What is investment risk and why does it matter?

Anyone making an investment will be familiar with the phrase ‘capital at risk’ – it will be slapped on every communication you receive. But ‘risk’ may conjure up different things to different people. Risk can even be your friend if you use it the right way.

That said, there is little doubt that risk is a major deterrent to stock market investment for many people. Boring Money research shows that 50% of savers with more than £10,000 agree with the statement: ‘I’m concerned about losing any money’. This fear of loss of capital is one of the biggest barriers to getting started with investing.

The problem is that stock markets often hit the headlines for the wrong reasons. While most of the time, they potter along quite happily, occasionally, they have significant movements. That’s when the ‘£500bn wiped off shares’ will hit the front pages. This is unhelpful in understanding the real risk inherent in stock markets.

What is risk?

There are various definitions of risk and it doesn’t help that the investment industry’s definition of risk is not the same as it is for most investors.

The investment industry defines risk as volatility – how much share prices move up and down. Under this definition, an investment is considered high risk if its price moves around a lot, whereas if the price stays pretty consistent, it is less risky.

The below illustrates volatility by risk category:

This is not how most people view risk. For them, they are pretty comfortable with share prices lurching higher; it’s just the down bits they don’t like. For most investors, permanent loss of capital is their greatest fear. In this scenario, they end up with less than they started with, at the point at which they need their cash.

How do people like you perceive risk?

Fundamental to investing is that with a greater acceptance of risk, there is a great opportunity for reward. However, most people don’t see risk in those terms. Most people see risk as something to be avoided.

Research from Boring Money’s 2025 Online Investing Report found that the main motivation cited to invest is to get ‘better returns’ – with 37% of people stating that this was the reason that prompted them to start investing in the first place.

But even amongst those who do invest, many are still uncomfortable around the idea of taking risk with money – 34% of investors agree with the statement: ‘I am comfortable taking on a lot of risk when it comes to my investments’.

Unsurprisingly, young investors are the least risk-averse – 58% of investors under 44 with £50,000 or more agree they are comfortable taking risk. But that still leaves a whopping 42% who are not. This means that younger people could be missing out on the opportunity to maximise their rewards over a lifetime of investing due to a fear of taking risk.

Risk aversion in general accelerates with age – peaking as people approach the ‘decumulation’ phase (preparing for retirement) between 55-64.

Aside from age, female investors are considerably more risk-averse than men across all age groups, with 47% strongly disagreeing with the idea of taking on ‘a lot of risk’ with their investments – driven especially by those aged 45 and above.

Stock markets aren’t as risky as you think

Yes, stock markets go up and down, but over time, they are not as risky as you might imagine. Research from Schroders shows a 91% probability of UK equities outperforming cash over any 10-year period in the past 123 years. Even over two, three, four and five years, the equivalent probability was 70% or above.

Morningstar data shows that equities, which make up the lion's share of most investors' portfolios, have managed to return 7.4% per year after inflation over the trailing 100 years (S&P 500 total real return, annualised). That’s in spite of two world wars, the Great Depression, the Cold War, a global pandemic, and a range of local economic crises.

