Penfold Workplace Pension Provider Review

Independent review by Boring Money

24 Oct, 2025

Penfold is a new name which is well worth a look for smaller employers. I think their sweet spot is firms up to 1,000 employees, especially those interested in salary sacrifice. Their app is fantastically engaging. Investment performance has also been strong. Not the cheapest, but it’s a personal high-touch service.

*This is the view of investment expert Holly Mackay based on her first-hand customer experience as a test account holder. This does not constitute regulated advice. You can read more about Holly's investments here.

Key strengths

Investment performance

📈 Performance overview

Penfold's default pension is a "lifestyle strategy" that automatically shifts your money from high risk to lower risk investments as you age. Over 8 years from retirement, you're in Growth (highest risk). Between 3-8 years out, you move to Balanced (medium risk). Under 3 years, you're in Protect (lowest risk).

It uses BlackRock funds with environmental considerations baked in as the core building blocks for the default fund.

Penfold changed its default pension portfolio in February 2025. It makes sense to us to look at past performance on this new portfolio, which is what every customer moving forward will have. However, if you want to look back on what would have actually happened based on the old portfolios, you can see more information here.

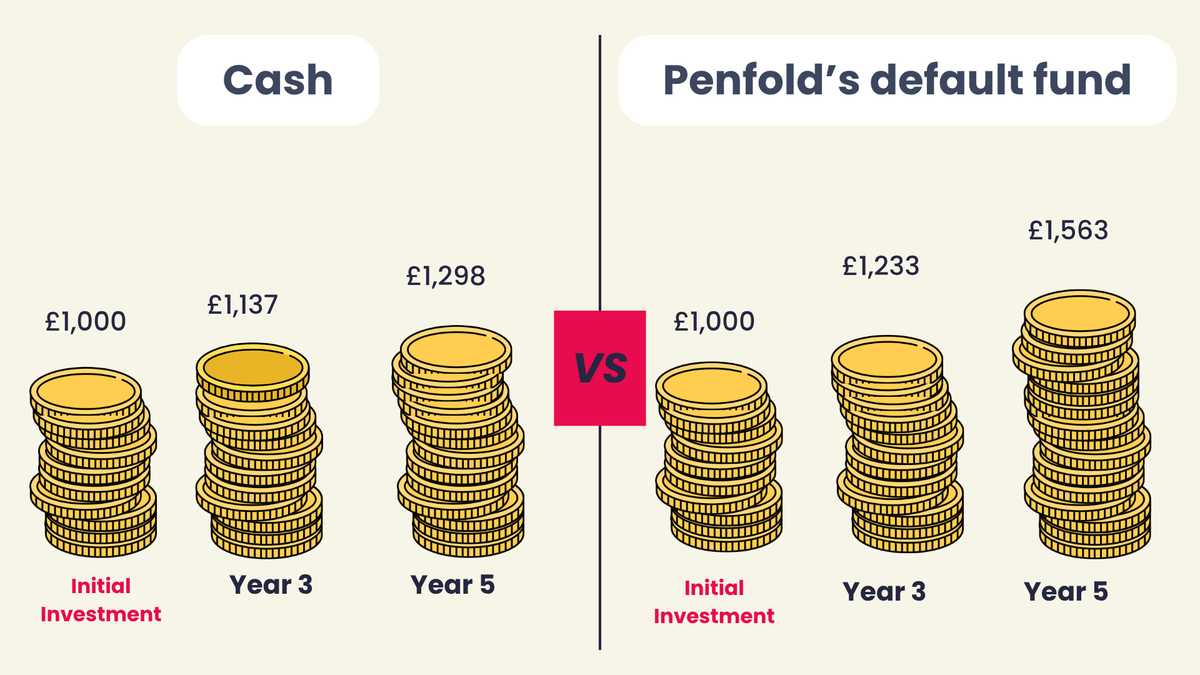

We show the performance of the Standard Lifetime Plan for Penfold customers.

Recent performance:

In £ terms:

Source: For Cash Comparison: FE FundInfo, Bank of England Base Rate.

Penfold also have three other plans available:

Past performance is not a guide to the future. Prices can fall as well as rise, meaning a member may not get back the full amount of capital originally invested.

