Investment Focus: Emerging Markets

20 Dec, 2024

Investors' intense focus on US markets has overshadowed opportunities elsewhere, particularly in emerging markets. These economies, while at earlier stages of development, are strategically positioned in key global trends including decarbonization, manufacturing reshoring, and artificial intelligence advancement.

Setting the scene

Emerging markets are diverse. They include behemoth economies such as China, India, Brazil, Indonesia, and Mexico, and smaller economies such as Chile, South Africa, and Turkey. These markets may have higher political and economic risks but are often growing faster than their developed market peers.

The large index providers, such as MSCI or FTSE usually determine the classification of an emerging market. Countries will be labeled as ‘emerging’ for a number of reasons. It is not just a question of economic power. For example, South Korea and Taiwan are among the four largest equity markets in the MSCI Emerging Markets Index, and both are classed by the World Bank as high income economies. South Korea has a GDP per capita of over $36,000, which puts it alongside Spain or Japan[1]. In South Korea, a stumbling block has been its lack of an offshore currency market and a short selling ban on all listed stocks.

The classification may also be influenced by the openness and transparency of a country’s capital markets. There are some very wealthy countries that still attract an emerging or ‘frontier’ market definition, such as Oman or Bahrain because their capital markets are difficult to access. China, India, Thailand, and the UAE, among others, have foreign ownership limits. It is also a problem for Vietnam, which has no offshore FX market. The rating agencies will also consider liquidity in companies’ stock – are companies tightly held by the government, or powerful families, for example?

The definitions of emerging markets will be reviewed from time to time and may change. Russia was removed from all indices when it invaded Ukraine. South Korea continues to verge on developed market status, though its recent political turmoil may have dented its aspirations. Changes in classifications can be important for the performance of individual emerging markets – promotion can bring new inflows, while demotion may see capital drain away.

Growth characteristics

The idea behind investing in emerging markets is that these countries are in an earlier stage in their development and therefore should grow faster than mature, developed markets. There are plenty of examples of this happening in practice. For example, after China joined the World Trade Organisation in 2001, it saw an astonishing expansion in its economy, from US$1.34 trillion to US$17.8 trillion today[2]. It now sits just behind the US, with 18% of the global economy[3]. India is currently experiencing economic growth of around 7% per year[4].

However, the economic development path can be bumpy, and there may also be more political risk associated with emerging markets. Russia is perhaps the most glaring example of this: in 2008, it made up around 10% of the MSCI Emerging Markets index. By the time it invaded Ukraine in February 2022, this had dwindled to 4%, and it is now classified as a ‘standalone’ index[5] and is, by and large, inaccessible to investors.

The types of companies within emerging markets are also very different. On the one hand, there are global champions, such as semiconductor group TSMC, and smartphone maker Samsung. These are some of the most powerful and important companies in the world. But there are also much smaller companies, regional banks, or retailers, that tap into fast-growing consumer growth in countries such as Indonesia or Thailand.

Fund managers suggest that there is more mispricing within emerging markets because there are fewer institutional and retail investors participating in these markets. There is also considerable variability in local support for stock markets – India and China, for example, have active domestic investors, whereas other countries rely on international markets. Additionally, financial regulation in emerging markets is often less rigorous, reducing the transparency, trust, and insight that investors are able to generate on specific stocks in many cases. All these reasons combined, amongst others, make emerging markets a fertile area for active stock picking.

While the potential for rapid growth in emerging markets is clear, these regions also come with inherent challenges and risks. The diverse economic landscape, varying market support, and financial regulations create opportunities for active stock picking. Despite these complexities, the growth story for emerging markets remains compelling.

Emerging Markets today

The growth story for emerging markets is still intact. The world’s emerging and developing economies are projected to grow at 4.2% in 2024 and again in 2025. This is more than double the rate of those in advanced economies (1.8% in 2024 and 2025)[6].

However, there is considerable nuance within that. India is flying, with an expected growth rate of 7% for 2024[7], while China’s economy has been struggling in the face of sliding property markets and weakening demographics. Overall, Asia has been growing faster than Latin America or Eastern Europe.

Equally, within emerging markets, there are pockets of significant growth and areas of weakness. Powerful technology companies sit alongside sclerotic state-led industries. There are areas of real innovation and others where emerging markets lag behind. There are also real differences in corporate governance standards and management skill.

