Rate relief, 5 tips... and Strictly Fever

By Holly Mackay, Founder & CEO

22 Sep, 2023

Thursday’s news on keeping interest rates steady at 5.25% caught most of us by surprise. It was certainly a week of PR gaffes and shows how ridiculous the race to be first off the news block has become.

For those of you who have had a blissful week with earplugs in, the Bank of England avoided a fifteenth consecutive rise in rates this Thursday, keeping rates at 5.25%. At 12.01pm, the 1.4 million Brits with variable mortgages collectively broke out into a post-traumatic sweat of relief, although of course the ongoing pressures remain painful.

One of the more unhappy people in the UK was the PR chap who sent me a pre-emptive press release on Tuesday night, with his clients’ mournful reaction to the ‘rise in inflation’ to 7%. This was of course complete nonsense and the figures published on Wednesday morning showed a fall in inflation from 6.8% to 6.7%. Oops.

Another ‘banking expert’ was caught out on Thursday morning when his PR agency sent out another release with his shocked reaction to the latest hike in interest rates. Hmmm… Not so fast, Meester Bond... The world is full of experts and I-told-you-so’s with 2 reactions ready to publish at any one point. I feel weak at the thought of the PR industry the day before the next election… God save me.

So what should we know about this week’s rate hold?

For those who see a half-full glass, this is marvellous. It signals either the top of the cycle or at least a sign that we are pretty near the top. Mortgage rates might stabilise and although the housing market will remain tough, it might at least become more predictable. Savers should probably feel fairly confident about locking in any longer-term fixes now. And those looking to trade in their pension savings stash for a guaranteed, regular retirement income for life (called an ‘annuity’), can get some relatively decent offers now.

For those Eeyores who see the half-empty glass, this is a sign that the economy is stumbling, wounded in the battle with inflation. The Bank of England clearly think everything is slowing down or they would have kept the pressure up. The recessionary wolves are circling the camp.

5 tips and ideas

If you are remortgaging in the next 6 months, do check the market for the latest deals. Bag yourself an offer now – and if rates do keep falling, can you jump to a better offer in a few months’ time? Our Essential Guide to Mortgages might help.

Cash savers – we are pretty near the top. The best current accounts are paying about 5% and the Government-backed reliable NS&I has a one-year fix of 6.2%. Not to be sneezed at.

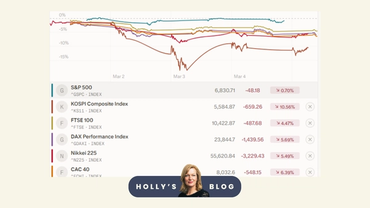

Investors – good news because markets hate inflation. But wobbly indicators for the perennially unloved UK stock market? UK Equity Income funds (collections of UK-based shares which pay nice dividends or regular cash dollops to their investors) are worth a look if you want your ISA or pension to generate some income for you. Most of the big investment platforms have shortlists of funds in this category, to help selection. Amongst the best-selling investment trusts last month were the established Merchants Trust (a sustainability nightmare packed with oil and fags but pays dividends of over 5%) and the City of London Investment Trust (rated better for sustainability by Morningstar, still with lots of fags and oil and weapons but again with a dividend of over 5%).

Annuities look pretty good right now – according to Hargreaves Lansdown “in September 2021 a 65-year-old with a £100,000 pension could expect to get an income of up to £4,940 a year from their annuity… the same person now able to get up to £7,317.” If you want to have a look at the best rates available today, the independent MoneyHelper Service, supported by the Government, has a helpful annuity calculator.

Investor alert – platform Bestinvest is running a cashback offer until November. And it’s a big one which I think is quite interesting. If you transfer £100,000 here and invest it, you would get £1,000 cashback, either paid into your ISA or pension if you are under your annual allowance or into a bank account. The cashback offer starts with £100 for £1,000 paid in, and scales up. You have to keep the funds there till the end of May next year and then you get the money. Worth a sniff? You can read what we make of Bestinvest here, along with reader reviews, or check out the deal in the link below.

Now to the real current affairs of the week. Strictly is back. I managed to watch 2/3rds of it last week and I did enjoy the glittery antidote to the current depressing news cycle. I am still at the stage of needing to work out who the ‘celebrities’ are, apart from Angela Rippon. But I will persevere.

Next week we will have the Boring Money Strictly challenge and ask you guys who you think will win the glitterball. How good are your crystal balls? I will also have my predictions ready. How many times will Johannes cry? Who will find true love in the next 15 minutes with a pleasingly slinky partner? How many times can I force my teenage son to watch it with me?

Have a lovely weekend everyone,

Holly

Want to get Holly's weekly blog straight to your inbox?

Already have an account? Login