What makes gold so precious?

31 May, 2023

Sponsored by Invesco

What’s so precious about gold?

Gold has been one of the most sought-after commodities by people throughout history and today it can play an important role in some investors’ portfolios. The yellow metal has long held monetary significance, being used by early civilisations to trade for goods and services, then more officially being made into coins and later being used to back many of the world’s currencies. Although the last remnants of the “gold standard” officially ended in 1971, when President Nixon severed the link between gold and the US Dollar, gold has remained a valuable and often highly sought-after precious metal. Now, with tensions between major global powers, various economic threats and growing concerns about the banking sector, we believe gold could take on an even more important role in 2023.

Demand for the precious metal¹

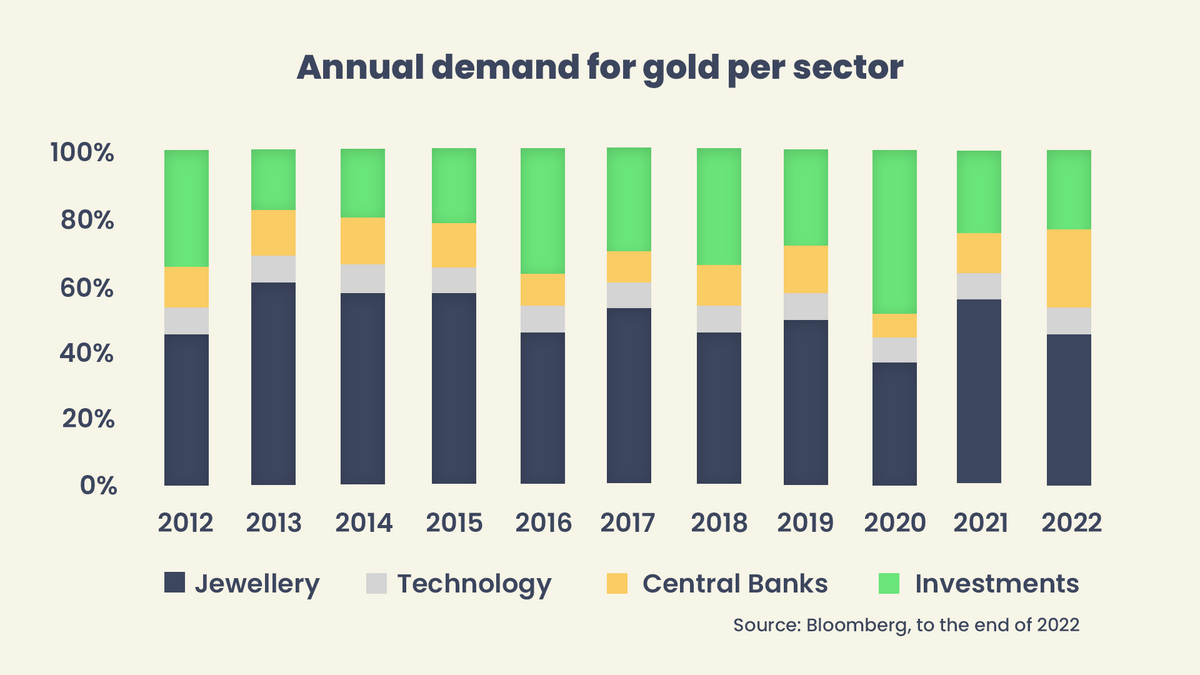

Interestingly, the allure of gold shines brightest in times of either celebration or turmoil. To the former we point to its cultural significance in much of Asia. Jewellery – especially in India and China – accounts for around half of the annual demand for gold. Technology applications make up around 8% of demand, while the balance can be split between central banks and investment. While demand from the jewellery and technology sectors are relatively constant, the other sources of demand tend to vary from year to year, and spikes are often triggered by fear or the unknown. Central banks have been net buyers of gold for each of the past 13 years, with 2022 being a record year as 1,135 tonnes of gold were purchased, 24% of total gold demand. Central banks, particularly in emerging markets, have been buying gold to help diversify their reserves and hedge geopolitical uncertainty.

Annual demand for gold per sector (%)

Individual investors can use gold for the same reasons as institutions and central banks. The basic concept of diversification is that you combine different assets in a portfolio or, more precisely, assets that tend to behave differently from one another. By this reasoning, there would appear to be limited benefit to adding corporate bonds to an equity portfolio, for instance, because these assets can often move in similar directions under certain conditions. High yield bonds can be more highly correlated with equities, meaning they too can often move together, as they’re driven by some of the same factors such as prevailing economic conditions and investors’ appetite for taking on risk. Instead, an investor wanting to diversify may wish to consider alternative assets such as gold.

