Investment Focus: Utilities

A stable backbone and growth engine for investors

By Boring Money

26 June, 2025

Utilities companies provide crucial services, such as supplying energy, water, or transport infrastructure. They're the pack horses in the economy, with businesses and citizens relying on the services they provide to live and work. This has tended to create reliable long-term returns for shareholders, establishing the utilities sector as a stable backbone for many portfolios.

🗝️ Key players: Leading utilities companies in the UK, Europe, and the US

Listed utilities firms in the UK include Severn Trent, Centrica and United Utilities, alongside waste groups such as Pennon. There are also grid providers

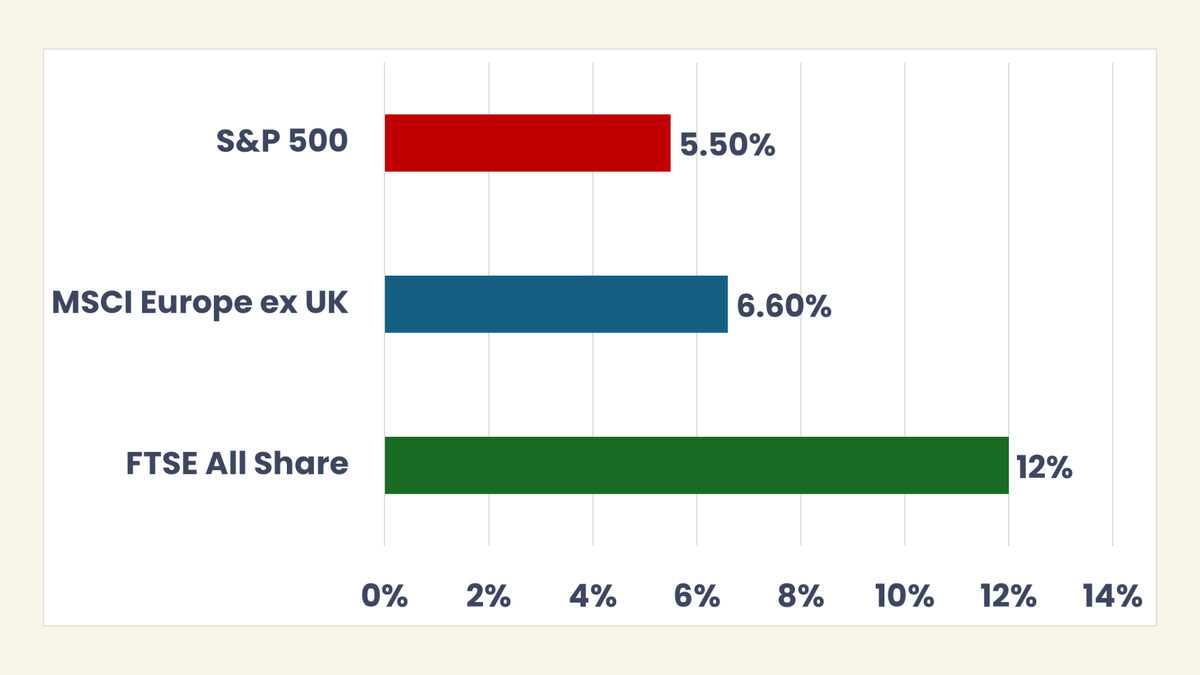

, including National Grid and SSE. Between them, energy and utilities have a 12% share of the FTSE All-Share. For Europe’s MSCI Europe ex UK index, the percentage is slightly smaller, at 6.6%, while for the S&P 500, it's just 5.5%.[1] The chart below illustrates the extent of the FTSE's exposure to utilities.Energy & utilities market share by index

Chart shows relative weightings of energy and utilities companies across major stock indices.

