A sprat to catch the customer mackerel?

10 Mar, 2023

Vast excitement in Boring Money HQ today as Hargreaves Lansdown spoil my nice, calm morning and announce pricing changes to some of their accounts. When the market leader moves like this, it’s big news in my sad little world!

Junior ISAs will now be free of charge – there will be no platform fee or ad hoc trading fees.

Lifetime ISAs will see the charges fall to 0.25% from 0.45%.

There was a lovely, moving press release about building wealth in the next generation and creating legacies, which brought a tear to my eye.

Before the cynical old inner battle axe wondered if this was a way to get some headlines about lower costs, without making much of a dent in your revenues?

The sprat to catch the investor mackerel?

6% of all DIY investors have a Junior ISA – the stocks and shares flavour. And this is 2% of all UK adults. [Side note: It is a source of constant sadness to me (honestly!) that about 75% of Junior ISAs sit in cash. Counterintuitively, we should be absolutely taking risk for Lil Bubba and loading up on shares when they are watching CBeebies. 18 years is a long time.]

And about 6% of all DIY investors have a stocks and shares Lifetime ISA. If you are under 40 and saving for a property (or retirement) they can be a great way to boost your savings. Parents – tell your kids or check out our Best Buy tables to see who we rate.

The point is that these accounts are definitely the understudies. They have less £ in them and fewer people have them. So this is a pricing sprat. Go out with some low headline rates to bring in some rich mummies and daddies with big ISAs and pensions.

But let me squash the cynic for a second. This is undoubtedly really good news for many Hargreaves customers and makes them a lot more competitive. It will shave off £20 of costs per year in a Lifetime ISA with £10,000 in it, making AJ Bell’s Dodl the only cheaper option on the market. And no-one can complain about paying zilch for great service on a Junior ISA. It’s very compelling.

One, two, three, four… I declare a pricing war?

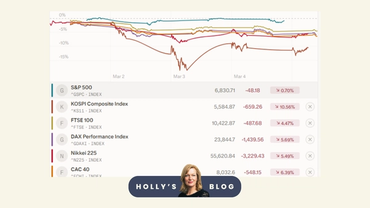

The most interesting question is how the other platforms respond. Will this lead to more pricing reductions or responses? You can see that things are getting more competitive – about 5 main platforms have advertised on telly this year and if you go on the tube, the ads are rife.

Watch this space…

These changes come in from Monday.

In other news... three things for you this week

First, as the end of the tax year gets ever closer, we really need to be more alert to tax than ever, as the Chancellor freezes thresholds and increases tax for us all. Next Tuesday, I’m hosting a 'Shake Up Your Savings' webinar at 6pm with Barclays, taking your questions on all things cash, ISAs, pensions and capital gains tax. We have nearly 1,000 people registered for this – do join us or register to get the highlights in your inbox.

Second, the thrills continue with the Budget next Wednesday. I’ll be covering this on the day and will bring you guys a round-up of the main points for savers and investors.

And third – this week we launch our brand new Investment Trust Hub. With jargon-free guides, my piece on how I use investment trusts in my portfolio, and the latest on the ‘Dividend Heroes’ for anyone looking for income from their investments.

Have a great weekend everyone.

Holly