Best budgeting apps for 2025: Monzo, Plum and more

By Boring Money

10 April, 2025

In an age where digital banking has become the norm and financial management increasingly happens at our fingertips, budgeting apps have evolved from simple expense trackers to sophisticated financial companions. These powerful tools now offer everything from automated savings and investment opportunities to personalised spending insights and subscription management.

The UK market in 2025 features several standout contenders that have refined their offerings to address different financial needs and preferences. Whether you're looking to build savings automatically, gain visibility across multiple accounts, earn competitive interest rates, or simply stop money from slipping through your fingers on forgotten subscriptions, there's a budgeting app designed specifically for your financial goals.

This guide examines five leading contenders - Monzo, Plum, Chip, Emma, and Snoop - highlighting what makes each unique in the crowded financial technology landscape. From full-service digital banks to AI-powered savings assistants, we'll help you navigate the options and find the perfect digital companion for your financial journey.

Monzo: All-in-one digital bank

Monzo has cemented itself as one of the UK’s most popular digital banks, offering an app-based experience that blends traditional banking with modern money management tools. It provides a data-driven approach to budgeting, helping you track spending, save smarter, and manage your finances with real-time insights.

Key features

Instant spending notifications: Real-time alerts whenever money enters or leaves your account.

Savings pots: Set aside money in separate pots and utilise features such as “roundups” (rounds up every pound you spend to the nearest pound and puts the difference in your chosen savings pot) and “lock your pot” (freezes your pot so you can't spend for a chosen period of time).

Budgeting tools: Set spending limits, track categories, and receive insights into your spending habits.

Get paid early: Get paid a day early when your wages are deposited into your Monzo account (T&Cs apply).

Cost

Plan | Cost | Features |

Monzo Free | Free | Standard banking features, instant notifications, savings pots, and spending insights |

Extra | £3.00/month | All Free features plus connected accounts, credit insights, advanced savings tools, and virtual cards |

Perks | £7.00/month | All Extra features plus a weekly Greggs treat, an annual Railcard, and 4.00% AER (variable) interest on savings* |

Max | £17.00/month | All Perks features plus worldwide travel and phone insurance, UK & Europe breakdown cover, and the option to add family for £5.00/month |

Information correct at time of publishing.

