Investment Focus: Real Estate

Recent recovery creates opportunities in REITs and commercial property

By Boring Money

24 July, 2025

Real estate is more than just the family home. It might include the buildings you work in, shops, warehouses, or even medical facilities. In general, this is an investment area where it's difficult for individuals to participate. A single building may cost millions of pounds and require expensive management and maintenance.

A range of collective investments offer access to different property investments. These include traditional commercial property, such as offices, retail or industrial buildings. Investors can also invest in niche areas such as care homes, doctors’ surgeries or student accommodation. There are also areas such as infrastructure, which are sometimes included alongside property in a portfolio.

🏷️ Key investment characteristics and market dynamics

There are a number of investment characteristics that are common to most property investments. For example, the return on most property investments is driven from the rental income that a tenant pays to use the building, less any day to day expenses for maintenance, plus any capital appreciation of the building itself.

The rental income will be driven by supply and demand, which in turn will be driven by societal shifts. For example, the work from home (WFH) phenomenon led to a significant decrease in demand for office space. This has put pressure on commercial landlords, who found they could no longer fill their buildings. The retail sector experienced similar pressures when people turned to online shopping.

Rental income will also be linked to interest rates

and inflation. Commercial property leases will often have automatic inflationary increases built into the contract. For investors, this means that commercial property income should increase in line with inflation. However, this only works where landlords have sufficient pricing power to push through rent rises.Capital growth is less predictable and will depend on the location and condition of the property. There will be risk versus return considerations. For example, countries such as Bulgaria, Hungary, and Croatia all recorded double-digit rises in their property markets in 2024[1], but inevitably, these are younger markets and carry greater risk. Mature markets such as the UK or France are likely to show slower growth, but with lower risk.

Property markets also divide into ‘prime’ and ‘secondary’. ‘Prime’ is the highest quality property and might include central London offices or upmarket shopping destinations. Secondary properties may have less desirable locations, lower sustainability scores, or shorter leases.

There will also be a difference between sectors. There are some fast-growing parts of the market. Retail warehousing, for example, became a high-growth area as e-commerce spread. Today, it's areas such as data centres which are helping to support AI development. Care homes have a demographic tailwind

, while student accommodation has also been an area of high growth.ℹ️ What is a Real Estate Investment Trust? (REIT)

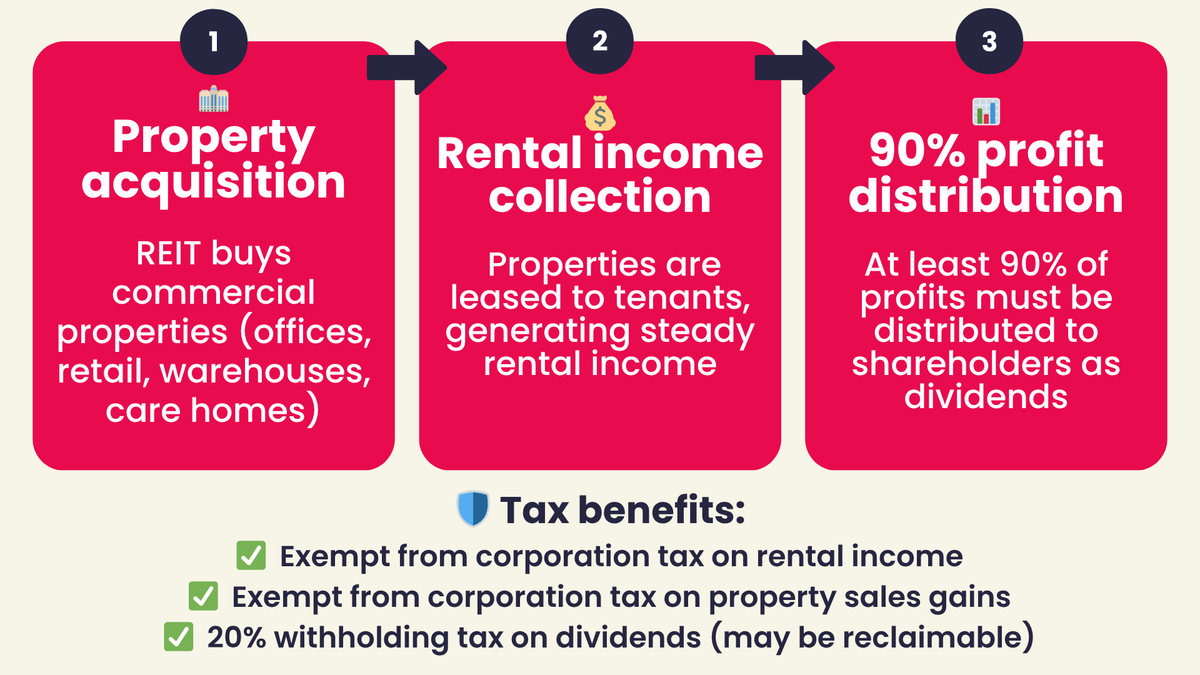

Many property investment companies are structured as Real Estate Investment Trusts or REITs. A REIT is effectively a property rental business, buying properties and renting them out to tenants.