The stock market performance

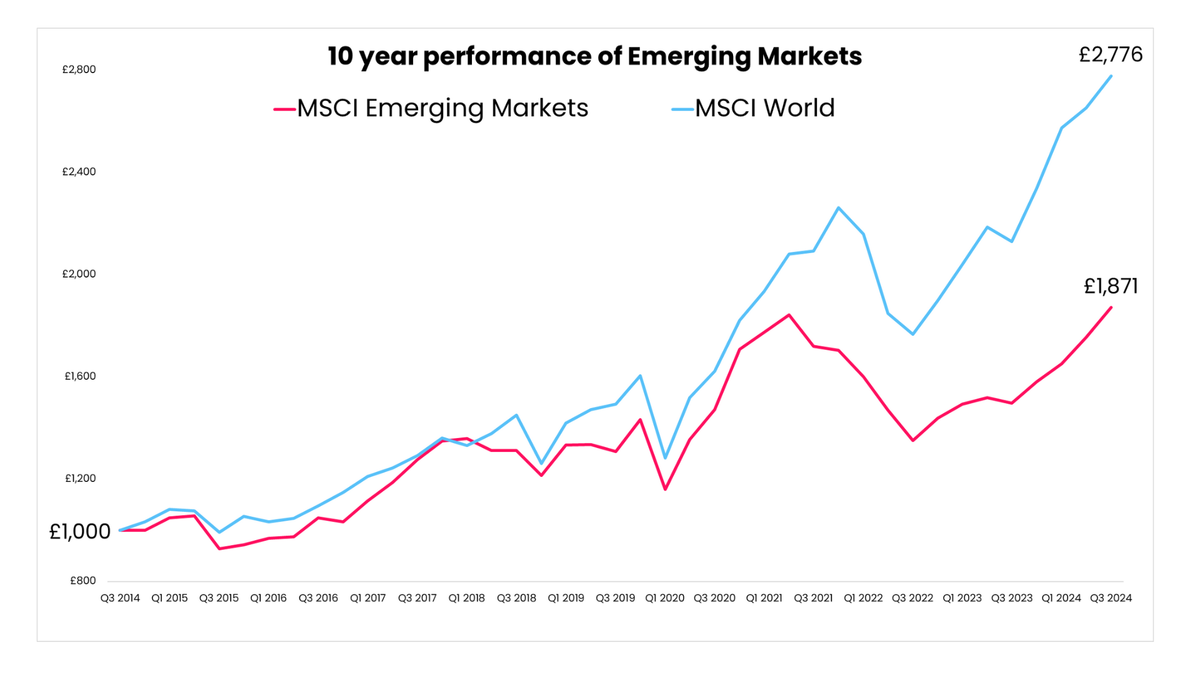

Overall, it has been a difficult decade for emerging markets. While the MSCI Emerging Market index has delivered an average annual return of 3.2% over the past 10 years, it pales next to the performance of the MSCI World index, which has risen by 9.3% per year.

Source FE Fund info, December 2024

This comparative weakness has had two main drivers. The first has been the astonishing strength of the US markets and the US Dollar. This has been hard to beat and has drained capital away from other parts of the world. When US technology could deliver 20-30% a year, why would investors take the risk on emerging markets?

The other problem has been China. China's stock market showed strength from 2010 to 2020[8], rising from 3,095 to 3,568, despite volatility. Tech giants like Alibaba and TenCent saw high returns. However, a government crackdown on tech firms in late 2020 led to prolonged market weakness, significantly impacting the MSCI Emerging Market index.[9]

There were success stories, however. India has seen an astonishing run of strength, with the MSCI India seeing an average annual return of 12.1% over the past decade, and 17.9% over the past five years[10]. Investors have been attracted by the country’s rapid economic expansion, stable politics and strong corporate sector.

There were also individual companies that did well. TSMC, for example, has been caught up in the general excitement around artificial intelligence. Its chips power much of the AI revolution. Its share price has risen 208% over the past five years[11]. Latin America’s equivalent of Amazon, MercadoLibre, is up 231% over the same period[12]. The opportunities have been there for skilled active managers.

