Digital Advice Guide: Financial Advice Without the Fuss

By Boring Money

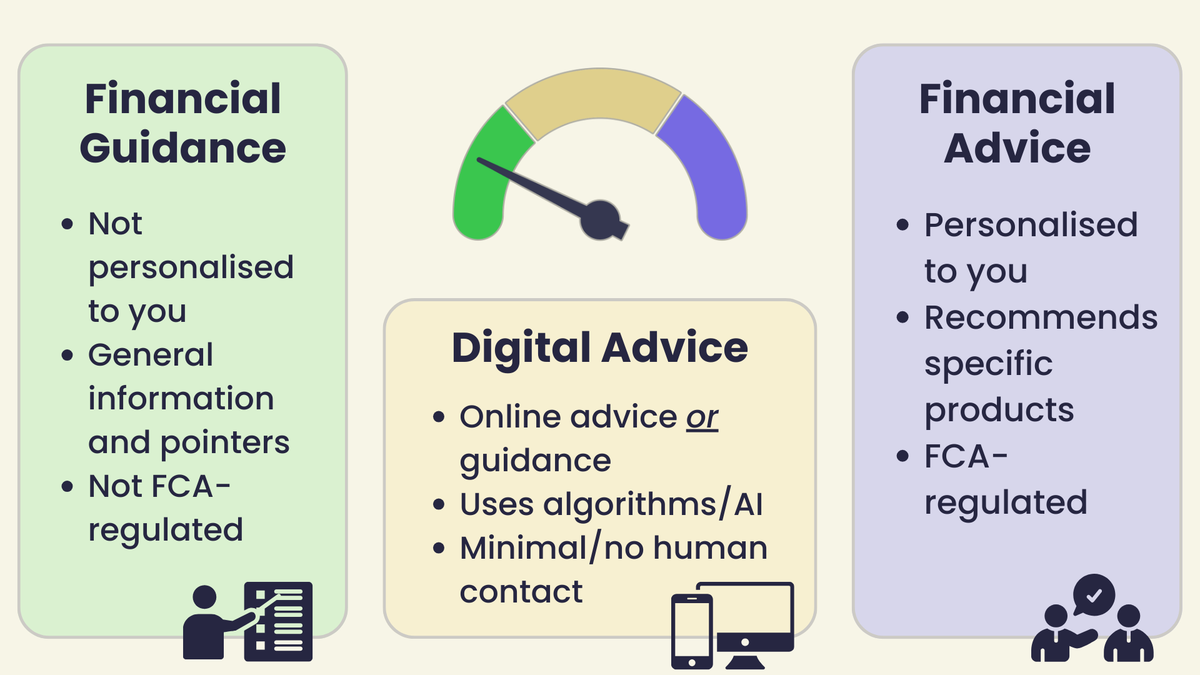

The basics of digital advice

Digital advice - also known as robo-advice - is a type of financial advice or guidance that uses technology to help you make better money decisions. It typically relies on algorithms to understand your financial situation, risk tolerance

and goals to then offer suggestions on how you can address your issue or achieve your objectives.More simplistic forms of digital advice (akin to financial guidance

) may begin the process with a questionnaire designed to garner some key information about your current finances, such as:Your age

Your gender

Your marital status

Your income

Current assets (savings, investments, pensions, etc)

Risk tolerance (how much investment risk you are willing to take on)

Your financial goals (saving for retirement, growing your wealth, etc)

More thorough forms of digital advice (more like fully-fledged, traditional financial advice

) may build on this information with a deeper dive into your financial behaviour.For example, it may request to view your bank account to understand your recent transactions - such as how much and how regularly you're saving or if you're spending more than you think you are. This more in-depth information can help to formulate more tailored recommendations unique to you.

"Hybrid" digital advice also incorporates the input of real, human financial advisers at various points in the process to give you a blend of automation and real human input.

Is digital advice right for me?

The pros of digital advice

✅ Lower cost than traditional advice

Digital advice is typically much more affordable than seeing a traditional financial adviser in person. Even the most thorough digital advice services usually charge less than 1% per year all-in, compared to around 2%+ for traditional financial advice firms or advisers.[1]

✅ Simple and convenient

You can get financial advice or guidance from your phone or laptop, anytime - no need to book meetings, commute, or take time off work. Most digital platforms use easy-to-understand questions, interactive tools, and plain-English explanations to help you navigate without a sea of jargon.