Fees and charges

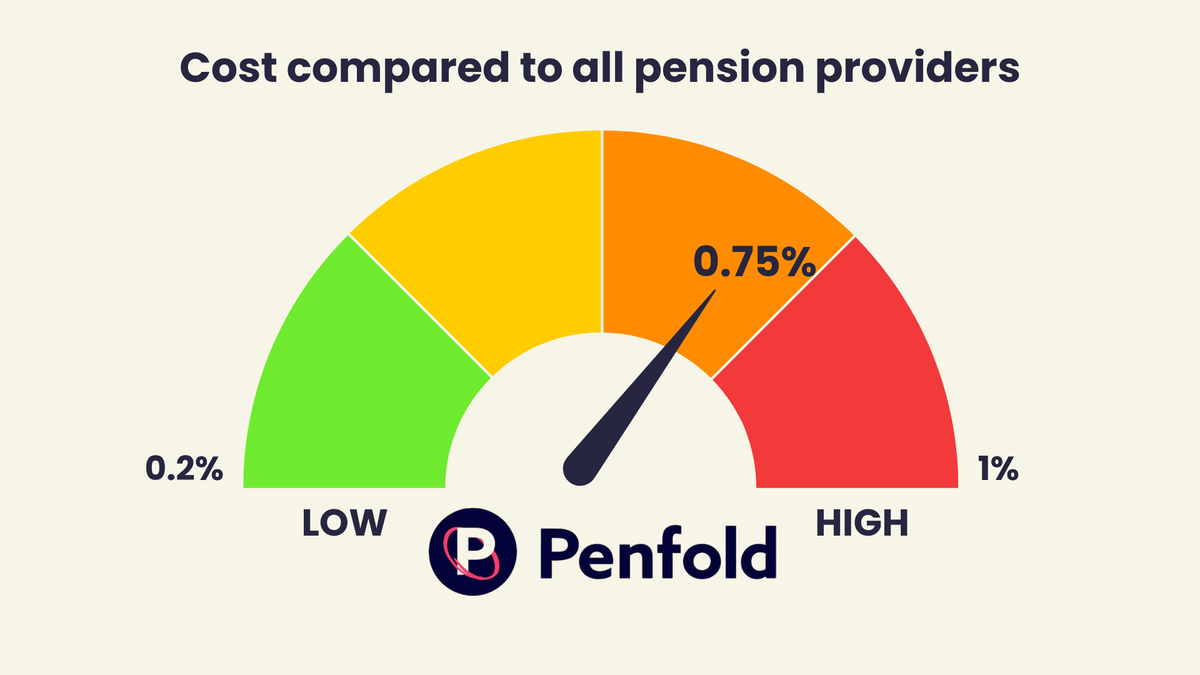

Penfold operates a tiered fee structure:

(0.75%) on assets under £100,000

(0.40%) on assets above £100,000

No event-driven charges for transfers or switches

Penfold is not the cheapest workplace pension. But the structure is amazingly simple to understand. You pay 0.75%. All-in. And if you are one of the very few with over £100,000 here, anything over this level will be charged at 0.4%.

If you went to a large, well-known pension brand, you’d probably pay more like 0.35% - 0.6% a year all-in. Which makes a difference over the long-term. But the trade-offs will inevitably be slower response times, less slick tech, a less personalised feel and potentially no easy salary sacrifice for SMEs which will matter to some. Horses for courses. Also make sure that you are looking where firms have fixed £ charges for some things, as these can add up over time. If we were talking about plane travel, Penfold’s model is the all-inclusive British Airways and some are more like Ryan Air.

The fee structure reflects their focus on providing comprehensive technology solutions and high-touch support rather than being the cheapest option in the market.

Typical cost ranges for workplace pensions and online pensions you choose and set up yourself.

Don’t shoot the messenger, but pension charges can look complex. The fees differ by company so it depends on who you work for. They will typically be more for companies with small numbers of employees, and more for companies who don’t make large pension payments.

As a rule of thumb, the average range of fees for a workplace pension is between 0.3% and 0.6% a year all-in, which is typically cheaper than a pension you might set up and run yourself.

Customer service and support

📫 Communications

Penfold's support philosophy treats customer service as part of the product fabric rather than a bolt-on service:

☎️ Customer service team

Penfold provide support to their members via telephone, email and chat via the app and on desktop. Their mission focuses on keeping contact volumes low by building customer feedback directly into product improvements.

For significant life events like bereavements, the operations team provides specialised support to guide customers through complex processes.

⭐ Customer satisfaction ratings

Trustpilot: 4.7 (from 1,867 reviews)

App Store: 4.9 (from 929 reviews)

Google Play: 4.9 (from 229 reviews)

Customers highlight kindness, speed, and quality of service.

According to Penfold, there were 0.59 complaints per 1,000 customers in the last reporting period. This is in the lower range of providers, so it looks reasonable to us.

Boring Money customer reviews

Help others by sharing your feedback!

04 January 2026

I am so impressed with Penfold and have given them a 5-star rating for making pensions finally feel simple. The app is incredibly intuitive and took all the stress out of consolidating my old workplace pots, which I’d been putting off for years. The 'Find My Pension' tool is a total game-changer, and I love being able to track my retirement goal in real-time. Their customer service is also fantastic responsive, human, and jargon-free. If you’re self-employed or just want a pension that actually makes sense, I can't recommend them enough!