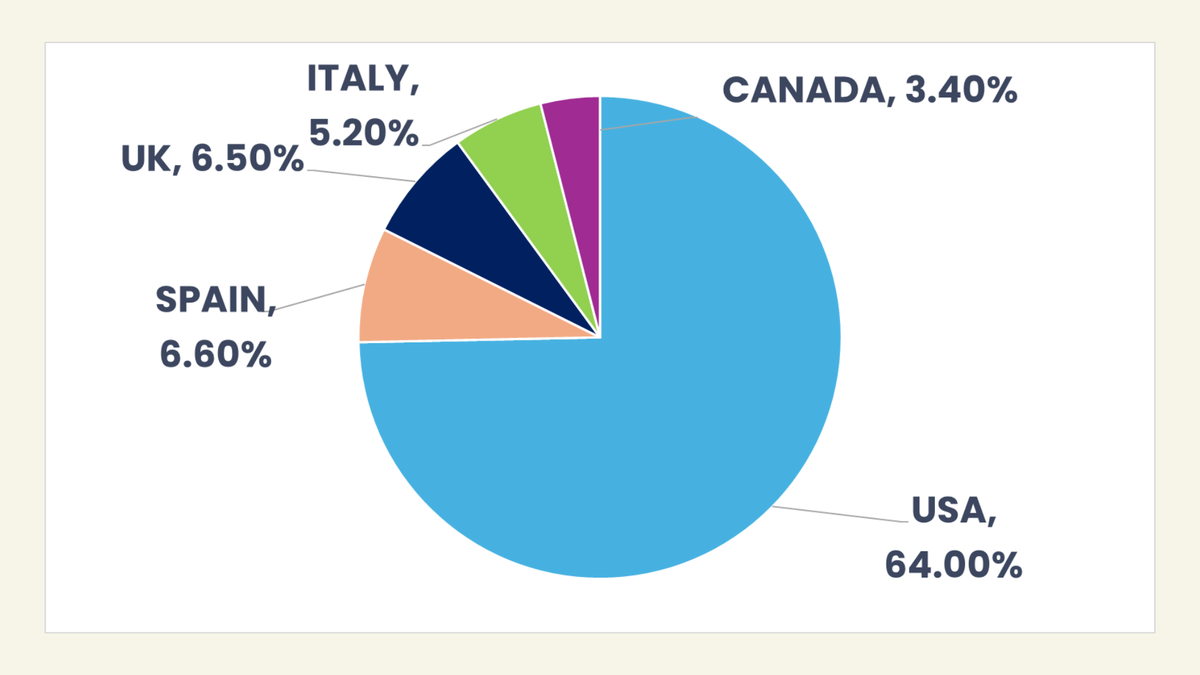

While the UK has notably higher exposure to energy and utilities compared to European and US markets, the world’s largest utility companies are still found in the US, which make up around 64% of the MSCI World Utilities index.[2] These include behemoths such as Nextera Energy, Constellation Energy and American Electric Power. Spain, the UK and Italy are also well-represented, with 6.6%, 6.5% and 5.2% of the index respectively.

MSCI World Utilities index, weighted by country

Chart shows relative weightings of different countries in MSCI World Utilities.

🦚 Investment appeal: Why utilities are a defensive choice

Traditionally, utilities have been viewed as a defensive

area of investment. People always need heat, water, electricity - whatever the economic conditions - and demand doesn't tend to fluctuate significantly with economic growth. Many utilities also have predictable cash flows that rise in line with inflation and are clearly mandated by regulatory organisations. These routine cash flows allow utilities to pay regular dividends to shareholders, making them a compelling choice for risk-averse investors.📋 Regulation and oversight: How authorities shape the sector

Utilities companies are often heavily regulated, with groups such as Ofgem overseeing energy (gas and electricity) and Ofwat for water in the UK. They're responsible for monitoring the activities of firms and determining how much they can charge consumers.

🍂 The energy transition: Renewables reshape the utilities landscape

The energy transition has changed the dynamic for this sector, adding renewable energy companies into the mix for the first time. These companies are growing their share of the energy market. The International Energy Agency says:[3]

Global renewable electricity generation is forecast to climb to over 17,000 terawatt-hours (TWh) by the end of this decade, an increase of almost 90% from 2023. This would be enough to meet the combined power demand of China and the United States in 2030.