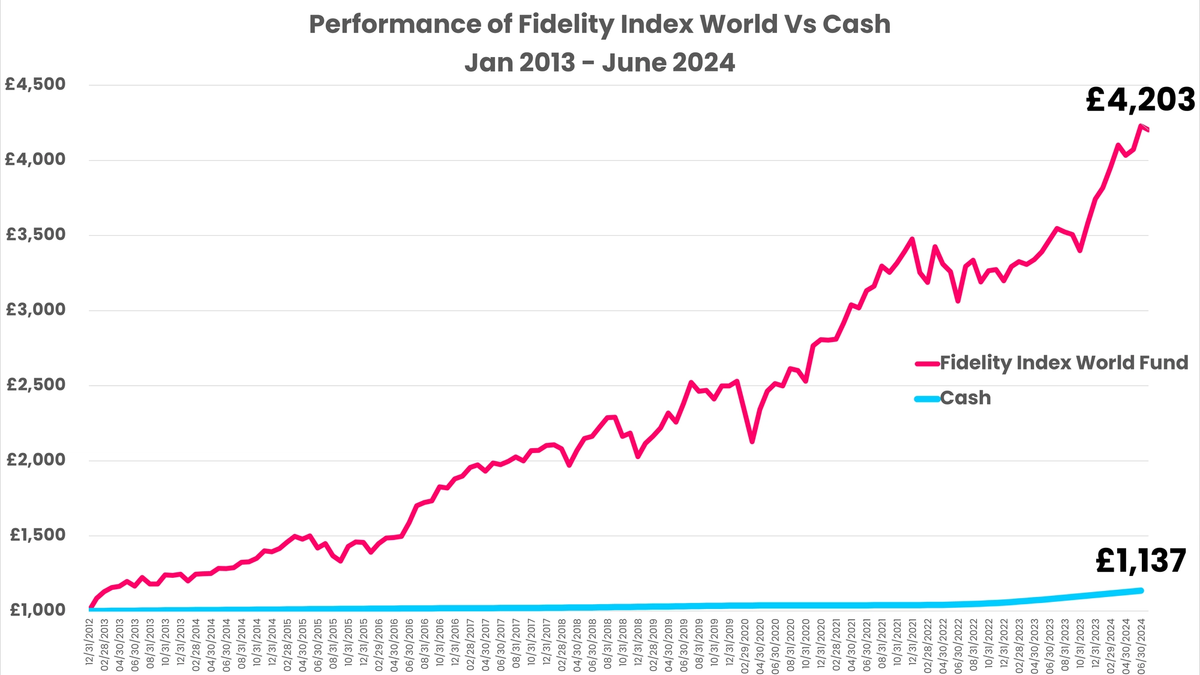

Below is an illustration of the Fidelity Index World performance – a good proxy for global stock markets - over a ten year period. As you can see, if you invested £1000 in December 2012 by the end of June 2024 it would be worth £4202.

Certainly, there are points along this journey where if you had invested at the wrong time and sold at the wrong time, you would have lost money.

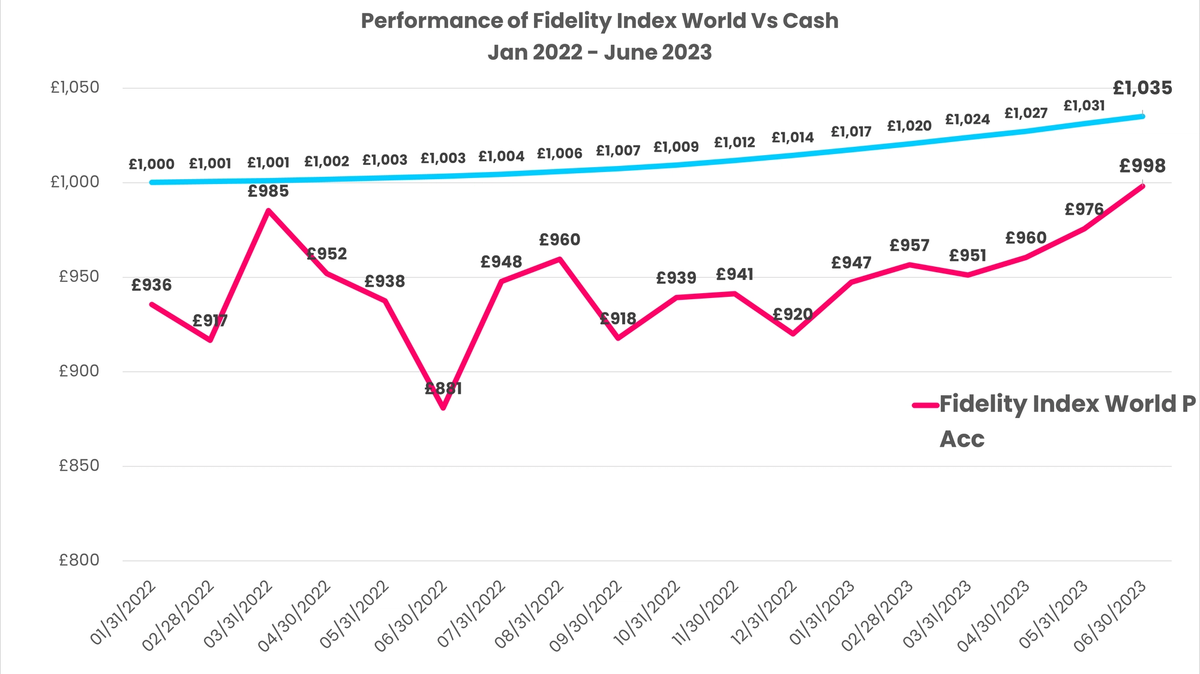

See below an illustration whereby if you had invested in January 2022 and withdrawn your investment in June 2023 you would have been worse off then if you held cash for the same period.

The key here is timeframes. If you had a long enough time horizon, you would have seen good returns.

Equally, relatively few people talk about the risks of holding cash. Cash feels intuitively safe because investors get back what they put in. However, this neglects the impact of inflation. Over the past 20 years, you would need a £10,000 investment to grow to over £17,000[1] to keep pace with the rising cost of living. It is far more difficult to do this if you hold all of your portfolio in cash.