Pros and cons

Plum: The AI-powered financial assistant

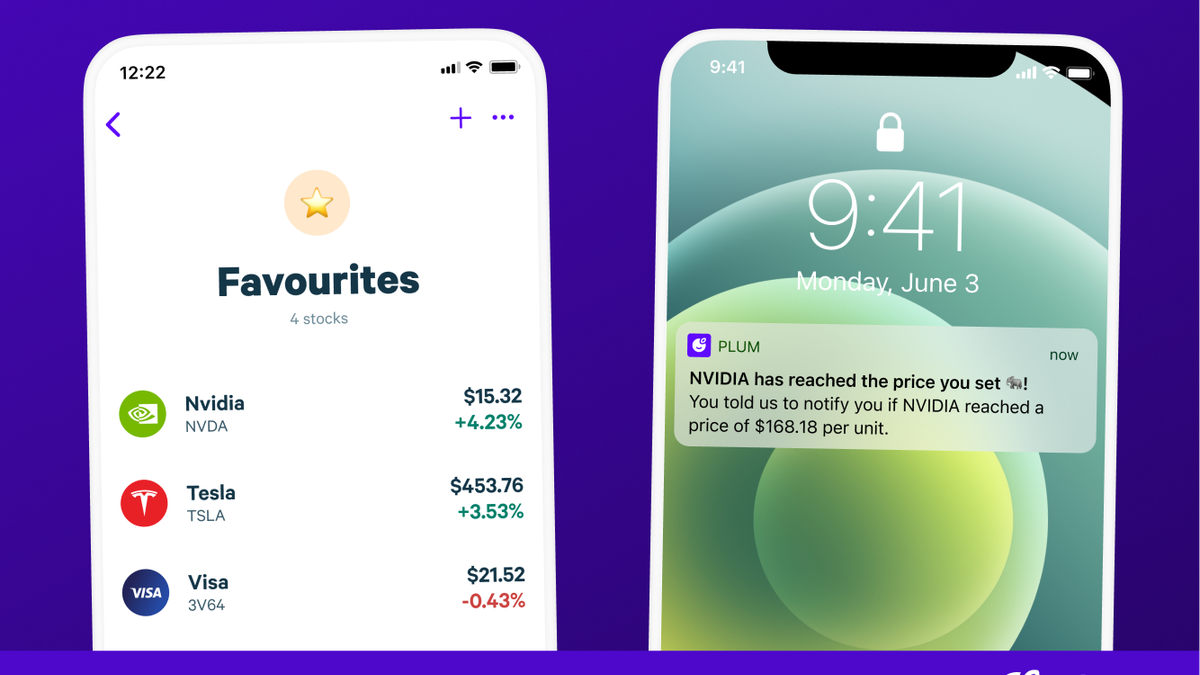

Plum has emerged as a robust money management and budgeting app, leveraging artificial intelligence to automate savings and provide insightful financial analytics. By linking directly to your bank accounts, Plum analyses your spending patterns and determines optimal amounts to set aside - making the savings process effortless.

Plum mobile app.

Key features

Smart automated savings: Unlike basic round-up savings apps, Plum uses AI to assess your income and spending habits, adjusting the amount it saves accordingly. You can also set savings rules, like "Pay Days," which set aside larger sums when you get paid.

Investment opportunities: Plum allows users to invest your savings into various funds, including ethical and tech-focused options, enabling your money to grow over time.

Spending categorisation: The app breaks down your expenses into categories, helping you identify areas where you can cut back.

Bill tracking and switching: Plum monitors your recurring bills and suggests switching providers if you could save money elsewhere.

Cost

Plan | Cost | Features |

Plum Basic | Free | Automatic savings, spending insights |

Plum Pro | £2.99/month | Unlocks Stocks & Shares ISA and access to more savings "pockets" (customisable pots) |

Plum Ultra | £4.99/month | Eligible for a Visa debit card for on-the-go spending |

Plum Premium | £9.99/month | Includes investment access, detailed analytics, and more control over savings automation |

Information correct at time of publishing.

Pros and cons

Chip: High-yield savings made simple

While Chip also offers automated savings, its main differentiator is the ability to earn market-leading interest rates. It partners with financial institutions to offer high returns on savings accounts, making it a go-to app for those who want to maximise their savings with minimal effort.

Key features

Competitive interest rates: Unlike traditional bank savings accounts, Chip offers some of the best interest rates available in the UK by working with financial institutions that provide higher returns.

Automatic deposits: The app analyses your spending and transfers small amounts into savings, but unlike Plum, it focuses on growing these savings through high interest rather than AI-based budgeting insights.

Savings goals: Users can create multiple savings pots for different financial targets.

Investment options: For those looking to take savings further, Chip offers investment options, but its main strength is still high-yield savings.

Cost

Plan | Cost | Features |

Chip Free | Free | Basic savings automation, access to small range of investment funds, competitive 0.25% platform fee |

ChipX | £5.99/month | Includes premium interest rates, larger range of investment options, priority customer support |

Information correct at time of publishing.

Pros and cons

Emma: The ultimate financial aggregator

Emma positions itself as a financial advocate, aiming to help users avoid overdrafts, find wasteful subscriptions, track debt, and save money. Unlike Plum and Chip, which emphasise saving, Emma is all about giving you complete visibility over your finances by connecting all your bank accounts, credit cards, and investments in one place.

Emma mobile app homepage.

Key features

Account aggregation: Emma links to multiple bank accounts, giving you a single dashboard to monitor your financial health.

Subscription tracking: The app identifies recurring subscriptions and alerts you to services you may no longer need.

Spending analysis & budgeting tools: Unlike Chip, Emma provides in-depth spending analytics and helps you create detailed budgets.

Cashback and rewards: Some premium users can access cashback offers when shopping with select retailers.

