Is IG good for investing?

Independent review by Boring Money

18 Feb, 2025

Investment expert’s opinion

IG offers lots of choice for more confident traders who will enjoy the app which serves up suggestions grouped by theme and sector. It’s mostly about shares, international shares but also spread-betting (playing with fire). The supporting research and content feels a bit thinner compared to some peers. Charges are low, particularly for larger accounts, and the large international brand will give comfort to some who struggle with the newer ‘funkier’ brands competing in this space.

*This is the view of investment expert Holly Mackay based on her first-hand customer experience as a test account holder. This does not constitute regulated advice. You can read more about Holly's investments here.

Who is IG?

IG is a trading platform which was founded in 1974. Its claim to fame is that it invented ‘spread betting’ - a form of speculative trading where you anticipate whether the price of a currency, index, commodity or share is going to rise or fall. Today IG is one of the world’s most popular choices for spread betting, is a constituent of the FTSE 250 index in London and is regulated by the UK’s financial regulator, the Financial Conduct Authority (FCA). IG states its business model is “built around being on your side and wanting you to trade profitably”.

Who is IG good for?

IG is a good choice for frequent share traders, those who want to learn about more sophisticated trading methods using a free demo account and lots of educational resources, and those who are interested in ready-made investments through IG’s Smart Portfolio service.

Pros and cons

Still not quite sure if IG is right for you? We’ve broken down the main pros and cons in the table below. Take a look for a bird’s eye view of the key takeaways.

Investments

IG customers can invest in a huge range of different investments, including:

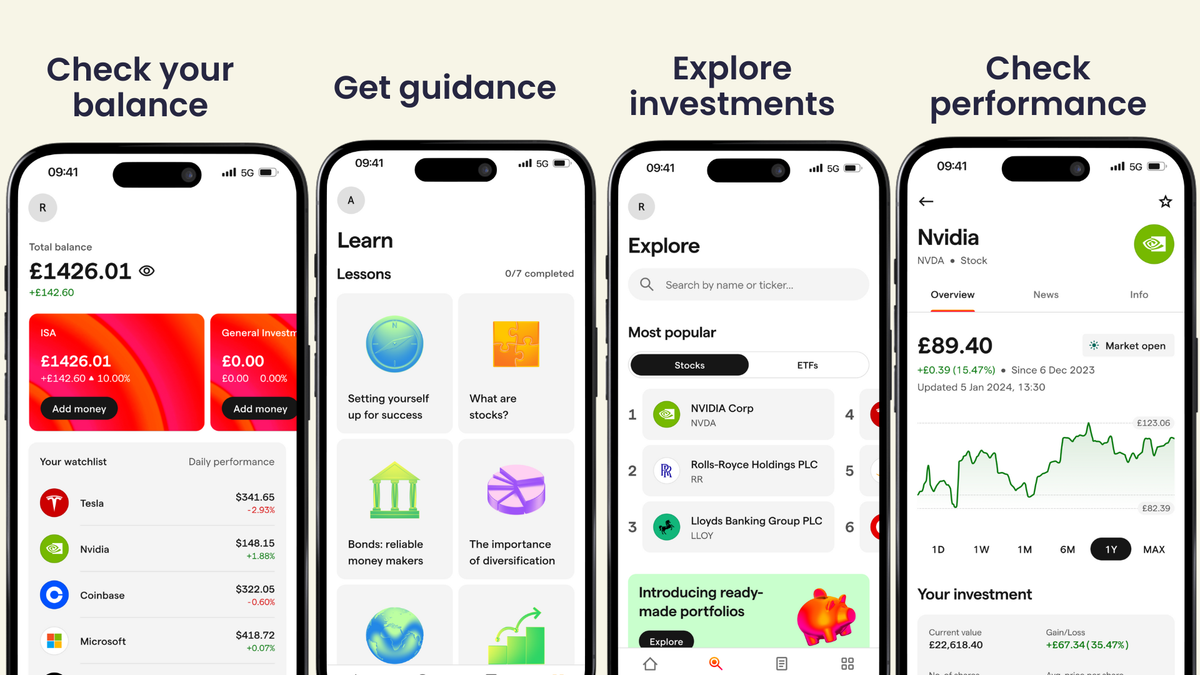

There is also a wealth of educational resources on IG’s website and app, including articles, guides, courses and even live learning sessions with financial experts to help you improve your knowledge on investing.

Screenshots are for illustrative purposes only and do not represent actual or current performance.

IG Smart Portfolios

IG offers a range of ready-made portfolios it calls its Smart Portfolios. These are essentially multi-asset funds that are made up of a blend of high and low-risk investments in different proportions. The idea is that if you prefer to minimise risk, you would opt for the lower-risk options, or if you’re more comfortable with risk and looking to maximise gains, you would opt for the higher-risk options.

The table below breaks down IG’s five Smart Portfolios in more detail.

