Home • Articles • BoE Interest Rate Decision: How it Affects Your Savings, Mortgage, Pension and More

BoE Interest Rate Decision: How it Affects Your Savings, Mortgage, Pension and More

By Boring Money

18 Dec, 2025

The Bank of England (BoE) has kept the base rate at 3.75%. We explain what it all means for your money, whether you're hunting for the best savings rate, due for a remortgage, or weighing up your retirement options.

📉 What's happening with interest rates?

In February, members of the Bank's Monetary Policy Committee (MPC) voted to keep the rate at 3.75%.

Bank of England base rate, 2022 - present

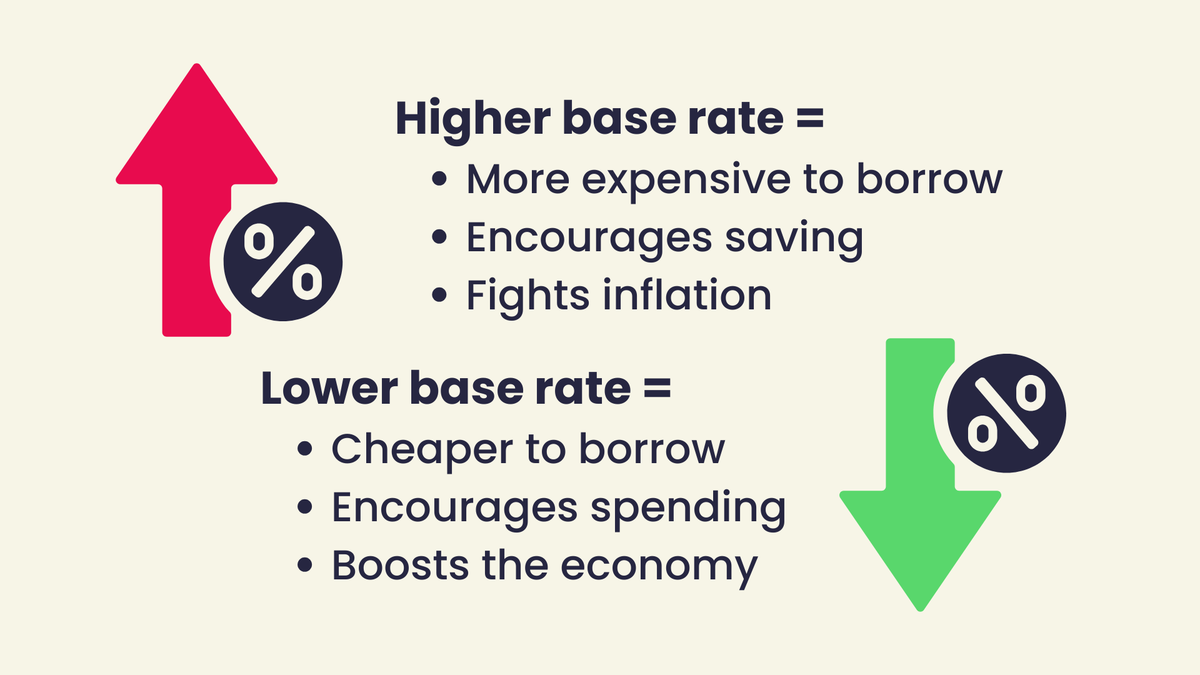

The Bank's base rate is the interest

rate it charges banks and lenders when they borrow money. It’s essentially the UK’s benchmark borrowing cost, and it influences everything from mortgage rates to savings accounts.It's also the Bank’s main tool for controlling inflation

, which it aims to keep at a target of 2%.When inflation is high - meaning prices are rising too quickly - the Bank usually raises the base rate to encourage saving and reduce spending, which helps cool things down. When inflation is low or the economy is weak, the Bank may cut the base rate to stimulate borrowing and spending, giving growth a boost.

⬇️ What's happening with inflation?

UK inflation fell to 3% in January 2026, down from 3.4% in December 2025, but still a long way from the Bank of England's 2% target. Translation? Your money is still losing value, just not quite as quickly as before.

Transport was the biggest factor. Petrol dropped 3.1p per litre and diesel fell 3.2p, while air fares followed a more pronounced seasonal pattern than last year — a bigger-than-usual December rise was followed by a steeper-than-usual January fall, creating a large downward contribution.

Food and non-alcoholic beverages eased from 4.5% to 3.6% annually. Prices actually fell 0.1% on the month, compared with a 0.9% rise a year earlier, with broad-based softness across bread, meat, dairy and drinks.

Education dropped sharply from 7.6% to 5.1%, almost entirely because private school fees surged a year ago when VAT was applied to them — that base effect has now dropped out of the annual comparison.

Housing also nudged down, with owner-occupiers' housing costs slowing for the 12th consecutive month and gas prices falling 3.4% on the month. Electricity bucked the trend, rising 3.7% in January due to the Ofgem price cap change, but this wasn't enough to offset the other housing tailwinds.

Partially offsetting all of this, restaurants and hotels ticked up (from 3.8% to 4.1%), largely because hotel prices fell by less than they did a year ago.

💰 Savings: Clock is ticking on competitive rates

It's been good news for savers in recent years, having enjoyed competitive returns with easy-access and fixed-term savings products paying as much as 5%+. But this is starting to change.