08 November 2025

Very transparent, easy to use, excellent investment performance

07 November 2025

I was happy to invest in the company.

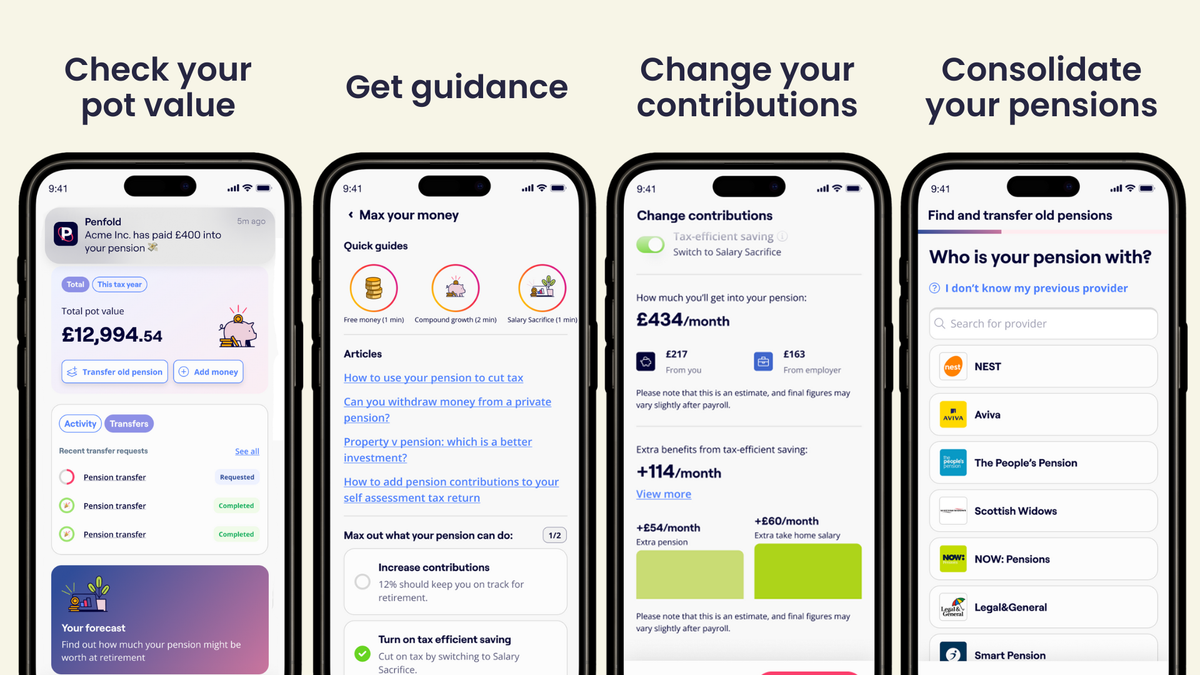

Digital tools and features

Penfold's technology-first approach delivers several innovative digital features:

💻 Digital experience

The platform prioritises simplicity, accessibility, and responsiveness as core design principles:

Employee features:

Pension consolidation tools with provider logos for easy recognition

"Max Your Money" educational hub

Forecast tools for retirement planning

Beneficiary management

Contribution increase functionality

Employer features:

Pull integrations, eliminating CSV uploads and reducing errors

Employer dashboard showing employee engagement

Simplified salary sacrifice setup and management

Real-time contribution processing

Sustainability and ESG commitments

Penfold is committed to aligning investment strategies with a low-carbon future in line with Paris Agreement objectives. While no specific Net Zero target date has been set, current portfolio trajectory suggests alignment with a 2050 target.

Default Investment Approach

Penfold's default investment plan allocates 90% of funds to the BlackRock MyMap Select ESG fund range, with the remaining 10% in listed real assets and alternatives. This fund range applies ESG criteria and aims to reduce carbon emissions.

For members more than 8 years from retirement, 90% of their portfolio is invested in the BlackRock MyMap 7 Select ESG Fund.

BlackRock MyMap 7 Select ESG Fund - Key Metrics:

Carbon emissions intensity is 39.6% lower than a typical pension portfolio. Carbon emissions intensity has reduced by 22.6% since March 2023. The fund selects investments with stronger ESG credentials and excludes high-emission sectors. The fund has no formal Net Zero by 2050 commitment, but emissions remain below the level required to meet that target.

Penfold is committed to making pension savings a part of the climate solution, aiming to deliver strong financial returns to its customers while contributing to a more sustainable future of the planet.