Renewables currently form around 34.5% of overall electricity generation, but this is forecast to rise to 45.6% by 2030.

Renewable energy companies tend to have a different investment dynamic. Rather than an established asset generating stable cash flows through the distribution of energy or water, renewable energy infrastructure needs to be built first. This brings a number of different risks for the companies involved. They may be more exposed to higher prices for raw materials, for example. This part of the market may also be more vulnerable to investor sentiment around the energy transition and global governments’ commitment to carbon reduction.

The drive towards renewables is also influencing some of the existing electricity grid companies. They will need to adapt to rising electricity demand, expanding the grid and re-routing networks to accommodate changing energy sources. National Grid, for example, is currently going through a ‘great grid upgrade’ programme, which is re-routing energy supply from, for example, wind farms in the North Sea to major cities across the UK, and installing batteries in the grid to cope with the intermittency of renewable power.

☣️ Risks and challenges: Debt, interest rates, and market sentiment

It's worth noting that many utilities have relatively high debt. This has been seen as a natural way to boost returns. However, it has landed some utilities in hot water. Cases such as Thames Water have been an uncomfortable lesson in the perils of excessive debt. It also means that the sector can be vulnerable to rises in interest rates - it tends to do well during times when rates are falling.

Another factor that may influence the sector is fiscal expansion in Europe. Many fund managers see the utilities sector as a natural beneficiary of increased government spending on infrastructure and defence.

As the European economy is very interconnected, the fiscal spending could impact companies beyond Germany and across Europe, as well as sectors beyond defence and construction, including, for example, utilities and specialty industrials.

📈 Recent performance: What’s driving the utilities sector?