Portfolio name | What is it? | Risk level |

Conservative | Invests in fixed-income products, primarily UK and US government bonds as well as corporate debt, with additional exposure to high-yield, index-linked and emerging-market bonds. | Very low risk. Described as suitable for “risk-averse” investors or those with short-term objectives. |

Moderate | Primarily invests in fixed-income products such as government, corporate and high-yield bonds. Some exposure to global equities and alternative assets such as gold. | Low risk. Designed for investors looking to protect their savings, but still want to keep ahead of inflation. |

Balanced | Invests in a blend of fixed-income products and global equities, with the addition of some alternative assets such as gold. | Medium risk. Designed for those who want to grow their savings over time but want to stay diversified. |

Growth | Invests primarily in global equities, with additional diversifying exposures to fixed-income products and alternatives. | High risk. Designed for investors with a high tolerance for risk and who are prepared to see sizeable fluctuations in the value of their investments in order to achieve long-term growth. |

Aggressive | Predominantly invests in equities, with residual exposure to fixed-income products and alternatives. | Very high risk. Designed for investors with a very high tolerance for risk, or those with an extended time horizon who can afford significant fluctuations in their savings. |

Accounts

Stocks & Shares ISA | Pension (SIPP) | General Investment Account (GIA) | Lifetime ISA | Junior ISA |

✔ | ✔ | ✔ | X | X |

ISA,GIA & SIPP offer available on IG*

Free Shares up to £1,000

Invest £300 and receive up to £1,000 in free US shares

Open an IG Share Dealing Account (ISA, GIA, or SIPP) and invest £300 by 27 Feb 2026 using code FREESHARES1K. Keep your investment or an active portfolio until 31 Mar 2026 to qualify. Free shares will be credited by 30 Apr 2026.

*Your capital is at risk. UK residents aged 18+ only. New share dealing customers only. One promotion per person. Cannot be used in conjunction with other offers. Shares are US-listed and subject to FX risk. Fees and charges apply. Value of investments can go down as well as up. T&Cs apply.

ISA,GIA & SIPP offer available on IG*

Invest and get a deposit match bonus up to £200

Open an IG Share Dealing Account (ISA, GIA, or SIPP) and make your first investment by 13 Feb 2026 using code DEPOSIT200. Maintain your investment or an active portfolio until 30 Jun 2026. Bonus is credited by 30 Jul 2026 (maximum £200).

Your capital is at risk. UK residents aged 18+ only. New share dealing customers only. One promotion per person. Offer cannot be combined with other offers. Fees and charges apply. Value of investments can go down as well as up. T&Cs apply.

ISA,GIA & SIPP offer available on IG*

Transfer investments and receive up to £3,000 cashback

Open an IG Share Dealing Account and submit a completed transfer form by 5 Apr 2026 using code TRANSFER3K. Your qualifying transfer must complete by 30 Apr 2026. Keep at least one open position for 6 months after completion. Cashback is paid by 30 Nov 2026 (maximum £3,000).

Your capital is at risk. UK residents aged 18+ only. New share dealing customers only. One promotion per person. Offer cannot be combined with other offers. Fees and charges apply. Value of investments can go down as well as up. T&Cs apply.

Fees and charges

The cost of investing with IG depends on which type of account you have. If you have a Smart Portfolio account, there is a flat account admin fee. The table below breaks it down in further detail.

Account Type | Admin Fee | SIPP Admin Fee | Fund Charges | Transaction Costs |

Share Dealing ISA and GIA | £24 per quarter/£96 per year | N/A | N/A | N/A |

Share Dealing SIPP | £24 per quarter/£96 per year | £210 | N/A | N/A |

Smart Portfolio ISA and GIA | 0.50% on the first £50k, 0% on amounts above £50k | N/A | 0.13% | 0.09% |

Smart Portfolio SIPP | 0.50% on the first £50k, 0% on amounts above £50k | £210 | 0.13% | 0.09% |

IG also charges a 0.7% FX conversion fee on international trades.

Customer reviews

Customers generally like the broad range of investment products, “efficient and prompt” customer service and the reliability that comes with this established, respected brand. However, some negative feedback includes the fees being too high and the website and app being “complicated” to understand.

Your opinion matters!

Leave a review for IG

20 December 2025

Great for share trading, and their fees have really come down recently (esp trading UK stocks).

Stephen

28 November 2025

I've been holding shares and also doing some spread betting with them. They are a solid good broker.

Christopher

05 July 2025

Good analysis tools but expensive pricing

05 July 2025

The service is good, the research aspect they have to do more to advise people like me

05 July 2025

Needs to make it easier to navigate the app it was a struggle at first to learn where eveyrhting is or even have a small tutorial on setting everyhting up

04 July 2025

Great company in general

04 July 2025

Good user interface, easy to trade, good signals

04 July 2025

Need to make financial tools more accessible and transparent

Most asked questions

Is IG safe?

Cash savings with Dodl are covered by the UK government’s Financial Services Compensation Scheme (FSCS), which guarantees reimbursement up to the value of £85,000 per person in the event that IG fails. Any amount above this threshold is unlikely to be covered. Investments with IG, on the other hand, are not guaranteed - by their nature, investments can and will go up and down in value.

Who owns IG?

IG, originally founded as IG Index, was founded in 1974 by British financier Stuart Wheeler. Today the company is listed on the London Stock Exchange, meaning investors can purchase shares in the company itself.

Glossary

Not 100% sure you understand something we’ve written in this review?

Discover jargon-free definitions of the most common words and technical terms used in the world of investing.

Risk warning

As is always the case with investing, your capital is at risk. The value of your portfolio can go down as well as up and you may get back less than you invest. Tax treatment depends on your individual circumstances and may change in the future.

All information in this review correct as at 01/02/2025.