Shares Explained: A Beginner’s Guide to Buying and Investing in Stocks

The basics of shares

In a nutshell

What are shares?

Our Founder & CEO Holly Mackay explains what you need to know about shares and how they work in the bitesized video below.

Investing, at the heart of it, is about putting your money into businesses you believe have the potential to grow. This is where shares come in. They let us own a small slice of a company, so if they do well, so do we. And if they flop, we lose money.

Also known as stocks, or equities, shares exist to enable companies to raise money to fund their activity and growth. Individuals or companies buy shares, and give that company some money in return for ownership of a small piece of that business.

The thought process behind buying a share is no more complicated than what you see on Dragon's Den. You're the dragon trying to work out if you should invest in the company or not. But buying a single share can actually be a risky way to access the stock market. Why? Well, you're putting all your eggs in one basket.

We spoke to a lady who was horrified that she bought M&S shares and they went down. "I mean, it was M&S! They're really busy!" Just because it's a big brand which looks safe and solid, doesn't necessarily mean they're making decent profits that year or tracking to plan.

Are shares right for me?

19% of UK adults own shares, but they're not the right sort of investment for everyone - especially if you're low on time or looking for an easy way to put your money behind several companies. Here's an overview of some of the main pros and cons of shares.

Cash vs shares

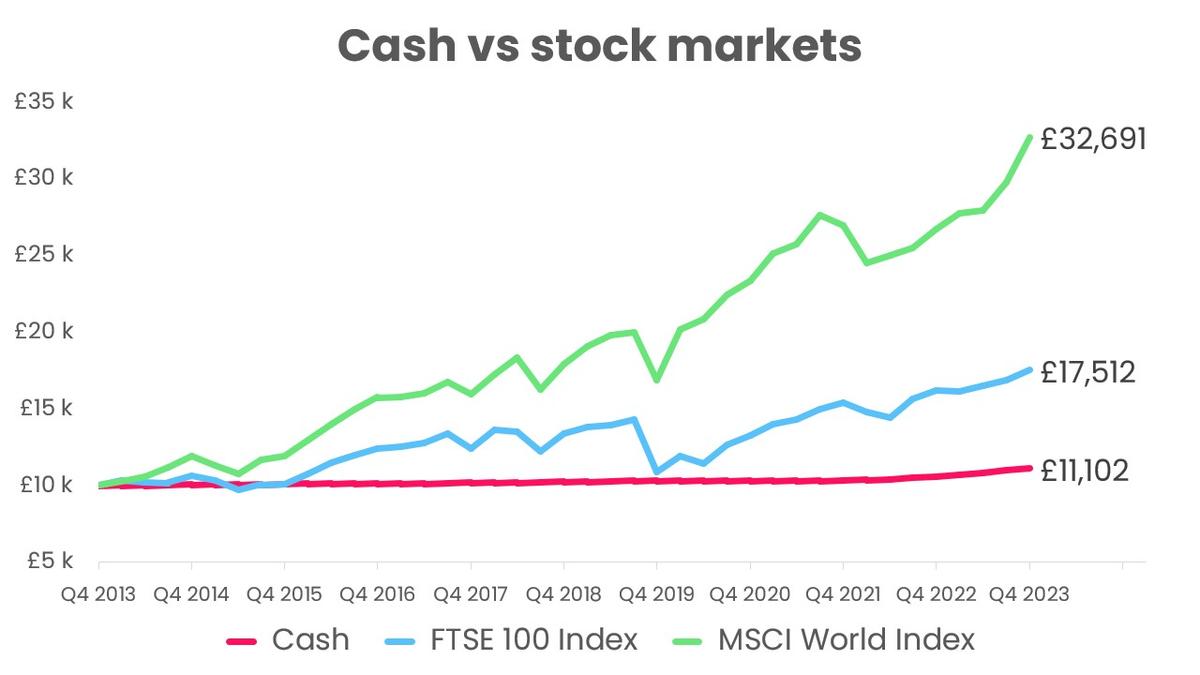

If you had put £10,000 away in 2013, what would it be worth by the end of 2023?

