Spring Statement Preview: What Tax Changes Could Rachel Reeves Announce

27 Feb, 2025

The Chancellor’s Spring Statement is due on 26 March. Rachel Reeves’s difficulties are well-documented and will be familiar to anyone managing a household budget: not enough coming in and far too much going out. It has led to speculation that she may raise taxes again, following the tax increases announced in the October budget. What should we be looking out for?

A silver lining in the numbers

It is worth saying that the situation for the Chancellor does not look as awful as it did just a few months ago. In mid-January, government bond yields spiked higher, potentially raising the cost of government borrowing to unsustainable levels. They have dropped back substantially, restoring some flexibility to Reeves’s calculations.

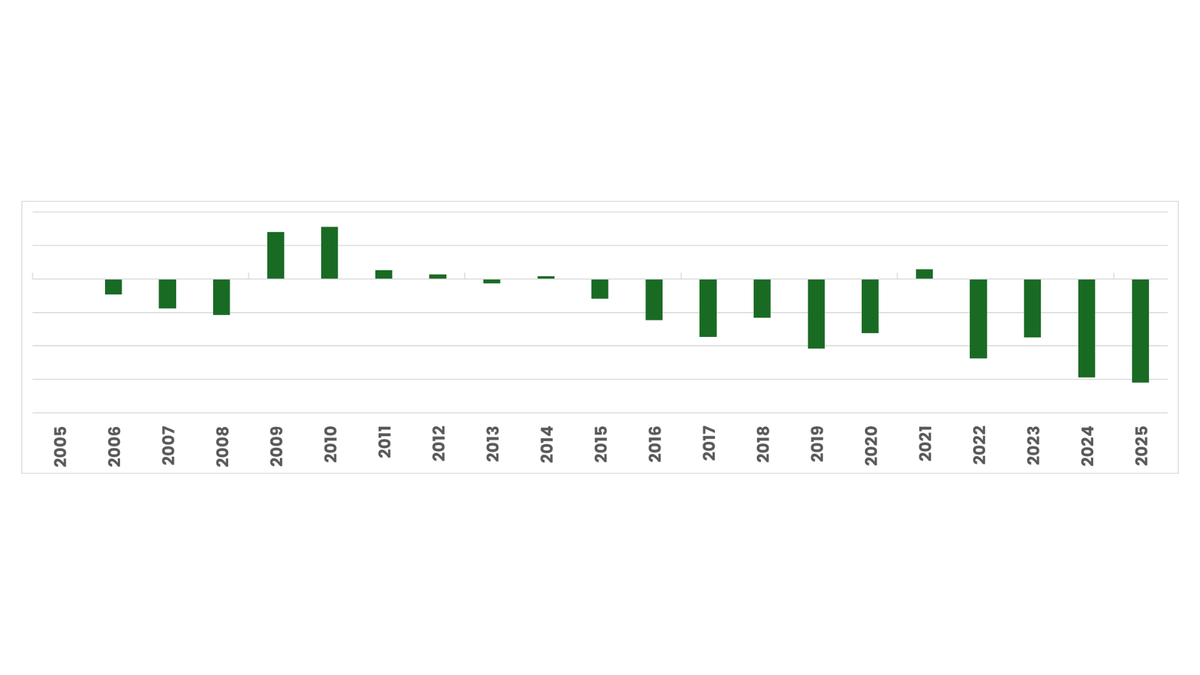

The Government’s ‘fiscal surplus’ – the difference between its income and expenditure - was £15.4bn in January[1]. While this was behind official forecasts, it was still the highest level for the month since records began more than 30 years ago.

Source: Office for National Statistics

Growth that's barely moving the needle

However, some persistent problems remain. The economy is growing but at an anaemic pace. The final quarter of 2024 saw GDP growing at just 0.1%. This was ahead of expectations but goes little way to solve the Chancellor’s spending dilemma.

Nina Skero, chief executive, Centre for Economics and Business Research at accountancy group BDO, says:

This does at least mean that the Chancellor won’t be delivering the Spring Statement in the midst of a recession. However, GDP per capita, which better reflects how people are feeling about the economy, has however been declining for the past two years.

