The 17 Sustainable Development Goals: Aligning funds with global targets

1 Nov, 2022

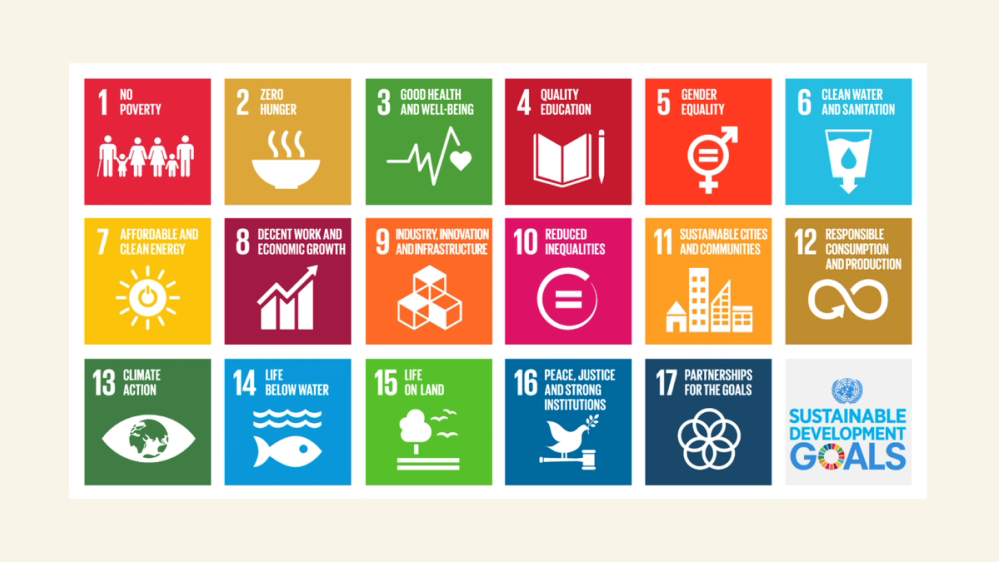

When it comes to matching your investments to your values, it can be daunting to know where to begin and how to decide if a product maps to your beliefs. But one of the best places to start your research is with the United Nation’s 17 Sustainable Development Goals (SDGs).

These 17 themes (see above), set out by the United Nations in 2015, are a set of interlinked goals designed for the global community to work towards achieving by 2030. From eradicating poverty to affordable and clean energy, the SDGs are a popular framework to use when assessing the sustainability credentials of an investment product, and can be a helpful tool if you’re unsure where to start your research.

Some providers helpfully relate their funds to specific SDGs, which makes it easier to see what positive outcomes your money will be aligned to. For example, Liontrust helpfully map their 20 Sustainable Future investment product themes to 8 of the primary SDGs.

These are as follows:

Source: Liontrust. Data correct as at October 2022.

Liontrust looks at the investment world through the prism of three mega trends – better resource efficiency, improved health, and greater safety and resilience – and 20 subthemes within these (see the table above), all contributing in different ways to create a cleaner, healthier and safer planet.

But nothing in life is that neat and tidy, right? Liontrust admit that there are sometimes overlaps, as most companies are, in reality, helping to meet more than one SDG at once. Let’s take a look at how Liontrust’s funds map to the SDGs.

In 2021, 24% of their funds’ exposure to the SDGs was aligned with SDG 8 - decent work and economic growth, and 18% to SDG 3 - good health and wellbeing, whereas just 3% mapped to SDG number 4 – quality education.

Liontrust states that their Sustainable Fund investment process is based on the belief that sustainable companies have better growth than is often assumed and actually defy market expectations when it comes to resilience. They use this underappreciated advantage to try to deliver outperformance across equities (just another word for “shares”), bonds (essentially a loan to a company or government) and managed portfolios (investments that are overseen and monitored by a qualified fund manager).

And, in supporting sustainable companies, Liontrust’s Sustainable Funds accelerate environmental and societal improvements.

Let’s look at some of Liontrust’s investment themes in a bit more detail. While there are plenty of tech and infrastructure companies making up some of the organisations Liontrust invests in, there are some home-grown, less wizzy talents too. Two such companies fall under Liontrust’s ‘building better cities’ and ‘making transportation more efficient of safer’ subthemes (aligned to SDG 11 - Sustainable Cities and Communities): Places for People and National Express respectively.

Places for People is a company that funds the provision of social housing, which is driving long-term positive benefits for society. National Express - which most of us will know from getting stuck behind on long-distance motorway journeys - also runs buses and rail services. Typically, it’s estimated that a single bus removes 30 cars from the road, leading to lower emissions, less congestion and improved safety, so National Express is well-positioned to help us transition away from the use of combustion engines in its fleet.

Liontrust have also taken the decision not to invest in any fossil fuel companies whatsoever. They back companies that are on the right side of positive trends for society, offering products and services that deliver a net positive contribution to sustainability. They also pick firms that are well-managed, profitable and are likely to generate good returns, and take an active approach to managing the organisations they invest in, engaging and challenging them wherever necessary.

The approach that Liontrust have developed is easy to understand, even for novice investors, and they explain things in a fuss-free, simple to understand way. You could do worse than read their annual report to dip your toe in the sustainable investing waters - it’s a good starting point to build your confidence in how the sector works! Check it out here.