✅ Low minimum amounts

Traditional financial advice is often only available to those with large amounts of money to invest. A recent survey found that 74% of financial advisers will only advise clients with a minimum of £50,000, and more than half (51%) would only advise clients with at least £100,000.[2] However, some digital advice platforms let you access their services with a portfolio of just £1 - making them far more accessible to those beginning to invest or save than more traditional advice.[3]

The cons of digital advice

❌ Less personalised

Digital advice is generally built for straightforward scenarios, not for people with complex tax planning needs, business interests, or messy finances. If your situation is more complicated, even the more thorough digital advice services may miss key details or nuance, so you may be better off seeking traditional financial advice for a more comprehensive assessment of your circumstances.

❌ Limited human contact

Some digital advice platforms are fully automated, so if you like talking things through with a real person, or want the option to ask follow-up questions, you might feel a bit deprived. Even if you opt for hybrid advice, the extra human touch usually comes at a higher cost - at which point, depending on your budget, you may decide that traditional advice is better suited to your preferences.

❌ Not all services are regulated

Finally, as we touched on before, many digital advice platforms actually offer only guidance - not regulated advice. That means you get general info but no personalised recommendations or legal protection. It’s important to know which you’re getting, as the difference is more than just semantic - it affects your rights if things go wrong.

Top questions on digital advice

What makes digital advice different from using an investment app?

Digital advice is designed to help you address an issue or achieve a goal in relation to your finances - such as which investment approach you should take or how you can save enough for your ideal retirement. Investment apps often just give you access to investment products, such as funds or shares, with no guidance or advice on how you should use them. Essentially, one gives advice, the other lets you invest.

Do I need a lot of money to use digital advice?

Not at all. Many digital advice services let you start with much lower amounts than is typically required before you can access traditional finance advice. Minimum amounts differ from firm to firm, but can start from as little as just £1 - so you don't need to have buckets of cash lying around to get help with your money!

Can I trust digital advice with my money?

If the service you're using is authorised by the FCA, then yes - it must follow strict rules around suitability, transparency, and protecting your money. However, if it isn't FCA-authorised (which may be the case if it's only offering lighter-touch financial guidance), you won't have the same legal protections should something go wrong. This may not be an issue if you're only looking for general information and pointers, but if you're seeking more thorough, holistic help then you'll want to check the FCA register to make sure the service you're using is properly regulated.

Will I still be able to speak to a real person if I need to?

Some services are fully digital, while others offer a hybrid model - with optional access to a human adviser (usually at extra cost). Always check what level of support is included before signing up. For some people, a completely automated approach will do just fine. But if you're keen to have the option to chat to a real person, you might be better suited to a hybrid model, or even just going down the route of traditional advice instead.

What if my finances get more complicated later on?

Digital advice is mostly designed to address straightforward needs, but some platforms will also let you switch to full financial advice if things get more complex - like when managing inheritance, business income, or tax planning. Not all digital advice services offer this though, so if you're likely to need more intensive advice in the near future, it might be wise to check if this is available before you sign up.

Key takeaways on digital advice

💰 Cost-effective, easy-to-access

For those priced out of traditional financial advice - or just not in need yet - digital advice offers a cost-effective alternative. You can typically start with low minimums and access help for a fraction of what in-person advice would cost.

❓ Understand what you're getting

Don’t be fooled by slick websites or clever branding. Some platforms offer regulated financial advice, with recommendations tailored to your circumstances, but others just provide financial guidance - useful info, but no personal recommendations or legal protection. Always check whether a service is FCA-regulated and the level of advice you can expect.

⛔ Not suitable for more complex finances

Digital advice works well for simple, straightforward challenges and goals. Think investing for retirement, building up your savings, or saving for a deposit. But if you’ve got complex finances (multiple income streams, tax concerns, or estate planning needs, for example), you might be better off reaching out to a qualified adviser for a more thorough review of your finances.

---