Home • Articles • Why invest?

Why invest?

12 Nov, 2021

Leaving your money in the bank is easy and stress-free. So why bother with investing? What’s the motivation behind taking additional risk and having to deal with the headache of choosing investments, monitoring them, and trading them?

People invest for two key reasons:

To gain long-term returns.

To maintain the value of their savings / protect them from inflation.

Most people want more money. Growing your wealth in the long-term is often the main reason for investing. You can generate a passive income via dividends, the value of your stocks can rise over time, and compounding can work its magic in your favour.

An extra £1,000 may be put to much better use when sitting in investments instead of your bank account, with global markets returning an annual rate of around 7% in the 2000s.

Inflation is a term that is thrown around a lot and is another vital factor to consider when discussing investing.

What is inflation?

It refers to a sustained increase in the general price level. No inflation isn’t a good thing, but high inflation can be very damaging, as prices rapidly increase. If inflation is growing faster than your wage, you are becoming relatively poorer.

Here's an example

Imagine you have £10 and Freddos cost 10p, your £10 has the equivalent value of 100 Freddos. Next year, the price of Freddos goes up to 20p. All of a sudden, your £10 is only worth 50 Freddos. You’d now need £20 to buy 100 Freddos, when it previously cost you £10. This is exactly how the economy and your savings work. The £10,000 savings that are in your bank account today will buy you £10,000 worth of things. But in 5 years, those same things may cost more, which means your £10,000 savings are now worth less stuff. In relative terms, your savings are losing value.

Investing can help you preserve or increase the value of your savings

Instead of watching the value of your hard-earned money being eroded by inflation, this money can be invested. As long as an investor’s return matches the inflation rate, they can preserve the value of their savings. Inflation rates tend to be between 1-3%, especially in recent times, so investors don’t need to opt for risky investments to achieve this level of returns.

Benefits of Freetrade

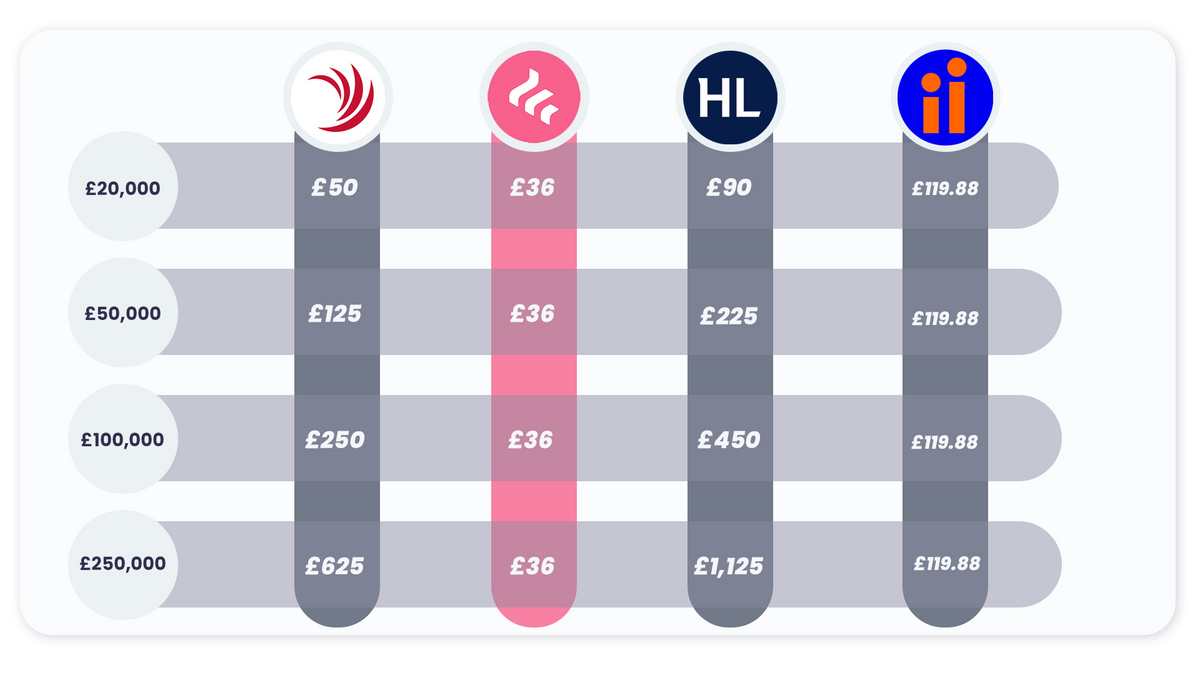

Freetrade offers investors many advantages, with a wide range of products and extremely low fees. Users of their general investment account (GIA) can invest absolutely free; there are no platform charges and no trading fees. Freetrade’s ISA is priced at £3pm, bringing the annual cost to £36. That is the equivalent of paying a 0.18% charge on a relatively modest portfolio of £20,000 – which is over 25% cheaper than AJ Bell. The potential savings continue to grow as portfolio sizes increase due to Freetrade’s fixed prices, as illustrated below.

The absence of trading fees further increases investors' cost savings with Freetrade, especially for regular investors, who save between £7-12 per share trade. Freetrade has a calculator tool on their website which breaks down their charges on a customised portfolio in significant detail and compares them to the charges an investor would face on the other main investment platforms.

In terms of features, a key advantage for Freetrade users is their ability to trade fractional shares. This is when you can buy a portion of a share, instead of purchasing the entire thing. Amazon’s share price is circa $3350, which would normally price it out of a lot of retail investors’ portfolios. Freetrade users can however buy 0.01 Amazon shares for $33.50 without any issues, whilst AJ Bell or HL users would need to cough up the full $3000+ dollars to get any direct Amazon exposure.

Users can also benefit from being members of the Freetrade community, including access to forums where a host of random, interesting topics are regularly discussed.

Range of offerings

Freetrade has continued to improve and expand on its range of offerings, with users now able to open GIAs, ISAs and SIPPs. Investors have access to UK & US shares, ETFs from some of the world's largest asset managers, over 150 investment trusts and IPOs & SPACs.

Freetrade Plus is Freetrade’s top tier, where users have access to the complete suite of investments and services on offer. For £9.99 per month, investors can benefit from a wider investment selection, the ability to make limit orders & stop losses, a Stocks and Shares ISA and priority customer service among a host of other things. Plus, members can also earn 3% interest on cash deposits up to £4,000. Maximising this allowance would earn them £120 per year, which would cover the Freetrade Plus fee, and make the service effectively free!

If you'd like to get started investing with Freetrade and earn a free share worth up to £200 click here.

This is sponsored content and was written in conjunction with Freetrade. As such, this content does not necessarily reflect the opinions of Boring Money. The cost calculations in this article were conducted by Boring Money’s independent research team. Reliance upon information in this material is at the sole discretion of the reader.