Nasdaq: where innovation can drive future success

31 May, 2023

Sponsored by Invesco

Nasdaq is a story about innovation. It was launched in 1971 as the world’s first electronic stock market and has since become home to thousands of the most innovative companies. Many of the firms that chose to list their shares on the Nasdaq stock market are now household names, including industry leaders such as Microsoft, Cisco and Google (now part of the Alphabet group). The latest study by Boston Consulting Group [1] shows that the five most innovative companies in the world are all listed on the Nasdaq-100 index. Not by coincidence, nine of the top 10 most innovative leaders in America are CEOs of Nasdaq-100 companies [2].

Apple and Tesla are good examples of how innovation is often linked to strong management. Since listing their shares on Nasdaq in 1980 and 2010 respectively, Apple and Tesla have become two of the most innovative companies in the world. Much of their success is down to their founders’ visionary capabilities and drive to continually innovate. Apple became the dominant name in mobile phones and personal music players, bringing out new models with new features almost every year, generally with massive fanfare. Tesla, meanwhile, captured the imagination of car buyers everywhere. They didn’t focus on what people wanted currently but instead imagined what they would want in future and changed perceptions by making electric vehicles cool and sexy. Neither company ever rested on laurels but rather constantly developed ideas for the future.

What’s the difference between Nasdaq and the Nasdaq-100?

More than 4,000 companies, worth a combined $20 trillion, have their shares listed on the Nasdaq stock exchange. This includes everything from relatively small start-ups all the way through to some of the largest companies in the world. Nasdaq is the online marketplace where any of those stocks can be bought and sold by investors from around the world. Nasdaq has the highest trading volume of any US stock exchange, with around 2 billion shares traded on average each day [3].

The Nasdaq-100 is an index, measuring the share prices of the 100 largest non-financial companies listed on the Nasdaq stock exchange. The weight of each company in the index is determined by its size (market capitalisation). The Nasdaq-100 index was launched in 1985 and, like any other index, you can’t actually invest in it. Instead, anyone wanting to gain exposure to the index can invest in an exchange-traded fund (ETF) that aims to provide the performance of the index.

The Nasdaq-100 is a “growth” style index, meaning that companies included in the index are considered to have the potential to generate higher sales and earnings growth rates than other companies. Innovative companies with high sales and growth rates have delivered historically higher share price performance relative to other companies. Of course, past performance is not a reliable indicator of future returns, and higher growth potential goes hand in hand with higher risk, so anyone considering an investment in a growth-style fund needs to consider the risk involved.

Higher growth potential can often be found in high growth industries, where the most successful companies can capture a larger share of their market, typically driven by the vision and conviction of strong leadership. Just think about the contributions that Steve Jobs and Elon Musk had in the success of Apple and Tesla respectively. Nasdaq-100 companies have greater exposure to disruptive technologies, with 58 of the 100 companies filing patents in areas such as artificial intelligence (AI), clean energy and blockchain. These companies account for 82% of the index in terms of market capitalisation [4].

