Top performing medium-risk ready-made portfolios

20 Jan, 2023

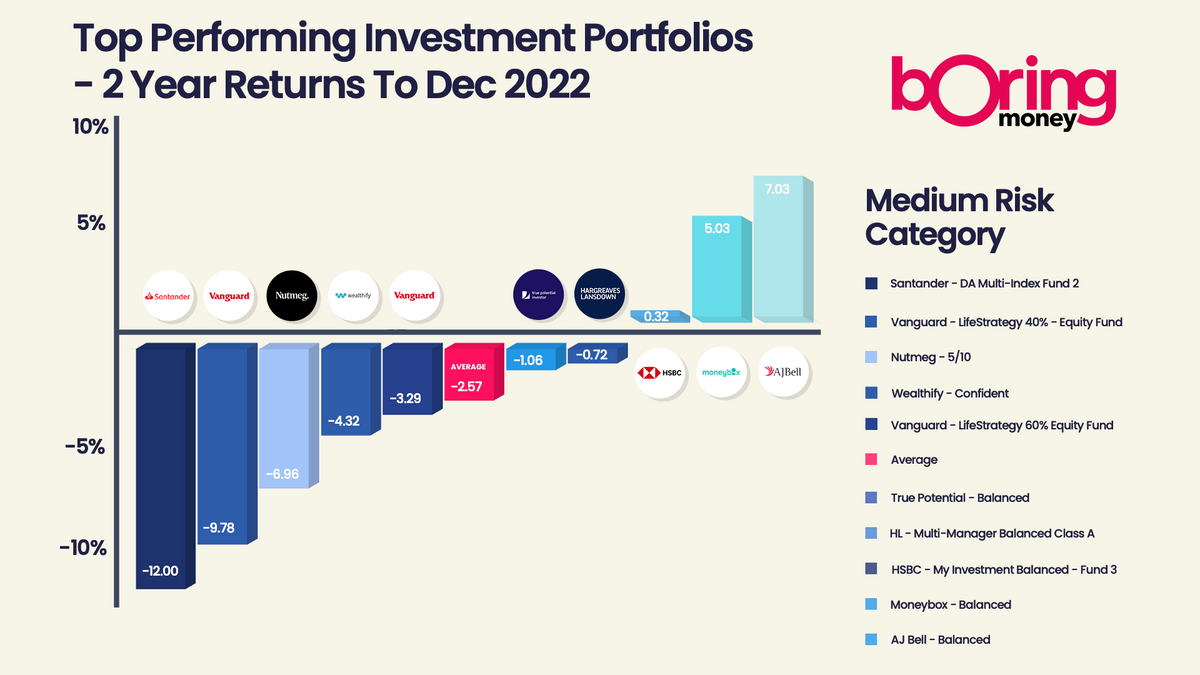

With a typically higher weighting in bonds than the high-risk options, medium-risk ready-made portfolios recorded sore losses in 2022, posting average losses of 10.7% for the year. These options typically have a range of between 40% and 60% in shares.

Santander's 'Multi-Index Fund 2' had the worst mauling over a 2-year period with losses of 12% over this timeframe. Ouch! The most cautious of the bunch in terms of holdings, it’s ironic that this conceptually cautious approach – loading up on theoretically low-risk bonds which then broke the rules as Liz Truss broke the economy – was the thing that burned them.

Scroll down for more information and the full table of performances!

Top performing ready-made portfolios

In the interests of fairness, and to show how much can change in volatile markets, this same fund was the best performer in the three months to December last year, making 5% in these 3 months alone.

Another fund with a similar weighting to bonds, the perennially-popular Vanguard 'LifeStrategy 40% Equity', has had an equally miserable two years.

Posting better performance though, AJ Bell’s 'Balanced' returned the most in this category over both a 2-year period and a 3-year period. Next up over the 2-year timeframe were Moneybox and HSBC.