Risk versus uncertainty

Consulting psychologist Paul Davies says how most of us define the word ‘risk’ when it comes to investing is misleading. He suggests that ‘uncertainty’ may be a more accurate term to use instead:

“To put it simply, ‘risk’ is a trigger word. Neuroimaging research has shown that hearing or reading this word activates areas of the brain, such as the anterior insula and the thalamus. These regions are where we process emotions such as anxiety, fear, disappointment, sadness and regret. Triggering this reaction is very useful when you want to stop people from drinking bleach, but it’s too extreme in the context of investing."

In the video below our Founder & CEO Holly Mackay speaks to Paul about the psychological interpretation of risk:

Risk doesn’t communicate both sides of the investing story – it only communicates loss. When someone is choosing what to do with their hard-earned life savings, it’s unfair to only speak in terms of loss. ‘Uncertainty’ represents both the positive and the negative sides of investing.

Davies adds: “It immediately communicates a balance that risk does not while not shying away from the potential downsides. People don’t welcome uncertainty either, but the word encourages consumers to investigate further rather than immediately running for the hills, scared they’ll lose everything.”

Stock market risk is not homogenous

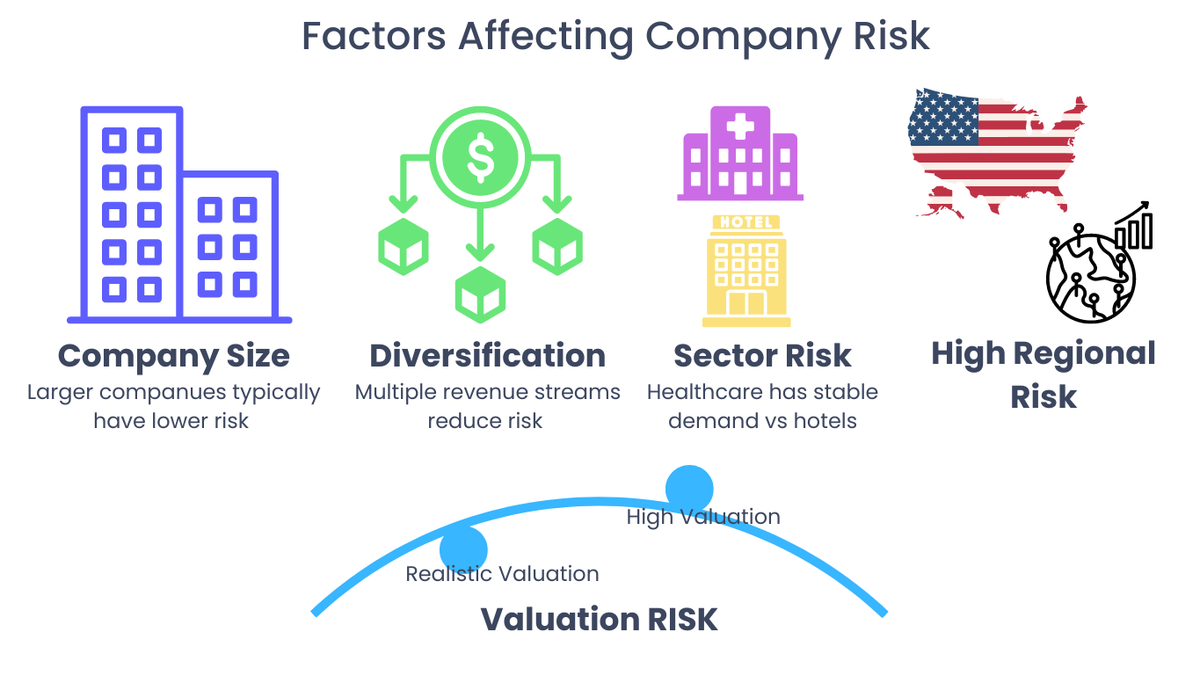

Companies are not all the same, which means they do not carry the same risks. A large company, for example, will tend to be less risky than a small company. They will have a broader range of revenue streams, a more diverse client base, and operations worldwide. This makes them less risky than, for example, a company with two or three key clients and a single product.

It is also true to say that different sectors and regions may carry different risks. A company in the US will have different governance and reporting standards to companies in other countries with less developed capital markets. A hotel business dependent on consumer spending will be inherently riskier than a healthcare business, where demand is stable across economic cycles.

Equally – and this is an important point – companies with lots of expectation built into their share prices will be riskier than those on more realistic valuations. The problem in the technology boom and bust (also known as the dot-com bubble, that occurred between 1995 and 2002) was not, in most cases, that the companies were bad, it was that expectations for their future growth had become impossibly high.

What can help you manage risk?