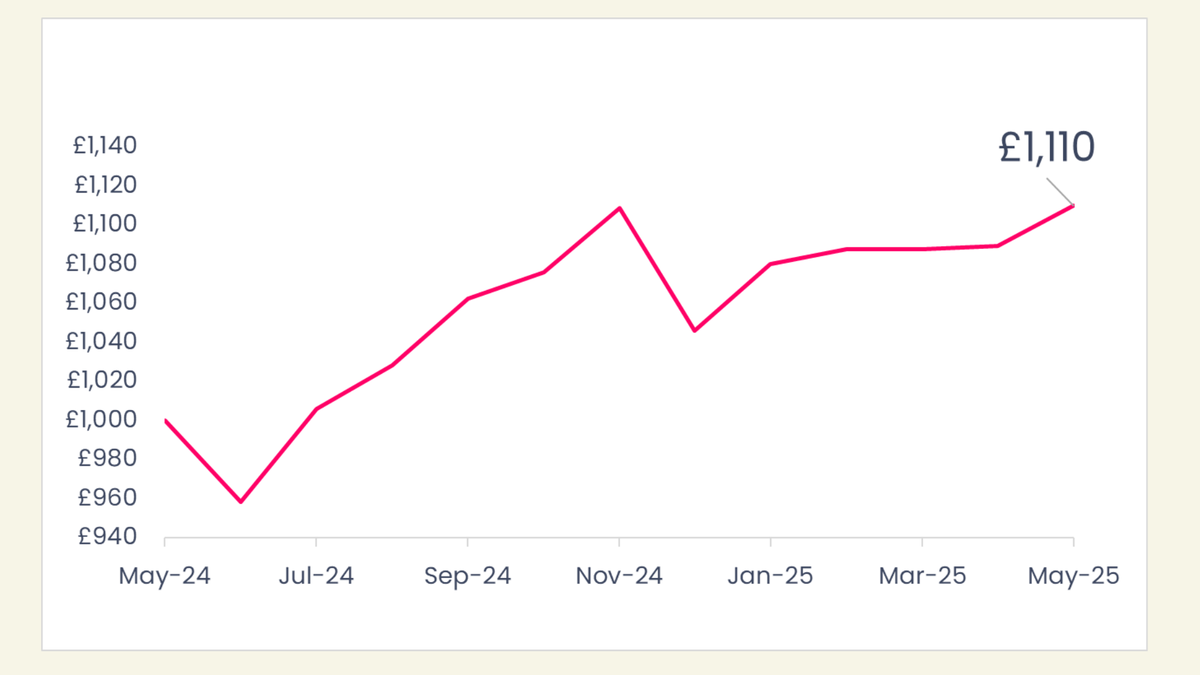

2025 has so far been a strong year for utilities. MSCI World Utilities is up 11% over the past 12 months alone.

Source: FE FundInfo. Return on £1000 investment in MSCI World Utilities index, May 2024 - present.

This performance is the result of a number of drivers. Lower interest rates have undoubtedly played a role; The rise in interest rates in 2022 dented share prices across the sector and led to a run of weak performance, delivering negative returns in 2022 and 2023. Although interest rates have yet to come down as much as expected, the sector has still seen lower borrowing costs and this has boosted returns from previously low levels. But there have been other factors at work.

The continued increase in data, computing, cloud migration and now, AI, have fuelled growth in data centres and the electricity needed to power them up, providing a powerful catalyst for many companies along this value chain.

Data centres currently consume 4.5% of U.S. power supply and estimates suggest this could grow to 8% or above by 2030. Increased electric vehicle usage and reshoring of manufacturing have added further demands to the grid, while an increased frequency of extreme weather events have increased the risk of blackouts during peak-demand periods.

Utilities have also benefited from increased spending on infrastructure across major markets. US infrastructure is creaking and needs upgrading, while European governments (in particular, Germany) have also been increasing infrastructure spending. The UK has also announced major spending projects, with the Labour government renewing its commitment in the recent Spending Review.

Another contributing factor is the growth in emerging markets infrastructure. As economic development accelerates, countries require better infrastructure and utilities to underpin productivity and growth. Urbanisation in particular can drive development of better utilities. As giant economies such as China and India build out new energy, water and transport networks, it can drive share prices for individual companies that benefit from this evolution.