The rental business must be at least 75% of the profits and assets of the company to qualify as a REIT. It must also distribute 90% of its profits to shareholders.

REITs come with attractive tax breaks: they're exempt from corporation tax on both rental income and gains on sales of investment properties. Dividends

are subject to 20% withholding tax, but some investors may be able to claim this back.REITS trade on a stock exchange and can be bought and sold like a normal share. They must also be ‘diversely owned’, meaning that there can’t be one large, controlling shareholder. There are also limits on the amount of debt that a REIT can have. These rules put important investor protections in place.

How REITs work

📈 Recent performance and market recovery

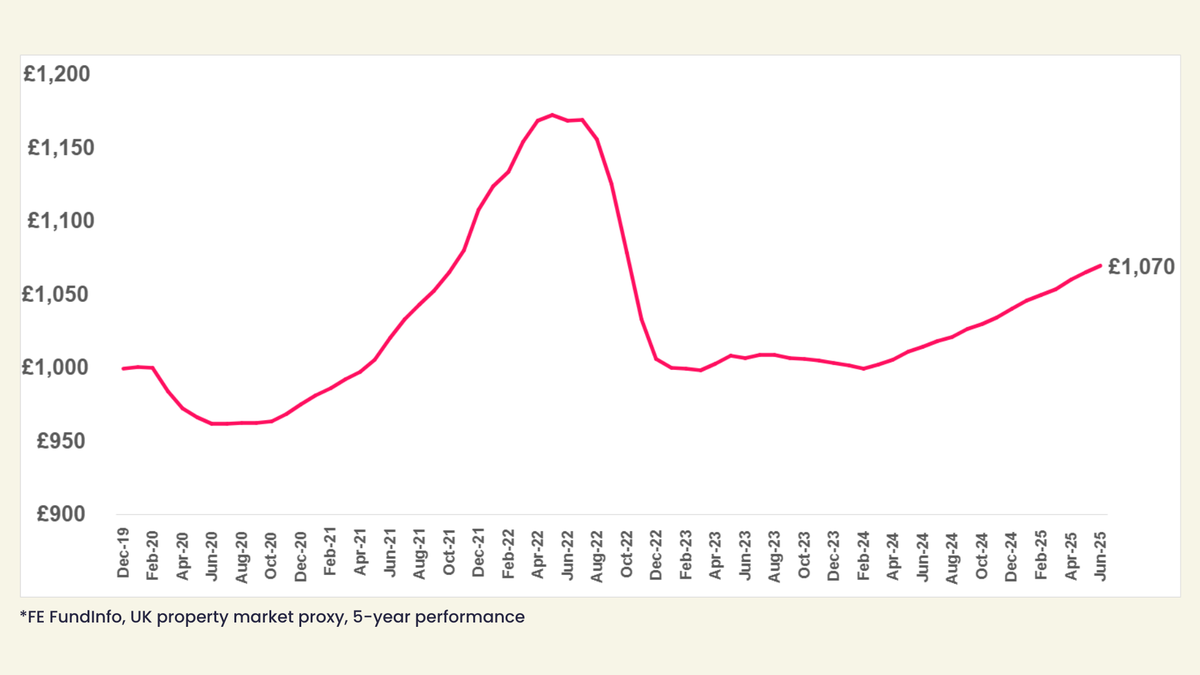

The recent performance of the real estate sector has been mixed. The sector was hit hard by rising interest rates: investors that had turned to commercial property because it was one of the few high-yielding assets when interest rates were near zero, suddenly found they had abundant choice elsewhere and deserted the sector. The clearest manifestation of this was the huge discounts that opened up between companies’ share prices and their underlying

assets.

Source: FE FundInfo, correct as at 20 July 2025.

Commercial property was also hurt as valuations recalibrated in response to the WFH phenomenon. It took time for longer-term term working patterns to emerge and investors stayed away from the office sector amid the uncertainty.

The average UK commercial property Investment Trust dropped 13% in 2020 and another 14.8% in 2022. Since then, it has struggled to claw its way back, rising just 0.4% in 2024 after a flat year in 2023. Most developed property markets have seen a similar trajectory.

That said, there have been pockets of strength for investors with the flexibility to look into other parts of the market. Some emerging markets, for example, have been on a different monetary policy cycle and have performed very well.

🔮 Property market outlook for 2025 and beyond

The outlook for the property market has been much more encouraging since the start of the year. Marcus Phayre Mudge, manager on the TR Property fund, which invests in a range of global REITS, says that income returns in particular have been very steady, while capital returns have varied significantly.

The price of money is coming down. Crucially, we have very little over-development.

This is notable contrast to the financial crisis, when there was lots of speculative development that needed to unwind. He says that the sector has seen strong rental growth, particularly in areas such as logistics and industrials. He adds:

The sector is very much part of the ‘value’ end of the equity landscape and as a result has been underowned for several years as investors have chased ‘growth’ stocks on ever-increasing valuation multiples. The performance of US equities

in the first few months of 2025 will, we think, encourage investors to look again at other parts of the equity market in terms of both geographies and sectors. Pan European real estate looks attractively underpinned.Nevertheless, there are still real differences between sectors. Office rents have started to recover, but much more at the prime end of the market.