The graph below shows you a recent example of how cash has performed compared to stock market shares. For the purposes of this illustration, we've looked at the growth of a single £10,000 lump sum investment in cash and in two stock market indices: the FTSE 100 and MSCI World (you can read more about these below the image).

It's clear to see that leaving your money in cash (pink) led to significantly less growth over the period between 2013-2023 than if you had invested in stock markets. And although the British FTSE 100 Index (blue) didn't perform quite as well as MSCI World (green), it still climbed by a whopping £7,514 - compared to gains of just £1,102 from cash over the same time period. Of course, these numbers look measly compared to MSCI World's impressive £22,691 gain.

NB: The dip you can see after Q4 2019 reflects the start of the COVID-19 pandemic and subsequent global lockdowns.

Source: FE FundInfo.

Will shares outperform cash in the next 10 years?

Just like the weather, it's impossible to predict what the future holds. All we can do is show what has happened in the past. Shares are a bumpier ride than cash – and not a short-term thing. Anyone who says they can guarantee you'll make money is probably lying. There are risks. But research tells us that shares have done better than cash 9 times out of 10 over any 10 year period since the stock markets began.

You buy and sell them on the stock market and, just like eBay, people make bids and offers. But it all happens super fast. Prices bounce up and down and at the end of the day it all comes down to sentiment – if loads of people want a slice of the action and these things are flavour of the month (think Nintendo after Pokemon Go), then prices rise as the sellers get a bit cockier. If people get turned off and the share in question is uncool, then everyone tries to offload them and the asking price falls.

Curious about what's got investors' interest this week? Catch up with Holly's award-winning blog every Friday for the low-down on what's going on in stock markets, how it could impact your finances, and some no-nonsense food for thought to help you make better money choices.

Want to get Holly's weekly blog straight to your inbox?

Already have an account? Login

How can I buy shares?

Rather than going to companies directly and asking to buy a share of their business, we access shares through a central market otherwise known as the Stock Exchange. Companies will 'list' on the Stock Exchange, which means anyone can buy or sell a share.

The Stock Exchange can be accessed through online investment platforms, many of which are beginner-friendly. These platforms allow you to purchase a small percentage of some of the world's largest companies - this ranges from BP to HSBC, Apple to Samsung, and Microsoft to British Airways.

You can either buy individual shares directly - through an online broker or an investment platform - or purchase a fund in order to get exposure to dozens of shares in one fell swoop. If you're new to investing and don't know where to start, check out our hand-selected Best For Beginners award winners to see which providers we think are the best starting point.

Buying bulk shares through a fund

The concept of buying shares through a fund is similar to buying a mixed case of wine. You don't have time to pick individual bottles, or don't want the responsibility of choosing the best, so you let it be done for you. You're outsourcing the selection of individual components to someone else.

A single fund will usually house around 30-60 shares. Whilst someone else may have invested £1,000 into an individual share, a very small percentage of your £1,000 may be invested into the same company. If that business then takes a hit you won't be so badly affected - the majority of your money is invested elsewhere. Basically, you are spreading your bets for security.

When investing through a fund, you are unlikely to have to pay trading or transaction fees. You will, however, encounter management fees throughout the duration of your investment. If you want to buy a few shares or a fund then it's usually best to open up an account online, and use your annual tax-free ISA allowance if you can.

Buying individual shares directly

When buying individual shares directly, you will encounter trading costs. You will typically encounter about £10 a pop, and 0.5% stamp duty to the government. This can accumulate to become an expensive way of buying small shares. The upside is that after initial purchase, you will not have to pay management fees as you would have with a fund - there's nothing to manage.

Buying a couple of individual shares is a risky way to get exposure to the markets - especially for less experienced investors. You have all of your investment tied into one or two businesses. If it goes badly for them, you're in trouble.

This method is good for people who like to take an interest in the market, are time-rich and confident to make decisions themselves. Shares are not so good if you are busy, don’t feel expert in this subject, or will only pick shares in companies you know and love.