Understanding the value of high-yield bonds

Sponsored by Invesco

17 July, 2025

This section is a paid promotion created in partnership with Invesco. The views and information presented reflect the sponsor’s messaging and may not represent the independent opinions of Boring Money. While we aim to ensure accuracy and relevance, this content should not be considered impartial advice.

Rhys Davies, fund manager for Invesco Fixed Income Europe, explains why the world's bond markets, significantly larger than equities, are becoming exciting again. He explores the case for high-yield bonds in a falling interest rate environment.

Investors might be forgiven for thinking that the financial world revolves around equities or, increasingly, Bitcoin, but in truth, the world’s bond markets are immeasurably larger and, for the first time in many years, exciting. Across 2025, some bonds, especially those issued by corporations, have been having a good run lately.

This should not come as a surprise, as bonds tend to do well in an environment where interest rates are coming down, a prospect that is certainly relevant to UK investors.

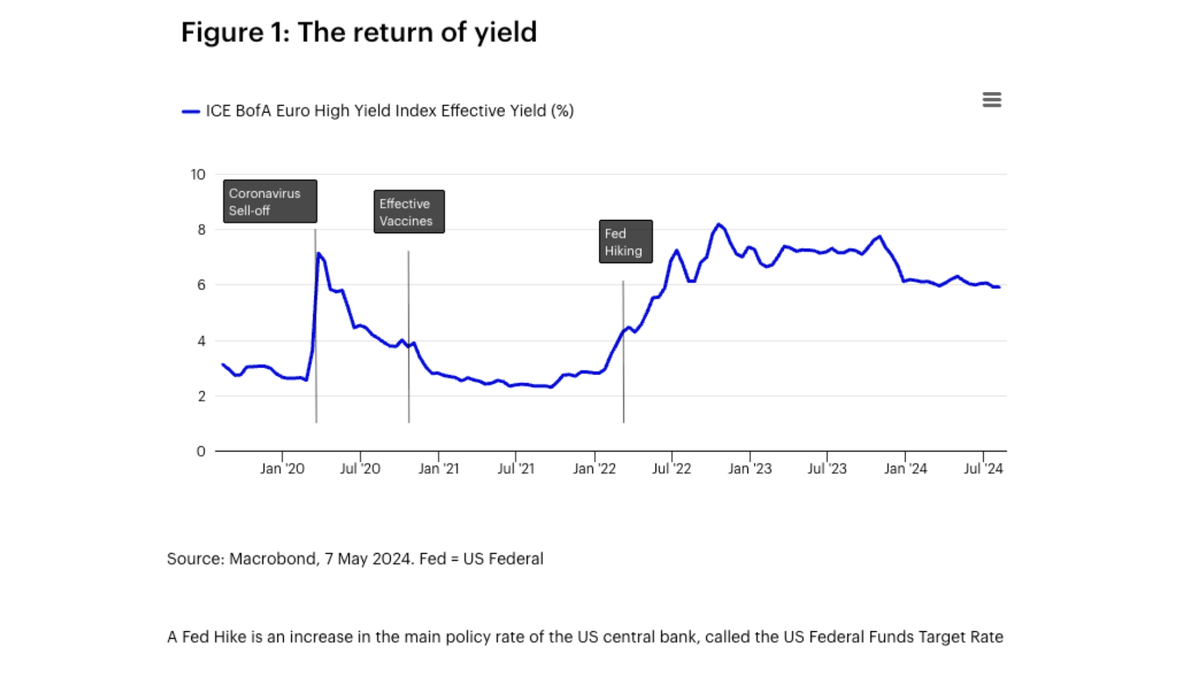

With interest rates expected to continue to decline and yields surpassing 6%, one particular category of corporate bonds - high yield bonds - presents an appealing option for income, diversification, and potential growth. Although risks such as inflation and defaults persist, active fund management can help mitigate these challenges and seize opportunities.

Comparing high-yield bonds and gilts

High-yield bonds are investments in corporations with lower credit ratings, which means they carry higher risk. To compensate for this increased risk, these bonds typically offer higher coupon payments. These yields compare favourably with UK government securities, known as gilts, where yields are currently around 4.2% for 2-year maturities and 4.5% for 10-year maturities. As figure 1 shows, yields of six percent or more have been consistent in the high-yield corporate bond space for the last few years.

Understanding corporate bonds

Corporate bonds are loans made to corporations in the US, the UK, and beyond, typically structured as bonds. This asset class is often referred to as corporate credit. Issuers—entities issuing such bonds range from those deemed, by independent ratings agencies, to have a lower risk of not paying the borrowing back classified as ‘investment-grade’ bonds, to higher-risk issuers. These higher-risk bonds, traditionally called ‘junk’ bonds, are more commonly known as high-yield bonds. Higher risk issuers must offer higher interest rates to compensate for the increased likelihood of default compared to investment-grade issuers.

In terms of ratings, the company must be rated at 'BBB' or higher by rating agency Standard and Poor's or 'BAA’ or higher by Moody's to be considered investment-grade, with most government bonds boasting multiple ‘A’ ratings. By contrast, anything rated below those ratings falls into the high-yield category, which includes bonds rated as low as C or CC. Crucially, the high-yield credit market is huge – the global market for these bonds is more than $2000 billion or $2 trillion.

Risks of high-yield bonds

One obvious reason for buying high-yield bonds is that they provide a higher income yield, currently over 6%. Even in the years between 2012 and 2021, when investors navigated a yield-starved investment landscape, the average coupon on global high-yield was 6.4%. That’s 3.8% higher than global investment grade and 5% higher than gilts.

Of course, there are some not insubstantial risks associated with high-yield bonds, not least that investors might find defaults rising as an economy slows down. According to Insight Investment, the typical investor tends to view the historic high-yield default rate as running at between 4% and 5% per annum, thus justifying much higher bond yields. Another obvious risk to watch out for is inflation. If inflation rates shoot up again (and shock the market), we might expect most, though not all, corporate bonds to fall in value as investors adjust their expectations for future returns and government bond yields start increasing again.

Nevertheless, despite these risks, the macroeconomic environment looks potentially appealing. Interest rates may continue falling, if only because UK inflation rates have fallen sharply (though they have taken a recent uptick). Defaults may start rising if there is a recession, but in that situation, the likelihood of interest rate cuts will grow.

---

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Invesco Bond Income Plus Limited

Invesco Bond Income Plus Limited has a significant proportion of high-yielding bonds, which are of lower credit quality and may result in large fluctuations in the NAV of the product. Invesco Bond Income Plus Limited may invest in contingent convertible bonds which may result in significant risk of capital loss based on certain trigger events. The use of borrowings may increase the volatility of the NAV and may reduce returns when asset values fall. Invesco Bond Income Plus Limited uses derivatives for efficient portfolio management which may result in increased volatility in the NAV.

Important information

This is marketing material and not financial advice. It is not intended as a recommendation to buy or sell any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication.

If investors are unsure if this product is suitable for them, they should seek advice from a financial adviser.

Views and opinions are based on current market conditions and are subject to change.

For more information on our products, please refer to the relevant Key Information Document (KID), Alternative Investment Fund Managers Directive document (AIFMD), and the latest Annual or Half-Yearly Financial Reports. This information is available on the website: https://www.invesco.com/uk/en/investment-trusts/invesco-bond-income-plus-limited.html.

Further details of the Company’s Investment Policy and Risk and Investment Limits can be found in the Report of the Directors contained within the Company’s Annual Financial Report.

Invesco Bond Income Plus Limited is regulated by the Jersey Financial Services Commission.