Gold tends to behave differently than more traditional assets such as stocks and bonds. Gold can also act as a hedge in times of heightened volatility and global uncertainty, as we saw at the start of the pandemic, on Russia’s invasion of Ukraine and, even more recently, with the collapse of Silvergate and more notably Silicon Valley Bank and the troubles affecting Credit Suisse. The latter events have rekindled not-too-distant memories of the global financial crisis, when gold also performed well as many investors shunned riskier assets in favour of what they deemed to be less risky, such as gold and government bonds. Of course, no true safe haven exists, as every investment has some amount of risk attached, and valuations can fluctuate widely.

What drives the gold price

Before considering what may happen to gold in the near term, you need to understand what drives the price. Influential factors include interest rates, bond yields, inflation, the US Dollar (USD), the state of the economy and geopolitics. Some of these factors are interconnected, meaning that if one rises, others will also rise, and vice versa. That tends to be the case with inflation, interest rates, bond yields and the USD. Geopolitical concerns, meanwhile, tend to exist independently of those factors. If you have certain factors pushing against the gold price, but others supporting it, it often comes down to which of the forces investors think will be stronger or more persistent.

Events over the last year provided some useful examples of how the gold price can behave in certain conditions. When Russia invaded in February 2022, some investors sought to reduce their risk with what they perceived to be “safe havens” such as US Treasury bonds and gold, causing their prices to rise. Once it became apparent that the conflict would not spill out beyond Ukraine, the gold price fell as investors started weighing up other factors.

Interest rate hikes by the Federal Reserve (Fed) took centre stage for the rest of the year. The Fed’s initial claim in 2021 that inflation would be “transitory” proved a monumental mistake as consumer prices continued climbing to a 40-year high. That meant the Fed was late in responding to inflation, and they went on to hike interest rates aggressively, which pushed up bond yields and the value of the USD. Because gold does not pay any income, it becomes less attractive for investors when the income paid out by competing assets goes up.

Furthermore, because gold is priced in USD, it becomes more expensive for people to buy if their currencies fall in value versus the USD. In 2022, we saw both rising bond yields and USD act as strong headwinds to gold, despite the geopolitical threats from Russia as well as growing tensions in China. As we said, when there are competing forces, investors would usually focus on the one they see is stronger.

The outlook for gold

So, here we are in 2023. The markets have started pricing in an expected date for the Fed to stop raising interest rates, as well as what the interest rate will be when it eventually stops, i.e., the peak or terminal rate. Some economic data remains concerning, however, especially on inflation and employment, making it more difficult for investors to predict with any confidence what the Fed will do. When the picture becomes clearer, and investors are more confident in the forecast, the headwinds from rising interest rates, bond yields and the USD should diminish.

Geopolitical and broader economic threats could then become the focus, and these are likely to support the gold price. Reports suggest that Russia is preparing a new offensive, while the West seems intent on funding Ukraine for “as long as it takes”. While that continues to boil, tensions between China and the West, particularly the US, could be stretched further over Taiwan. Would there be any retaliation? This comes as the Chinese surveillance balloon episode is still vivid in the minds of the American people and, indeed, the rest of the world that witnessed it from afar.

If all that wasn’t enough, we also have the potential threat from the banking sector. If there are any knock-on effects from either the collapse of Silicon Valley Bank or what is happening now with Credit Suisse, and these spill over into other parts of the sector or to the wider economy, some investors could flee riskier assets in search of what they see as relative safe havens. So much has happened in such a short timeframe.

How can someone invest in gold and what are the risks?

First of all, it’s important to understand that gold is not a risk-free asset. The price of gold can go down as well as up, just like any other investment. People who want to invest in gold have several options, some providing more effective exposure to the gold price than others, and each with its own risks.

Gold mining stocks

As the gold price rises, so too would you expect the profitability of gold miners to increase. That should, in theory, make their share prices go up. While that is sometimes the case, the gold price is not the only determining factor when it comes to these companies’ stock prices. The efficiency of the miner’s process, labour costs, financing costs, location of the mines and transportation costs all come into play. Because of these additional factors, investing in the stocks of gold mining companies might be a less effective way to gain exposure to the actual gold price.

Gold bars and coins

Buying and holding physical gold could provide more accurate exposure to the gold price compared to investing in mining stocks. However, investors choosing this method need to source where they’re going to buy the coins and bars, plus sort out transportation, storage and insurance. These additional costs and the additional work involved could make this a less appealing option for some investors.