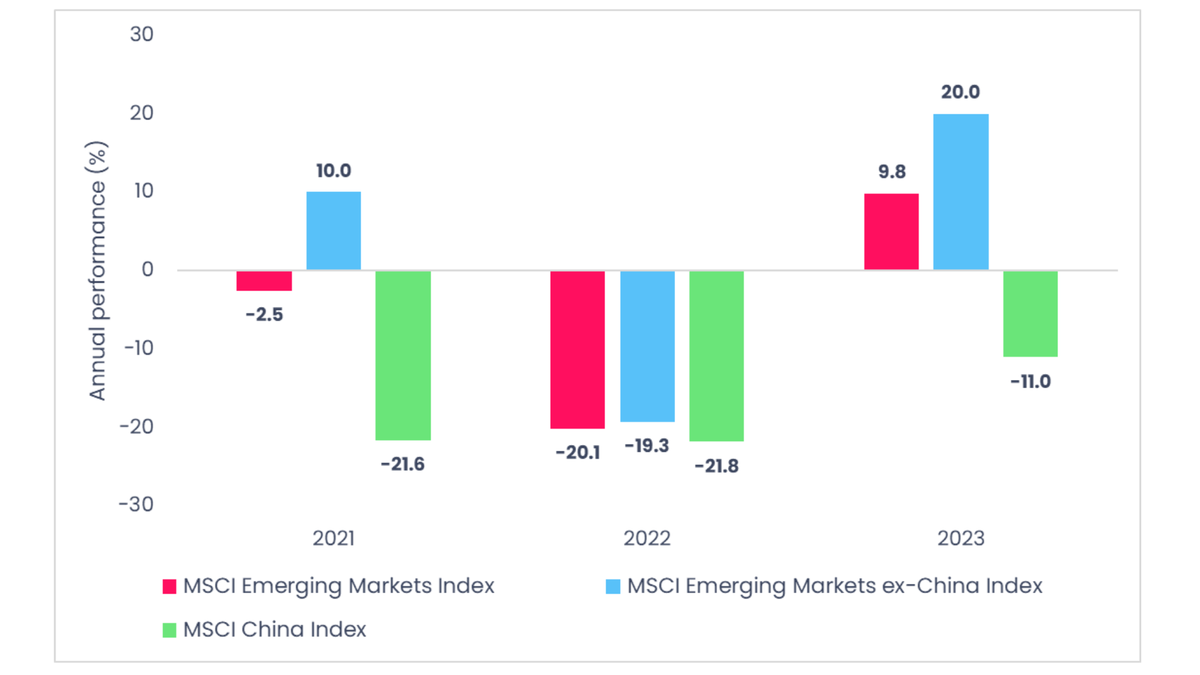

Active managers have managed to swerve some of the problems in the sector, moving to be underweight China, for example. Analysis from Citywire shows that many of the major emerging market funds are significantly underweight China relative to the MSCI Emerging Market Index [13]. This has helped performance in the longer-term, with the average fund in the IA Global Emerging Market sector proving more resilient than the MSCI EM index. In 2022, the worst year for the index, the average fund dropped 12.2%[14], while the index dropped 20.1%.

The graph below highlights the benefits of underweighting China between 2021 - 2023, by comparing the returns of MSCI's Emerging Markets Index with and without China, as well as singling out the MSCI China returns over the same period. In both 2021 and 2023, there is a significant difference in the performance of the two emerging market indices, with China a clear detractor after posting double-digit negative returns.

