Top performing ready-made portfolios

20 Jan, 2023

2022 was a bleak old year for every ready-made portfolio. Things got a bit better in the last 3 months of the year, but every ready-made investment option we cover recorded a loss in 2022.

Two things really stood out. First up, more cautious investors will be feeling shaken by 2022. Medium and low-risk investments had an unusually dismal year thanks to the poor performance of the usually mild-mannered bonds, which nosedived in September after the badly-received mini budget sent bond prices tumbling.

And secondly, the strong US dollar meant that this became a critical question for all firms – some made the long-term decision to remove currency risk and use ‘hedging’. You can argue for and against this as a strategy and some years you win, some you lose. In 2022, those who hedged – or removed the impact of currency moves – actually lost out on some nice currency gains.

Scroll down for more information and the full table of performances!

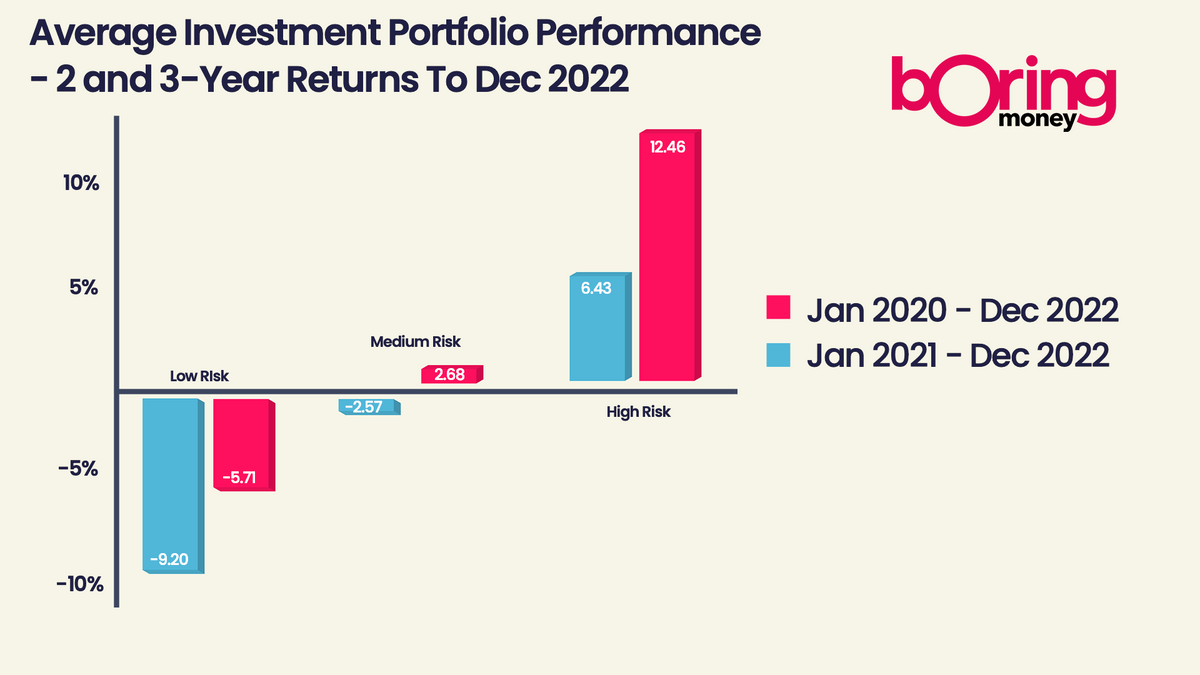

Average ready-made portfolio performance by risk level

Investing is, of course, a long-term game and 2 years is still quite a short timeframe to judge performance. If we also include the 3-year returns, it doesn’t change who has done well very much, but we can see the negative effect that adding 2020 to the mix has.

Using man-made dates like 1 January to ‘book-end’ performance windows is also imperfect – of course we don’t worry about this as investors – just how much something has gone up by since we bought it.

And looking ahead to 2023, those who hold more bonds, or those who hedged, might yet have a cracking year. So treat these numbers as interesting – but not the final say on who is any good.

Top ready-made portfolios by risk level

Want to see the top best-performing ready-made portfolios for each risk level? We've got you covered!