The bifurcation between the best and the rest remains the overriding feature of virtually all office markets. The structural shift in how and where businesses want to use office space is compounded by the overarching need to improve the energy efficiency of all buildings. This environment is generating opportunities, particularly for well-funded property companies that have the resources to carry out the required refurbishments.

A similar picture is being seen for retail. Prime properties can still command rental increases. The rest of the market is stable, but unexciting. Consumers in most developed markets remain resilient, buoyed by inflation-linked pay rises and savings accumulated during the pandemic. More importantly for owners of bricks and mortar, the rate of online sales growth appears to be slowing. The industrial market has been very strong, and now looks more expensive than the other areas. However, the fundamentals of the market are still strong.

A final galvanising factor for the market has been merger and acquisition activity. A lot of REITs have merged, wound down or seen their assets acquired by a rival. For example, Warehouse REIT received a cash and share offer from Tritax Big Box REIT, at an improved valuation to Blackstone’s previous offer.[2] Care REIT and Urban Logistics REIT were both taken over in the first half of 2025.

Winterfloods points out that the sector is seeing increasing popularity. Its research shows that 89% of the sector by market cap was re-rated in June. The Property – UK Commercial sector is the second best-performing Investment Trust sector for the year to date, generating an average return of 18%, according to the AIC. Yet almost all funds still trade on a discount to the underlying value of their buildings.

Clearly we need capital to flow into Europe from the US and there are signs of that happening. Our share price performance has been strong over the last two years and our discount has come in significantly. There has been a good move in the diversified property trusts. They had been a bit unloved.

A final factor that may encourage investors back to the sector are the attractive yields on offer. Property investments always tend to offer a higher income, but today many Investment Trusts are offering a starting income of 7-8%.

⛕ How to invest in property

It used to be the case that investors would access ‘bricks and mortar’ commercial property through large collective property funds such as those provided by M&G, Aviva or Janus Henderson.

However, these funds floundered because there was a mismatch between the liquidity

offered to investors and the liquidity of the underlying assets. In other words, investors were told they could sell out daily, but the underlying properties may take months or even years to sell. Funds ended up halting redemptions, to the frustration of unitholders. It became increasingly clear that this was not an appropriate structure to access commercial property.Investment Trusts are now the most popular option for retail investors. There are a range of different flavours. There are dedicated UK property funds, such as AEW UK REIT, or Schroder Real Estate. These invest directly in a range of commercial buildings. There are also specialist funds investing in supermarkets, warehouses, or life science buildings. There are European or global trusts, and even funds looking at niche markets, such as Macau or Cuba.

There are also Trusts that invest in property securities

. The TR Property Investment Trust, for example, invests in Real Estate Investment Trusts across the world, aiming to provide diversified property exposure by region and property type. The Schroder Real Estate Investment Trust takes a similar approach. These Trusts have more flexibility to move in and out of different markets than bricks and mortar trusts.Given the liquidity constraints, property isn’t as easy to package into an ETF or passive

format. Nevertheless, there are passive funds available that track property indices, such as the FTSE EPRA/NAREIT UK Index.Investors can also invest directly in property shares. Land Securities, for example, is a large, diversified property company. Its portfolio includes retail, leisure, workspace, and residential hubs. It has a significant presence in Central London and regional retail destinations. It owns Bluewater in Kent, for example, or One New Change in the City of London.

The table below illustrates the top 10 best-performing investments year-to-date in the real estate sector.

Top 10 best-performing real estate investments

Investment | YTD | 3 Year | 5 Year | OCF |

Warehouse REIT | 45.98% | -10.42% | 28.94% | 1.41% |

Ground Rents Income Fund | 39.64% | -44.28% | -57.47% | 2.33% |

Supermarket Income REIT | 30.05% | -15.10% | -0.75% | 1.72% |

Target Healthcare REIT | 28.12% | 14.10% | 24.47% | 1.51% |

Social Housing REIT | 21.40% | -5.87% | -5.55% | 1.64% |

Life Science REIT | 20.00% | -46.05% | N/A | 1.80% |

Tritax Big Box REIT | 14.53% | -8.95% | 20.76% | 0.84% |

Value and Indexed Property Income Trust | 12.74% | -2.49% | 66.52% | 2.00% |

AEW UK REIT | 12.25% | 18.55% | 135.86% | 1.60% |

Schroder European Real Estate | 11.67% | -14.09% | 41.94% | 2.59% |

Source: FE FundInfo, correct as at 20 July 2025. This table displays performance over multiple timeframes across the past 5 years for a range of investment funds/portfolios.

Commercial property is currently experiencing an encouraging recovery after a period in the doldrums, and investors have a broad choice in how they access that recovery. From here, property should be a strong long-term option for investors who like an income from their investments and stable capital growth over time.

---