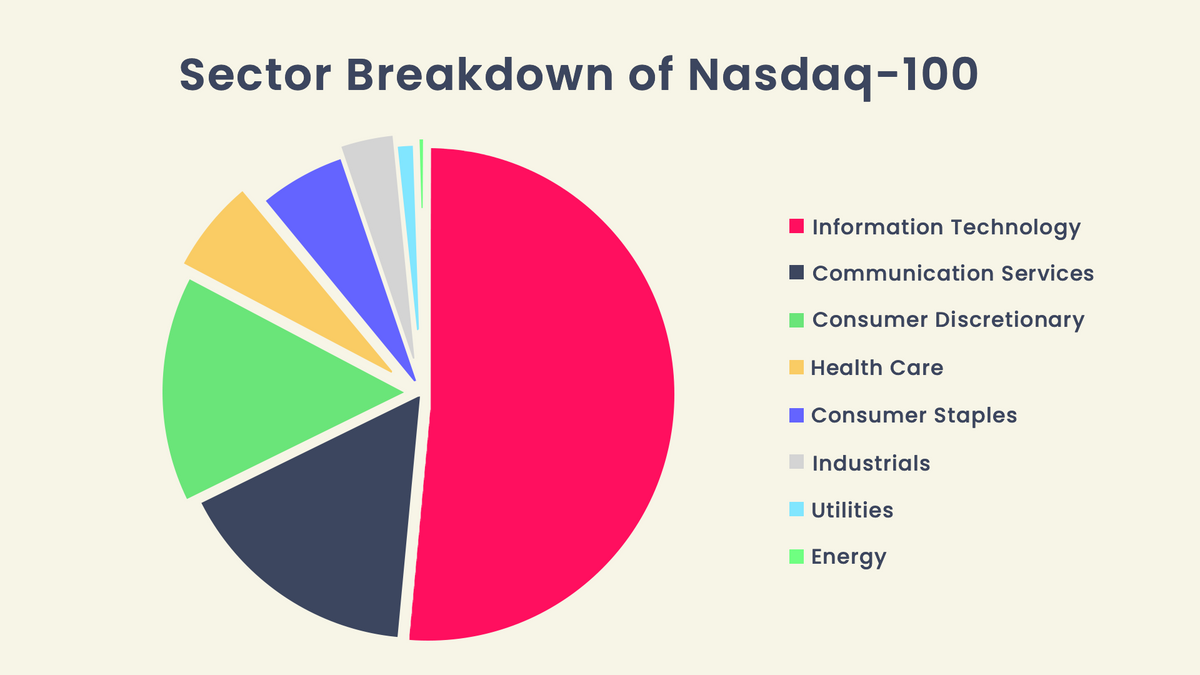

The Nasdaq-100 index is more than just technology

While the technology sector currently accounts for just over half of the Nasdaq-100 companies, in terms of their market capitalisation, a host of other sectors are represented where innovation is a fundamental driver of company success. As you can see from the chart, this includes communication services (16.3%), consumer discretionary (15.0%), health care (6.3%) and consumer staples (5.8%).

Source: Bloomberg, as at 29 March 2023

Let’s be honest, who wouldn’t like to think their company is innovative? And maybe all companies are to a degree. For an objective measurement of innovation, we can look at how much a company spends on research and development (R&D). Most innovative companies will use a higher amount of their current sales to fund R&D on future products and services. That usually requires a company to accept lower earnings in the year they’re spending on R&D… with the trade-off being the potential for higher earnings growth in future years.

On average, companies in the Nasdaq-100 index spend almost twice as much on R&D than companies in the S&P 500 index. As a percentage of sales in the previous 12 months, R&D spending by the average Nasdaq-100 company is 38% higher than companies in the S&P 500 index [5]. In the first quarter of 2020, at the start of the pandemic when many companies would have been uncertain about the future, Nasdaq-100 companies increased their R&D spending.

Unexpected companies in Nasdaq-100

Once you’re aware that the Nasdaq stock exchange tends to attract innovative companies, often those involved in technology and other disruptive, high-growth industries, it’s easy to understand the examples mentioned so far. But there are some Nasdaq-100 companies in sectors that you wouldn’t associate with technology, disruption or even innovation.

Consumer staples, for example, is likely to be far down the list of innovative sectors, but PepsiCo proves that anyone with the will and vision can be an innovator. This food and beverage company launched the “Open Innovation Portal”, a hub for developing external partnerships to accelerate the firm’s research and development. An example was partnering with a biotech firm to create a more sustainable packaging solution, which reduced the time it usually takes to get to market.

Lululemon Athletica is a consumer discretionary firm founded in 1999 and part of the Nasdaq-100 index only recently (2018). The Canada-based retailer designs engineered sportswear for maximum performance through innovative and functional technology. It saw the value of its brand increase by 40% in 2020, according to an annual study from Kantar BrandZ, making it the 3rd biggest riser in the year [6]. Having a strong brand can prove particularly critical during difficult economic times and uncertainty. Lululemon reported a 24% increase in net revenue in the final quarter of 2020 [7], when much of the world was still locked down, compared to the quarter just before the pandemic began.

Investing for the future

Whether you’re looking for companies involved in the most cutting-edge technologies or just those in less exciting industries but with the vision and creativity to drive future growth ambitions, you’ll find examples throughout the Nasdaq-100 index.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Important information

This is marketing material and not financial advice. It is not intended as a recommendation to buy or sell any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication.

Data as at 14 April 2023 unless otherwise stated.

Views and opinions are based on current market conditions and are subject to change.

This material has been communicated by Invesco Asset Management Limited, Perpetual Park, Perpetual Park Drive, Henley-on-Thames, Oxfordshire RG9 1HH, UK. Authorised and regulated by the Financial Conduct Authority.