ING points out that the bigger issue may be the OBR’s 2025 growth forecast – currently 2% – which now looks “wildly optimistic” in light of a weaker run of data and mounting economic headwinds. This could disrupt tax and spending projections.

Prices still creeping up

Then there is inflation. The latest CPI data showed prices rising at 3%, driven primarily by energy prices, but also one-off factors such as VAT on school fees. The energy price cap rose more than expected in late February - from its current level of £1,738 to £1,849 a year. The BBC recently reported that seven taxes are due to rise in April – water bills, energy bills, council tax, car tax, broadband, stamp duty and the ‘stealth’ tax of a freeze on tax thresholds.[2]

Skero says there may be more inflationary pressures coming down the road from the NI increases: “The upward contributions from labour-heavy sectors might suggest that some businesses were getting ahead of the higher NIC bills with price rises, but as the higher rates only come into effect in April, their impact on prices, wages, and employment will take some time to properly analyse.” Rising inflationary pressures could give the Bank of England pause for thought on future interest rate cuts, which would otherwise have given the Chancellor some breathing space.

Mounting spending demands

The Chancellor is also facing a range of spending pressures. As well as long term pressures such as an ageing population and a rising benefits bill, she has recently had to find another £12-15bn for defence spending (coming from the Overseas Aid budget).

Against this backdrop, further tax rises remain a possibility in the Spring Statement, even though it is not billed as a tax raising event. It is also possible that the Chancellor will tweak some of the more unpopular measures from the Budget. Accountancy group Bishop Fleming said:

Reeves told a recent CBI conference that there would be no more tax rises on the scale of the Autumn Budget, but she was then forced to row back on that statement by the Prime Minister - leaving it open for more tax increases in 2025[3].

Where Might the Tax Axe Fall?

What might Rachel Reeves target?

Cash ISAs: there are rumours that Reeves could get rid of the tax breaks for cash ISAs. Cash ISAs remain popular with savers, taking around two-thirds of overall ISA subscriptions[4], but there is a question over whether the Government should be incentivising people to save into cash rather than the stock market. The Chancellor may not go the full hog, and may simply reduce the limits for cash ISAs.

Inheritance tax – the Chancellor has already raised inheritance tax on unused pensions, and for farmland. However, Evelyn Partners' head of estate planning Ian Dyall believes that IHT could continue to be a target for the chancellor. He says:

It might not be long before Rachel Reeves is again forced to seek new ways of boosting tax revenues. With the self-imposed limits on how she can do this, IHT remains one of the few ways the Chancellor can wriggle out of the fiscal strait-jacket.

He believes she may target the gifting regime, which would allow her to raise more revenues without cutting the headline rate of IHT or nil-rate bands.

Capital gains tax – having raised capital gains tax on Stocks and shares in her October budget, there has been speculation that the Chancellor will come back for more in the Spring Statement. This may involve raising the levels further or dropping the allowances. On balance, however, it may not be worth the political headache. Capital gains tax raises relatively little for the Treasury, and the amount of tax collected tends to rise as rates fall. As such, hiking CGT even further may be counterproductive.

NIC changes – There has been widespread condemnation of the rise in employers’ NICs, with accusations of it being a ‘tax on business’. Employers have also objected to it coming at the same time as rises in the minimum wage. Bishop Fleming says it is not out of the question that employers may be offered some relief:

This might be via an increased Employment Allowance or perhaps a higher threshold before employers' NICs become payable. Additionally, could there be an announcement on NIC relief for the charity sector?

The Chancellor's Balancing Act

All in all, it is an uncomfortable tightrope for the Chancellor, with almost all choices unpalatable. The nuclear option would be to abandon the Triple Lock on the state pension, which looks unsustainably generous in these straightened times. However, it may be too soon after the Winter Fuel Allowance cut and it will depend on how brave the Chancellor is feeling.

--------

[1] BBC, Febraury 2025

[2] BBC, Febraruy 2025

[3] Bishop Flemming

[4] Gov.uk, September 2024