Banks and building societies tend to align their cash savings products with the base rate, although they’re often a bit slower to react when there are changes (especially when it suits them).

Evidently, the usual advice is to shop around and make sure you're getting the best rate you can.

Another cut to the Bank rate will take its toll on savers, who will probably take it on the chin because they’re grateful interest rates no longer begin with a zero. However, there is a risk that cash savers will end up being slowly boiling frogs, never prompted to reassess their allocation to cash because of the gradual pace of interest rate cuts. We know that as a nation we have too much held in cash, so much so that the financial watchdog and the Chancellor are trying to get us to move out of it, and invest instead. Lower interest rates should help in that regard, but the slow drip of loosening monetary policy means savers will likely move in their ones and twos, rather than en masse.

🏡 Mortgages: Relief for many with reduced rates

For many homeowners and buyers, the Bank's decision to keep the base rate to 3.75% is good news.

📉 Tracker mortgages

Tracker rates have been gradually closing the gap on fixed rate options but are still behind the best of the fixes. However, with more base rate cuts expected next year, we will potentially see more borrowers wondering if following rates down could make for a better option in the longer run.

Trackers are also more likely to be free of any early repayment charge which gives added flexibility. However, there’s no guarantees that rates will continue to drop and so borrowers need to have some ability to cope with rising payments if rates take a turn.

🌀 Variable rate mortgages

Standard variable rate (SVR) mortgages aren’t directly tied to the base rate, but most lenders follow the Bank’s lead. Around 600,000 homeowners in the UK have an SVR deal, and the current average rate is 7.5%.[6] If the base rate is cut later in the year, this should be reflected - just bear in mind that SVRs are typically higher than most fixed deals, and lenders can be notoriously sluggish about passing on cuts.

🔒 Fixed rate mortgages

Fixed rates have improved substantially and improved the choices for those still edging toward the end of an ultra low 5 year fixed rate. Lenders are competing hard and there could be more scope for lenders to improve their rates in the new year when they will want to get off to a good start.

Although rates are already pricing in further rate cuts next year, there’s still scope for market expectation to see rates drift down further. Borrowers are therefore even more likely to need advice to help them find the right option and keep track of a fast moving market.

👵 Pensions & annuities: Rates still at record highs

Higher interest rates over the past few years have helped push annuity

rates to their highest levels in over a decade. That’s been a rare slice of good news for retirees looking to lock in a guaranteed income for life, but if further cuts are on the horizon, we could see rates start to decline.That being said, experts maintain it's unlikely that annuities will plummet overnight.

While the recent upward trend has been steady, it feels unlikely annuity rates will fall back to historic lows. Interest in annuities is likely to remain strong, particularly given the anticipated changes to [Inheritance Tax] in 2027, which may prompt more people to consider annuities as part of their retirement planning.

Best annuity rates, December 2025

Annuity type | Age 55 | Age 60 | Age 65 | Age 65 | Age 70 | Age 75 |

Single life, level, no guarantee | £6,476 | £6,856 | £7,724 | £8,205 | £8,499 | £9,671 |

Single life, level, 5 year guarantee | £6,468 | £6,844 | £7,667 | £8,145 | £8,390 | £9,425 |

Single life, RPI, 5 year guarantee | £4,082 | £4,460 | £5,359 | £5,925 | £6,123 | £7,246 |

Single life, 3% escalation, 5 year guarantee | £4,456 | £4,832 | £5,745 | £6,259 | £6,538 | £7,642 |

Joint life 50%, level, no guarantee | £6,107 | £6,549 | £7,155 | £7,509 | £7,851 | £8,729 |

Joint life 50%, 3% escalation, no guarantee | £4,126 | £4,556 | £5,141 | £5,620 | £5,955 | £6,921 |

Source: Retirement Line, Hargreaves Lansdown.

If you're approaching retirement and considering an annuity, it would be wise to shop around and start getting quotes well in advance. This will give you the best chance of securing the best possible rate on your retirement savings.

It's also worth remembering that annuities aren't your only option and that you can even opt to blend one with a drawdown strategy to maximise your income:

For those who want to lock in an income for retirement and ensure essential needs are covered, but still want an element of flexibility, it is helpful to remember that annuities can be used alongside other decumulation strategies. One way is by keeping some savings in drawdown or by staggering the purchase of annuities to benefit from higher rates as you age. This offers the best of both worlds: the certainty and security of a guaranteed income, with the flexibility to respond to changing needs throughout retirement.

If you're considering purchasing an annuity, contact a professional annuity broker or financial adviser before committing yourself to anything. They can help you filter options best suited to your individual circumstances.

🎯 The bottom line

Here are the key takeaways of what you need to know about your mortgage, savings, and pension pot in light of the Bank's decision:

🤔 So what should you do?

---

[1] House of Commons, July 2024

[2] Office for National Statistics, September 2025

[3] Deutsche Bank UK, September 2025

[4] MHA, August 2025

Post a comment:

This is an open discussion and does not represent the views of Boring Money. We want our communities to be welcoming and helpful. Spam, personal attacks and offensive language will not be tolerated. Posts may be deleted and repeat offenders blocked at our discretion.