Source, MSCI, December 2024

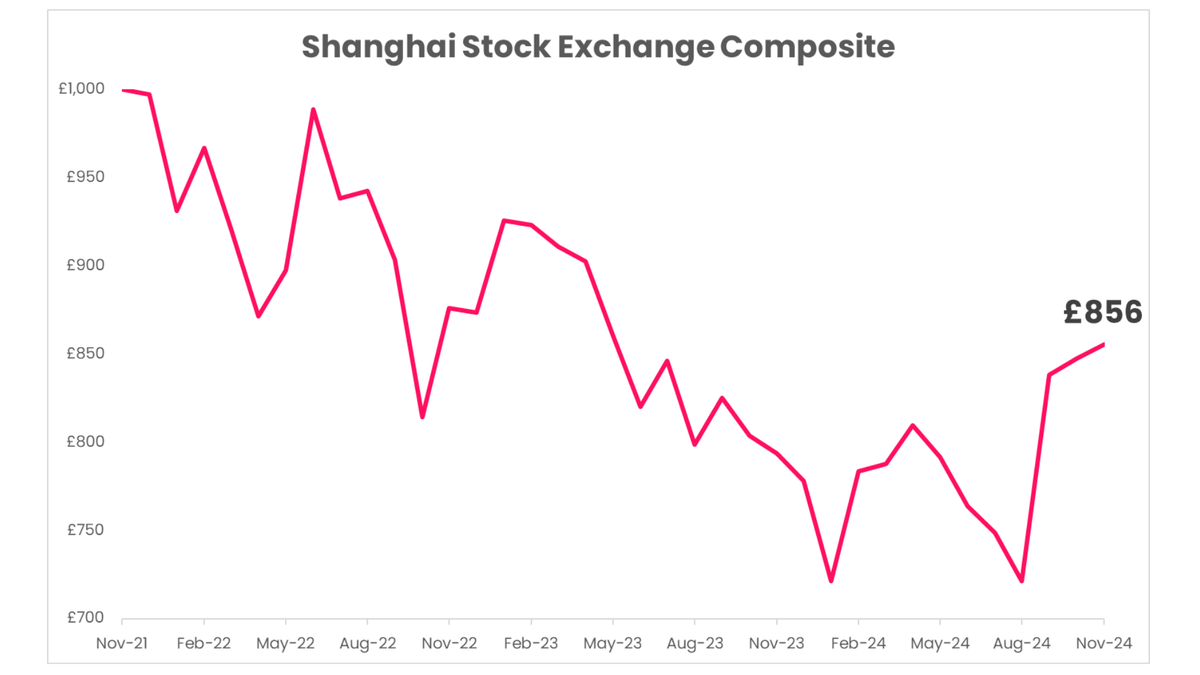

However, this year, that underweight to China has been more difficult. After three difficult years, Chinese equity markets responded to the government’s announcement of a stimulus package. The Shanghai Composite rose 27.5% from 20th September to 8th October[15]. A net of $40.9 billion flowed into all EPFR-tracked Emerging Markets Equity Funds during the week ending 9 October[16]. The market has hung on to these gains, even amid mixed feelings on the likely success of the package. This has seen the China underweight turn to a disadvantage, with index funds outpacing their active equivalents.

Source, FE Fund info

India versus China

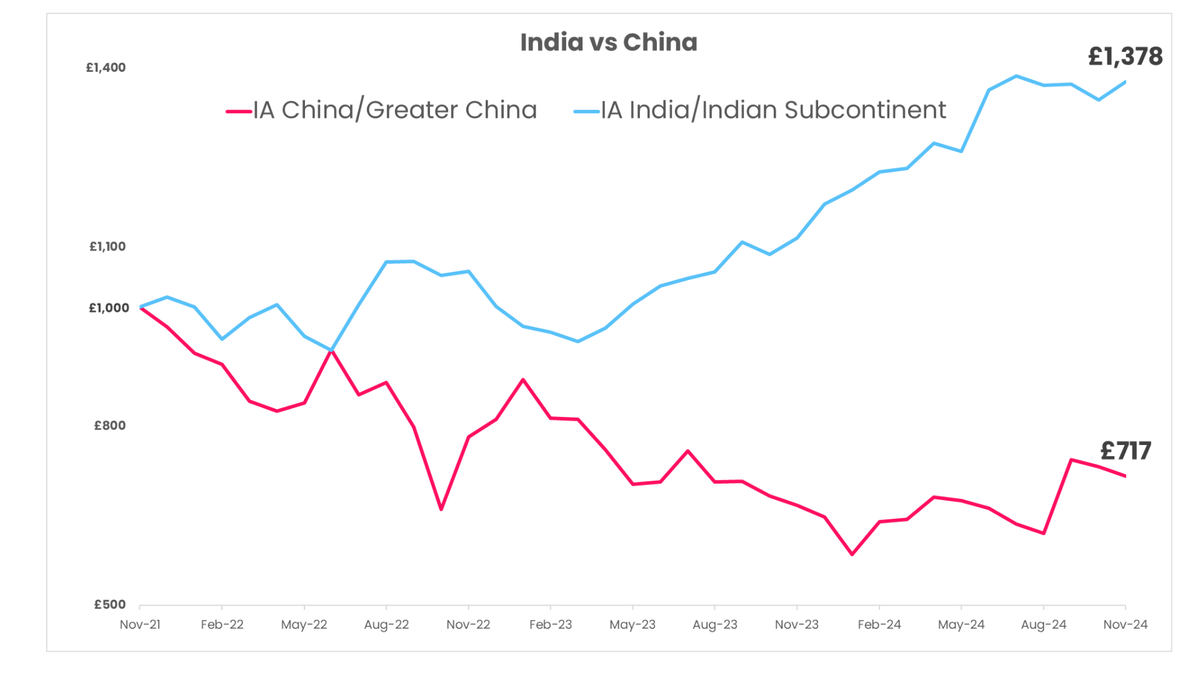

The future direction of emerging markets will be partly determined by the outcomes in India and China. Over the past three years, the average fund in the IA India sector is up 38%, while the average China fund is down 28%[17].