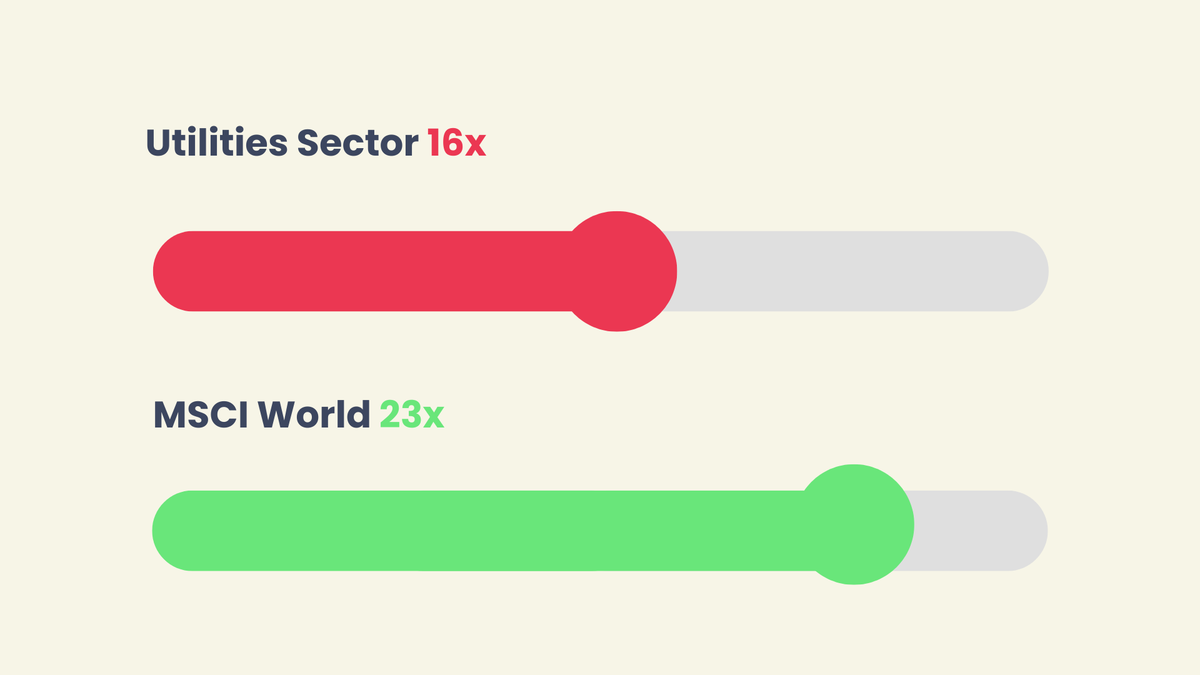

These are all long-term trends that should continue to drive the sector for some time. Utilities companies remain inexpensive relative to the MSCI World index and, at the time of writing, offer an attractive dividend yield

of 3.7%.Utilities vs MSCI World, P/E ratio

P/E ratio, at time of writing.

However, it's worth noting that tariffs could be a modest headwind

for renewables developers in the US, says Tancrede Fulop, senior equity analyst and renewables expert at Morningstar:Expect any higher costs to be passed through to customers via higher power purchase agreement prices over time. The most exposed company is Ørsted…We favour undervalued companies that have limited exposure to power prices and are sensitive to interest rates, like E.On. Enel, Iberdrola, and National Grid also meet these criteria but are not in buying territory yet… Tariffs combined with the risk of an early phaseout of federal tax credits could slow the development of clean power in the US. Still, European developers could reallocate their investments elsewhere or trim them.

💸 How to invest in utilities: ETFs, trusts, and infrastructure funds

Investors interested in investing in - or increasing their exposure to - the utilities sector have a number of options to explore.

ETFs

Investors can target utilities groups directly, but for those who prefer to take a more diversified approach, there are a number of utilities ETFs. Many of these are designed to track the MSCI World Utilities index. Fidelity, iShares, Xtrackers and SPDR (State Street Global Advisers) both offer this type of passive

ETF.There are also a range of ETFs that focus on different parts of the utilities sector, including the renewable energy infrastructure Investment Trusts, such as the Renewables Infrastructure Group or Greencoat Renewables. These invest in renewable energy assets, including – potentially – battery storage. They've had a difficult few years and are now trading at significant discounts to the net asset value (NAV) of the underlying assets and pay large dividends.

Investment Trusts

The Investment Trust sector also provides more niche opportunities, such as Utilico Emerging Markets. This trust focuses on infrastructure and utilities in the emerging markets space, investing in a range of assets - including electricity, water and waste, plus data services and digital infrastructure. Its largest holdings are in Brazil, China and emerging Europe. It also currently boasts a high (3.7%) dividend yield.[5] Another option is the Ecofin Global Utilities and Infrastructure Trust.

Funds

While there aren’t any active open-ended funds specialising directly in utilities, there are a number of infrastructure funds. M&G, for example, has a Global Listed Infrastructure fund, which has around one third allocation to utilities.[6] Franklin Templeton has its ClearBridge Global Infrastructure Income fund, while KBI Global Sustainable Infrastructure is another option.

🕵️ Outlook

The utilities sector provides an important defence against difficult markets, but also has growth drivers that may drive a stronger performance than has been seen historically. AI is creating demand for electricity, at the same time as infrastructure is being upgraded. Emerging market demand is also likely to be a factor for many utilities companies. Overall, it's an exciting moment for the sector, with myriad elements coming together to prime these often overlooked companies for positive growth.

---

[1] MSCI Europe Ex UK, June 2025

[3] International Energy Agency, January 2025