So what do we know about managing investment risk? Well, crucially, ‘risk’ does not equate to losing it all. Even during some of the worst financial upheavals, such as the Global Financial Crisis in 2008 and the more recent market’s reaction to Liz Truss’s disastrous mini-budget, markets generally bounce back.

Below are six things to consider to help you manage risk.

1. Time

The FTSE 100 fell 31% in 2008, but two years later it had fully recovered and then some. This was undoubtedly a problem for an investor who sold out during the dip, but for those who were able to hang in there until it had recovered, the damage to their portfolio was minimal (if any at all). Once again, it’s about your timeframes and avoiding being in a position where you need to sell your investments at a loss – i.e. becoming a “forced seller”. All stock market investment should be approached with a long-term time frame.

2. Diversification

The greatest risk for investors is to have everything on red, and it comes up black. Stock market investment is not a casino and you shouldn’t risk it all on the spin of a wheel. Putting all your investments into a single company or sector – even if you think it’s a sure thing – is to be avoided. There are always risks you cannot anticipate.

With this in mind, choosing investments exposed to a wide range of geographies and sectors is an important means to manage risk. You can achieve this through a balanced collective fund. You may not get the euphoric highs of picking the one technology stock that goes to the moon, but neither will you get the (more likely) bust. With a diversified spread of investments, if any one of them underperforms or crashes, you’ll be able to offset the losses against other, better-performing investments in your portfolio.

Multi-assets funds are a great way to have a diversified portfolio and can be likened to an investment ready-meal. Instead of buying all the ingredients yourself and worrying about putting it together, you can outsource everything to an investment manager and have them do it for you.

Holy Mackay explains multi-asset funds below:

3. Income

Targeting companies that pay out a share of their profits to investors through dividends can be a tool to manage risk in a portfolio. It means you get back 4-5% of your investment each year, which is reassuring. Dividends have historically been a significant share of the return from stock markets. Investors can choose to reinvest dividends to buy more investments and this can be a powerful way to grow wealth over time.

Investment Trusts can be a good vehicle for income as they offer dividends, which you can think of as a cash bonus you get to say “thank you” for investing in them. But here’s the icing on the cake: a fund manager can set aside up to 15% of a trust’s income during successful years to boost dividends at times when it hasn’t performed so well. Thanks to this unique function, many Investment Trusts tend to consistently pay - and even increase - their dividends during periods of market turmoil, and are an attractive option for investors looking for a steady stream of income, particularly if they focus on trusts with a reputation for consistent dividend payments.

If that's what you're looking for then the AIC's Dividend Heroes are the optimal place to start.

4. Regular savings

Drip-feeding money into the stock market helps smooth out returns to investors. Investors will be buying at different price points, which ensures they aren’t investing large amounts of money when the stock market is very high (and therefore, potentially, about to fall). It may not see investors make more money, but it makes for an easier journey.

5. Rebalance your portfolio

Rebalancing should happen once or twice a year and it’s about restoring the original weightings of the investments in your portfolio. You can rebalance by adding any top ups or re-directing any regular saving instructions to areas that have become a smaller portion of the portfolio, or by selling investments in areas that have performed well. This is a good discipline in helping investors buy at lower prices and sell at higher prices.

6. Invest in funds

Collective funds offer an easy and convenient way to invest, popular with novice and experienced investors alike. They’re a collection of investments chosen and run by a fund manager, so you benefit from the knowledge, skills, and experience of a professional. With thousands of funds available, you can invest in a mix of asset types such as shares and bonds to spread the risk around.

Read more on different types of funds in our guide here.

How much risk should I take with my investments?

There are plenty of online tools and calculators that can tell you how much risk to take based on your age, wealth and appetite for risk. There are investment providers out there that can match you with a risk level that is personalised to your appetite and comfort levels – a bit like online dating for investing. Many will also suggest a ready-made portfolio.

Generally speaking, portfolios designed for investors seeking higher risk will have a higher proportion in individual shares, as these are typically considered more volatile assets, whereas lower risk portfolios may have a higher allocation to bonds, as these are traditionally seen as low-risk. So Wealthify’s ‘Cautious’ portfolio typically contains around 90% low-risk investments, including bonds, whereas its ‘Adventurous’ portfolio has around 90% in high-risk investments, such as shares.

You can read more about ready-made portfolios and how they work in our beginner’s guide.

Every quarter, we track the performance of popular ready-made portfolios available to UK investors across different risk levels from low to high. Check out the latest results to see which portfolios came out on top here.

Risk can be on your side

Investors shouldn’t be nervous about stock market risk. It is an important part of the stronger long-term returns from stock markets. Stock markets will bounce around, but there are plenty of ways to mitigate this volatility and to build a portfolio that stays within your comfort levels.

---