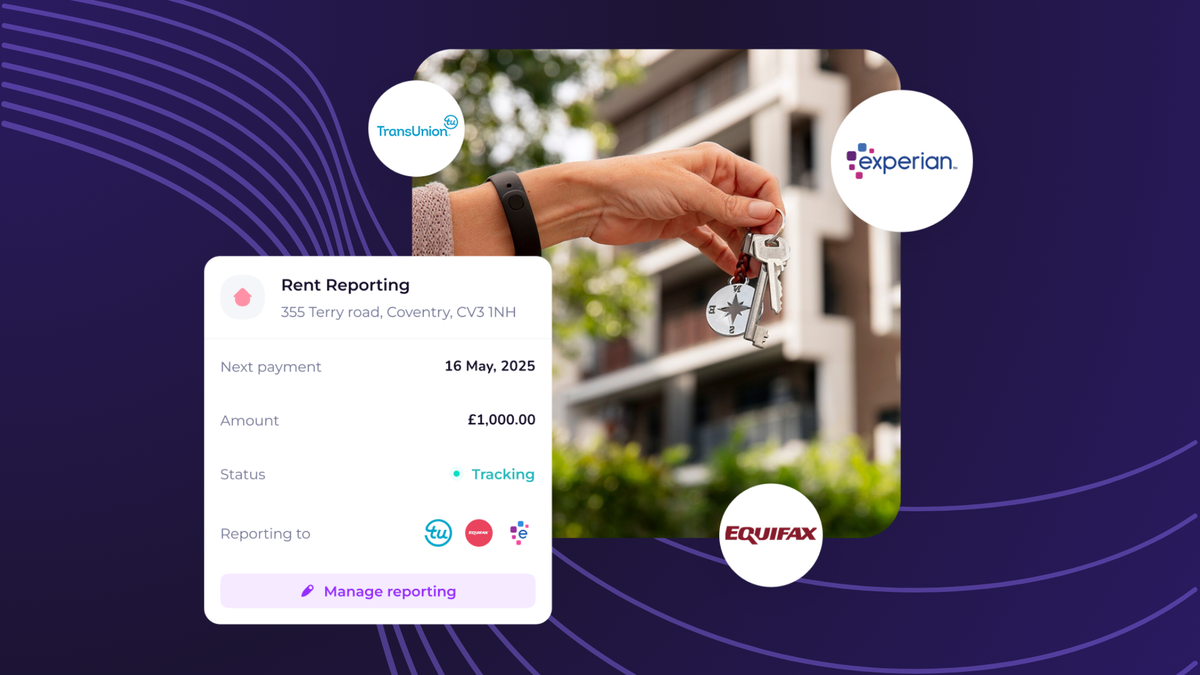

Credit boost: Exclusive Rent Reporting feature allows you to report rental payments to improve your credit score.

Emma's Rent Reporting feature.

Cost

Plan | Cost | Features |

Emma Free | Free | Basic budgeting, spending insights, and subscription tracking |

Emma Plus | £4.99/month | Adds custom categories, advanced analytics, and cashback rewards |

Emma Pro | £9.99/month | Includes unlimited budgeting, historical data exports, and more control over linked accounts |

Emma Ultimate | £14.99/month | Unlocks exclusive perks like priority support and AI-driven financial coaching |

Information correct at time of publishing.

Pros and cons

Snoop: Money-saving tips on your mobile

Snoop is a UK-based budgeting and money-saving app that connects to your bank accounts to give you a full picture of your finances. Its main mission is to help you spend smarter, minimise waste, and spot opportunities to save. Think of it as your financial co-pilot - except it never sleeps and never misses a trick.

Key features

Account aggregation: See all your accounts, balances, and transactions in one app via Open Banking connections.

Spending insights & budgets: Categorises your spending, tracks trends, and lets you set budgets by category.

Bill tracking & alerts: Monitors subscriptions and regular payments, notifying you about price hikes or duplicate charges.

Money-saving suggestions: Sends personalised recommendations and offers based on your spending habits.

Cost

Plan | Cost | Features |

Snoop Free | Free | Connect accounts, view spending insights, receive savings suggestions, basic budget tracking |

Snoop Plus | £4.99/month or £39.99/year | Unlocks custom spending categories, exportable data, manual accounts, detailed reports and more |

Information correct at time of publishing.

Pros and cons

Which budgeting app is best for you?

Each of these apps excels in different areas, so your choice depends on what you need most:

App | Best For | Standout Feature | Interest Rates | Cost |

Monzo | Full digital banking experience | Complete banking + budgeting tools | Up to 4.00% AER (variable) | Free - £17/month |

Plum | Hands-off savers | AI-powered automated savings | Via investment only | Free - £9.99/month |

Chip | Maximising interest | High-yield savings accounts | Up to 4.32% AER (variable) | Free - £5.99/month |

Emma | All-in-one financial visibility | Account aggregation & subscription tracking | Up to 4.45% AER (variable) on certain pots | Free - £14.99/month |

Snoop | Reducing financial waste | Money-saving recommendations | None | Free - £4.99/month |

Information correct at time of publishing.

Quick decision guide:

Choose Monzo if you want a full-service digital bank with integrated budgeting tools.

Choose Plum if you prefer AI to handle your savings decisions automatically.

Choose Chip if earning the highest interest on your savings is your priority.

Choose Emma if you need visibility across all your accounts and subscriptions.

Choose Snoop if you want personalised tips to reduce spending and cut financial waste.