of tariffs.

“In Europe, we have been overweight in several trading platforms as we believe they will be beneficiaries of consumers taking greater control of their investments. In April, we added to these holdings (Plus500; IG Group Holdings) as they are direct beneficiaries of elevated trading activity that we feel will likely follow the recent volatility,” Dorner says.

Further still, the team also incorporated derivatives as a hedge against any valuation drops that might have dampened the portfolio’s relative resilience: “Having been overweight European banks, we had slightly reduced our holdings ahead of Liberation Day and purchased put options to protect the portfolio from potential weakness in the sector.”

As at August 2025, the Polar Capital Global Financials Trust is tracking slightly ahead of its benchmark MSCI ACWI World Financials, with YTD returns of 9.32% compared to 7.00%. It’s currently trading at a -1.76% discount.[3]

Polar Capital Global Financials Trust, net GBP returns YTD

PCGFT ordinary share price | 9.32 |

MSCI ACWI Financials | 7.00 |

Source: Polar Capital, August 2025

“While the long-term implications of the tariff regime remain unclear, we remain ready to reposition the portfolio as needed,” says Brind. “We are encouraged that the Trust has navigated the recent volatility well, underscoring the benefits of our more active and balanced approach.”

Looking ahead: Positive outlook underpins this unloved sector

What the rest of 2025 will look like for global markets is yet to be seen, but so far, the macro uncertainty that dominated H1 looks set to stay – at least for a bit longer. War rages on in Europe and the Middle East, the Trump administration continues to tinker with its trade strategy, and in the UK, the Bank of England juggles the difficult balance between keeping a lid on inflation and addressing a weakening economy.

In spite of this, Polar Capital believes financials maintain strong fundamentals and attractive valuations, and are optimistic that the sector will hold up well. They cite three specific areas which underpin this quiet confidence:

Rising M&A activity

Mergers and acquisitions (M&A) are giving European banks a boost. There’s a growing mood in Brussels and beyond that Europe needs its own ‘regional champions’ – heavyweight banks that can stand toe-to-toe with the US mega-players.

Since the Global Financial Crisis (GFC), many European institutions have strived to build up their balance sheets. However, there’s also a sense that regulations have become a tad stifling. Many policymakers now see the regulatory regime as overly complex and restrictive, and are pushing for reform: “The pendulum has swung too far the other way to the detriment of economic growth.”[4]

Increased retail trading

Trading platforms saw increased volumes in H1 2025 – something we can largely thank Donald Trump for. The market volatility and accompanying speculation piqued retail investors’ interest, with many reviewing and rejigging their holdings.

“The market volatility that has characterised 2025 is good news as this helps drive volumes,” commented the Association of Investment Companies (AIC). “Digitalisation and AI are driving down costs and enhancing profitability – that goes for other parts of the sector too.”[5]

Strengthening emerging markets

Finally, against the backdrop of a weak US dollar and an entrepreneurial uptake of digitisation, emerging markets are quickly becoming an attractive corner of the financials market:

“A weakening US dollar is normally associated with a better period for emerging markets. The best financials stocks in these countries are exploiting technological process to provide attractively priced financial services to an underserved customer base and are seeing explosive growth as a result.”[7]

Polar Capital Global Financials Trust, geographic exposure (%)

Source: Polar Capital, August 2025

Of course, when it comes to investing, there is no such thing as a guarantee. However, for now there is plenty of reason to believe that financials stocks will continue to deliver strong performance, benefitting from a perfect storm of macro factors which would leave some sectors in a dither.

The AIC is similarly optimistic about the sector as a whole, and believes the Polar Capital Global Financials Trust is “well-positioned” for the rest of the year:

“Nothing goes up in a straight line – and we would encourage investors to look at the Polar Capital Global Financials Trust opportunity in terms of multiple years rather than months – but the 2025 trust has got off to a good start and we think it is well-positioned for the future."

---

[1] FE FundInfo, July 2025

[2] MSCI ACWI World Financials, July 2025

[3] Association of Investment Companies, August 2025

[4] Association of Investment Companies, July 2025