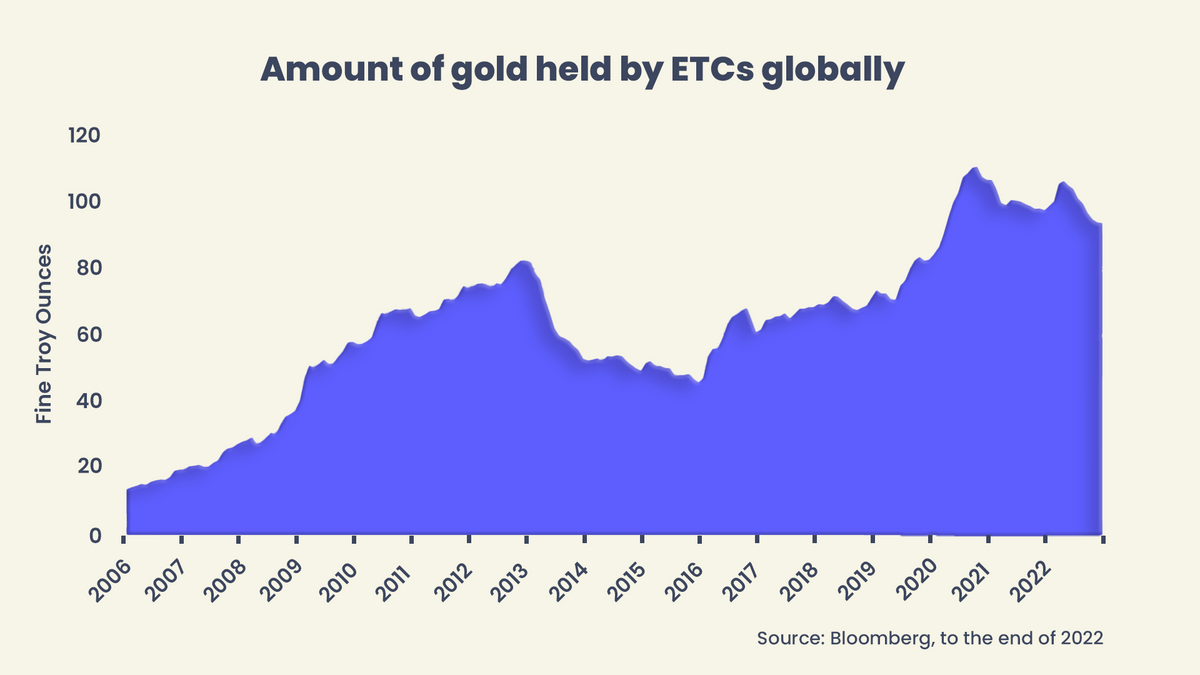

Physical gold ETCs

Gold exchange-traded commodities (ETCs) can offer investors a simple and efficient means for gaining exposure to the gold price. Gold ETCs are backed by physical gold, meaning the ETC will buy and hold gold bars (stored in secure bank vaults) equivalent to the total value of the ETC. With all the hard work done by the ETC, investors are not burdened with having to arrange the sourcing, transportation, storage or insurance of the gold bars. Units in a physical gold ETC can be bought and sold throughout the day in the same way as ordinary stocks and shares. The price is determined by a standard benchmark, such as the LBMA² Gold Price.

Amount of gold held by ETCs globally

Conclusion

If you are looking for ways to diversify your portfolio, you may wish to consider an investment in gold, either through a physical gold ETC or one of the other avenues. Some factors that influence the gold price are different from those affecting more traditional assets such as stocks and bonds, making gold a potentially effective diversifier. Gold tends to be most sought-after either in times of celebration – see jewellery demand during the festival and wedding seasons in China and India – or when there are heightened fears and uncertainty. It’s often during these more volatile and concerning times when some investors may consider turning to gold.

[1] Source for the demand data: World Gold Council, March 2023.

[2] London Bullion Market Association.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Instruments providing exposure to commodities are generally considered to be high risk, which means there is a greater risk of large fluctuations in the value of the instrument.

Important information

This is marketing material and not intended as a recommendation to buy or sell any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment / investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication.

Data as at 14 March 2023 unless otherwise stated.

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals and are subject to change without notice.

This material has been communicated by Invesco Asset Management Limited, Perpetual Park, Perpetual Park Drive, Henley-on-Thames, Oxfordshire RG9 1HH, UK. Authorised and regulated by the Financial Conduct Authority.