Source, FE Fund Info, December 2024

Here's how these two Asian powerhouses contrast:

India's Position:

China's Position:

James Thom, manager of the Abrdn Asia Dragon Investment Trust, remains positive on India:

India is one of the world's fastest-growing major economies, supported by a resilient macro backdrop and supportive government policies. India's foreign exchange reserves are at record highs, and inflation, at less than 5%, is well under control.

Infrastructure has improved, enabling the smooth functioning of business between states.

Thom adds that corporate India is in good shape:

Companies are more efficient, less indebted and growing faster. Economic growth is translating into corporate earnings – there has been a step change in the speed of earnings-per-share growth.

The problem is that investors have to pay a price for that. India is now at its highest Price-to-Earnings Ratio in decades[18]. (The price-to-earnings (P/E) ratio is a financial metric that compares a company's share price to its earnings per share. The lower the P/E, the lower the entrance fee to participate in the company's profits.) The recent wobble around the election showed some vulnerability.

China has the opposite problem. Pretty much everyone agrees that it is extremely cheap. According to Sharukh Malik, portfolio manager, Asian & Emerging Markets at Guinness Global Investors, even with the spike in performance in China at the end of September and early October, there is still a lot of room for China to catch up with the rest of Asia and emerging markets. China's valuations are still trading very cheaply relative to other major markets.

However, it has a myriad of problems. There are no guarantees that its stimulus measures will work to support demand. Anthony Srom, manager of the Fidelity Asia Pacific Opportunities trust, says the measures may be too small and do not necessarily address key problems such as flagging consumer confidence. Then there is the Donald Trump effect. China is in his sights for tariffs. He has suggested tariffs as high as 60% on Chinese imports, which would dent the Chinese economy. It may be that the government will introduce more stimulus to compensate, but it remains a major risk.

China has a range of highly innovative and successful companies. It is a world leader in areas such as electric cars, renewable energy and social media. It is a market that requires real selectivity.

Opportunities for investors

Emerging markets offer unique opportunities that cannot be found elsewhere. The majority of the semiconductor supply chain is located in Asia. Many of the raw materials necessary for the energy transition, such as lithium and copper, are found exclusively or predominantly in emerging markets. Additionally, these markets have large, fast-growing consumer bases, creating opportunities for companies like MercadoLibre and other innovative domestic retailers.

They are also growing more quickly. Xavier Baraton, Global Chief Investment Officer, HSBC Asset Management, says:

The world's premium growth rates will likely be in Asia and in Frontier economies. We anticipate India will be the fastest growing large economy in the world and see improving macro fundamentals in South East Asia and in MENA in 2025.

He says that they remain “under-loved by investors” while being attractively priced.

However, there are headwinds. Baraton adds that emerging and frontier markets may be vulnerable to rising uncertainty around trade policies and a stronger US dollar.

John Citron, co-portfolio manager of JPMorgan Emerging Markets Investment Trust also continues to see compelling growth opportunities, particularly in India, North Asia, and Latin America:

India has produced world-class companies, particularly in IT services. China's situation is more complex, but its advanced manufacturing and electric vehicle sectors are thriving, bolstered by government policies aimed at stabilising the economy and driving innovation.

He also finds opportunities in Latin America and Emerging Europe. He holds Argentine IT services firm Globant, for example, and WEG, a Brazilian producer of electric motors.

Jorry Nøddekær, lead fund manager of the Polar Capital Emerging Market Stars Fund, sees some headwinds from Trump’s policy agenda but believes a deal may be possible between Trump and President Xi. This would remove some of the uncertainty.

We are still very strong believers in our longer-term 'new multipolar world' view, in which manufacturing and investment move out of China into countries like India, Vietnam, Indonesia and Mexico. We expect volatility but remain positive about our technology companies for 2025 and beyond.

Emerging markets encompass a diverse set of opportunities, and hold real opportunities for growth. The US has crowded out investment elsewhere, but as the mega-cap technology story grows long in the tooth, investors may start looking to the growth available in emerging markets once again.

