Miserable Meta Mark ….and the Boring Money Army

28 Oct, 2022

Following is a technical analysis of this week in markets:

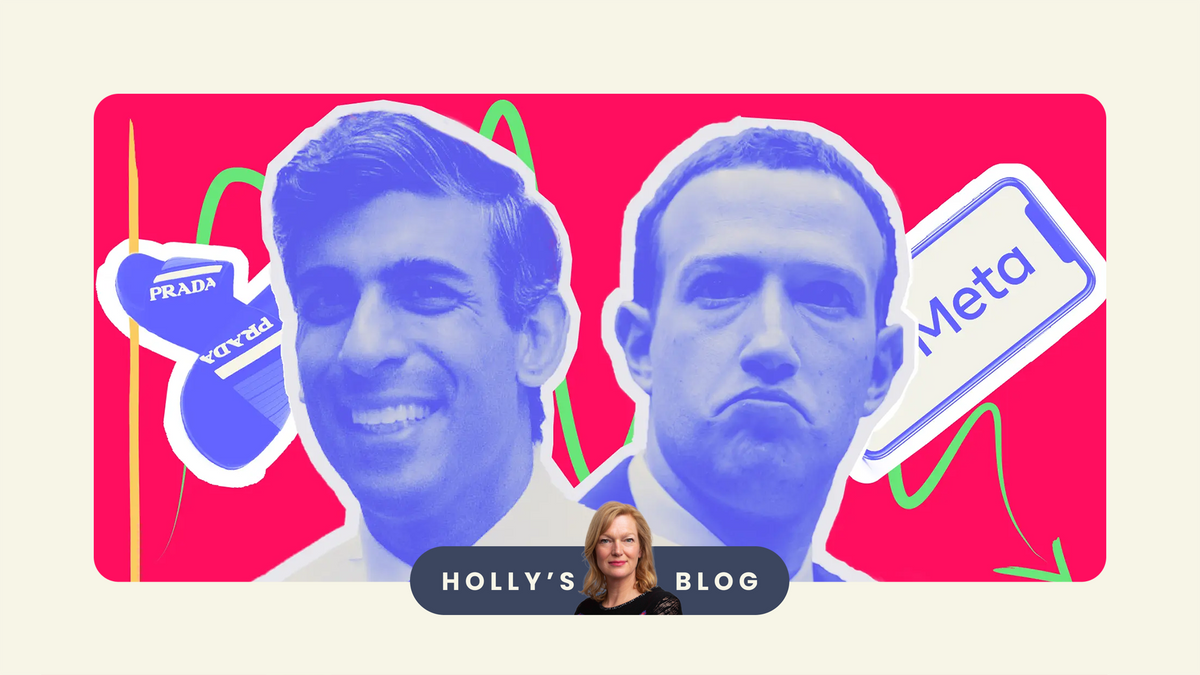

Dishy Rishi and his Prada sliders are happy

Elon Musk and his $44 billion new bird, Twitter, are happy

Shell and their oily £8.2 billion three-month profits are happy

US tech firms are getting unhappy

Meta Mark is mega unhappy

Before we dig into this insightful analysis a little more, I have a request for you.

Join the Boring Money Army

We have a research panel of our wonderful readers called the Boring Money Army. Here’s the deal. You tell us what you think about things for incentives, prize draws and competitive market research rates paid for any more involved feedback. So you get a side hustle and we collect insights. These insights fuel our work with the industry, who use us to tell them what their customers think about them, or what people think about markets, communications, new apps or similar.

We are now embarking on a growth spurt and so need to grow the ranks. If these blogs have helped you, if you think the industry needs to hear feedback to improve, or if frankly you like the sound of making some dosh on the side, then please get involved. As usual, we are interested in anonymized insights mapped to demographics, not individuals. We don’t sell names or contact detail to anyone, that’s grubby.

Please do join us – all ages, experience, confidence levels and temperaments welcome! We have 3 Amazon vouchers of £100 up for grabs so please join us.

And back to markets

It’s been a dreadful week for technology firms in the US. The Big 5 of tech – Alphabet (Google), Amazon, Apple, Microsoft and Meta (Facebook) - are collectively worth about $780 billion less than when this current earnings season began. Gulp.

Amazon shocked analysts yesterday with a Bah Humbug Q4 forecast and Meta reported a slump in profit margins on Wednesday. People are spending less on advertising and the business is costing more to run. Analysts are also a bit ho-hum about the metaverse, which no-one likes quite as much as Mark Zuckerberg. They basically want to see less mumbo-jumbo talk of ‘weird alien sh!t’ and more focus on cold hard cash today.

Meta’s shares fell about 25% on Thursday and the company lost $85 billion in value. SAY WHAT?! Their shares are now about 75% below their record high last summer. Poor ole Marky. And Amazon’s shares fell about 14% in out-of-hours trading yesterday, as they warned that operating profits in Q4 could be basically zilch.

These falls come against a general backdrop with gloomier mood music. The biggest 500 companies whose shares you can buy in the States – the S&P 500 – are down on average about 20% this year.

Is this a disaster? Time to dump them?

This is not like the dot.com crash of 2000. The leading tech firms are enormous businesses which are part of modern day infrastructure. Arguably they are utilities and an essential part of the plumbing. Take Microsoft for example – imagine trying to unplug them from your company and your home. Nightmare. They are not the silly software tiddlers of 2000.

But for sure valuations were sky-high and this is a correction which many say was long overdue. Any new potential investors – this is not a bad time to consider to starting. It’s all a lot cheaper than it was a year ago. At volatile times, drip-feeding into markets is sensible, rather than jumping all in on any one day.

It’s becoming increasingly clear that the next 6 months are going to be brutal. Revenues will fall and costs will rise. People will be laid off and some companies will go under. ‘Tis the season to be jolly! The upside of this for mortgage holders is that I simply cannot see this as an environment to support long-term continued interest rate rises.

For long-term, fortune will favour the brave who hold their nerve and buy when others are selling. As always. Life really is very dull and predictable (says the financial commentator who has seen 2 monarchs, 3 PMS, 4 Chancellors and I’ve lost track of Home Secretaries in the past four months!).

A little teaser of something to come…

Next week, the team and I at Boring Money will be launching a brand new service we have been working on all year. It’s aimed at women aged between 40 and their early 60s, and has been crafted with support from 500 wonderful Founder Members.

Watch this space……………#drumroll!

Have a great weekend everyone.

Holly