Key considerations for investors thinking of investing in Emerging Markets

Overview

Investors seeking exposure to emerging markets should consider a wide range of factors. One of these is their expectations for the individual regions they are investing in - as highlighted above, the fortunes of a large market such as China can have a significant impact on the overall returns of a wider index. Another important area to consider is foreign trade policies, which also links strongly to currency, and therefore returns. From a policy perspective, it is essential to consider your exposure to a specific industry. Are you heavily exposed to the same industries in all regions, and therefore perhaps despite being adequately diversified from a regional perspective, you are at the mercy of a specific sub-sector? There are ways to mitigate some of these emerging market risks, such as diversification, and hedged solutions for those who don't want to experience currency fluctuations.

China represents about 25% of the MSCI Emerging Market index. Investors that want exposure to China can either go down the global emerging markets fund route, these offer a lower-risk entry point as it allows investors to spread risk across more than one market. For direct exposure, dedicated China ETFs tracking major indices like MSCI China or FTSE China provide focused investment in Chinese companies, particularly tech giants such as Alibaba and Tencent. Those preferring active management can choose between open-ended funds that target growth sectors where China leads globally (such as renewable energy, battery storage, and electric vehicles) or Investment Trusts, which currently trade at a 12-14% discount to their underlying holdings – potentially offering additional returns if the Chinese market recovers.

Strategic sectors

Within emerging markets, investors can analyse strategic sectors to either make sector bets or ascertain whether they want exposure to these markets. Considering all these areas within the context of your wider portfolio is important. The following table outlines key sectors within emerging market economies and considerations:

Strategic Sector | Key Actions | Investment Considerations |

Semiconductor Supply Chain | • Explore Asian companies in semiconductor industry | Consider portfolio-wide exposure and concentration risk |

Raw Materials for Energy Transition | • Target emerging market producers | Essential materials for renewable energy transition |

Consumer Market Opportunities | • Research innovative domestic retailers | Focus on markets with expanding consumer bases |

Technology and Innovation | • Identify emerging market tech opportunities | Look beyond traditional tech hubs |

Geographic Diversification | • Analyze high-growth economies (India, Southeast Asia, MENA) | Balance risk-reward across different market stages |

Market Performance

Analysis of top-performing emerging market investments reveals several key trends. Small-cap focused funds, (investment vehicles that primarily invest in companies with relatively small market capitalizations, typically $300 million to $2 billion, often offering higher growth potential but with increased risk compared to larger-cap investments), have demonstrated strong performance over the past five years, with the Mobius Investment Trust leading returns at 70.57%.

ETFs offer cost-effective exposure with Ongoing Charges Figures (OCF) as low as 0.55%, while actively managed funds command higher fees but may offer additional alpha,(how much better (or worse) an investment performs compared to what you'd expect it to perform, considering its risk level), through selective stock picking and market timing.

Top-performing investments in Emerging Markets

Investment | 3 Year Performance | 5 Year Performance | Ongoing Charges Figure |

Mobius Investment Trust | -8.79% | 70.57% | 1.50% |

SSGA SPDR MSCI Emerging Markets Small Cap UCITS ETF (EMSM) | 15.28% | 61.11% | 0.55% |

iShares MSCI Emerging Markets SmallCap UCITS ETF (IEMS) | 15.28% | 61.11% | 0.55% |

abrdn SICAV I Emerging Markets Smaller Companies Fund | 9.43% | 54.89% | 1.20% |

Invesco Global Emerging Markets Fund | 16.16% | 53.49% | 0.75% |

Invesco Global Emerging Markets (No Trail) Fund | 15.29% | 51.57% | 1.20% |

GQG Partners Emerging Markets Equity Fund | 49.34% | 51.57% | 1.05% |

Risk Management and Implementation

A comprehensive risk management strategy is essential when investing in emerging markets. Key focus areas should include:

Market Monitoring

Track trade policy evolution and implications

Monitor US dollar strength impacts

Prepare contingencies for market volatility

Portfolio Management

Build sector volatility buffers

Maintain a balanced investment distribution

Prioritize long-term growth trajectories over short-term fluctuations

---

[1] International Monetary Fund

[3] Worldometer

[4] International Monetary Fund

[5] MSCI, March 2022

[6] International Monetary Fund, October 2024

[7] International Monetary Fund, October 2024

[8] Marketwatch

[9] My News, May 2024

[10] MSCI World Index

[11] MarketWatch

[12] MarketWatch, MercadoLibre Inc.

[13] Citywire, October 2024

[14] Trustnet

[15] MarketWatch

[16] EPFR, October 2024

[17] Trustnet

[18] World PE Ratio