11 Dec, 2020

Lesson 7:

10 things you need to know

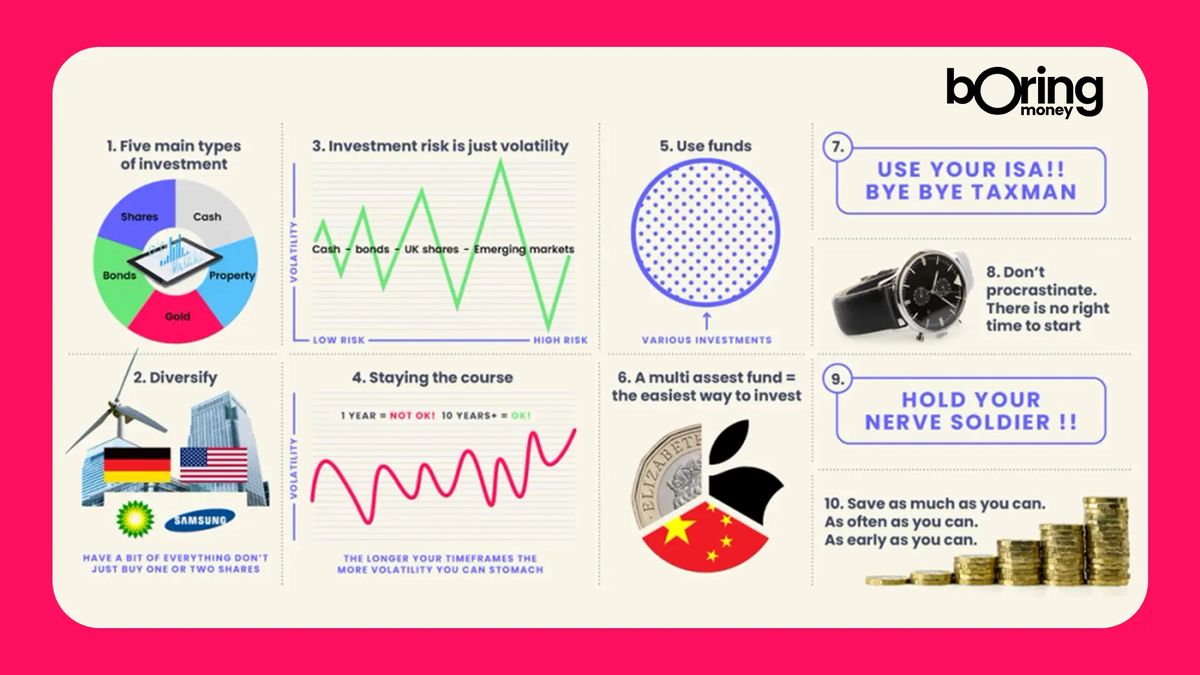

Finally we recap this course with a 10 point summary of what we think the main things are for a beginner investor to know and understand.

Here’s an infographic as a summary to get you going. A little appetiser. And you can read more below.

1. There are 5 main types of investment that retail investors tend to think about. Cash. Property. Gold. Bonds. Shares. Bonds are when we lend money to countries and companies in return for some interest along the way – the more risky the country or the company, the higher the interest rate on offer. Shares, or equities, are literally buying ownership of a small fraction of the company.

2. Generally it’s a good idea to have a mix of this stuff because they balance each other out. If Putin starts making threats about nuclear attacks, shares will typically fall because it’s seen as a threat to the normal functioning of companies and markets. No-one’s thinking about buying a new car, flying or importing steel for their factory when a nuclear threat is raging. But at the same time the price of gold would probably soar because it’s tangible, you can keep it under the bed and it’s seen as safe when everything else is not.

3. We all know that investing carries risk, but it's not the same as running across a motorway! Investing risk typically means volatility and is not to be confused with being cavalier or putting it all on black. It’s just describing how much something will jump up and down in value. Cash is like a staid old tortoise. Bonds are like a gentle wave. UK shares are like the Peak District. And Emerging Market shares are like a grasshopper on speed.

4. One of the only really important questions is how long your timeframes for investing are. The main thing is to avoid being a forced seller when things are rubbish. If you had invested in 2005 and needed the cash to buy a house in 2008 after the global meltdown, you would have been stuffed. If you had invested in 2005 and taken the money out in 2015, you would have made 74%. The longer your timeframes the more volatility you can stomach. If you are saving for 20 years and are sitting in the comfort blanket of cash, the major risk is that you won’t have enough money when you retire. Taking out a cash Junior ISA for a baby is nothing short of bonkers. This is an 18 year contract so for heaven’s sake spice it up for schnookums.

5. Less confident or time poor investors should avoid buying single shares or following tips from the cabbie or an ‘expert’. Use a fund. This has been true since the 1600s when investors realised that packaging together and backing multiple ships and journeys of the East India Company was smarter than backing one which could be sunk or raided. Think of a fund manager like a personal shopper you employ to find the best things for you and match them together. A fund will typically have about 30 – 80 investments in it so you don’t have to do the choosing or monitoring.

6. A great way to start is with a ‘multi-asset’ fund. Back to point 2. This means you pick one investment fund and in that, the experts will blend all of those investment types from around the world. So you get a truly balanced meal with a dash of China, a dollop of bonds and a pinch of Apple. A passive multi-asset fund is the cheapest way to get going. You will generally have to choose how risky you are prepared for this to be. Back to question 5 and timeframes. 5 years or less? Go less risky. 10 years or more? You can spice things up.

7. Don’t pay more tax than you need to. We all have a £20,000 ISA allowance every year. An ISA is like a see-through financial Tupperware box you stick your investments into and the tax man can’t get into it. Use it.

8. Don’t procrastinate. There is no right time to start and no-one has a clue what the future holds. Not even very clever grey haired Mathematicians. We live with dodgy global leaders, oil price shenanigans, pandemics and in a nation that likes Love Island. This all defies logic and how grown-ups should behave. Drip feeding in a little every month on a direct debit is a good way to smooth out the price at which you buy in to the markets.

9. Do not panic if in year one things go south. In 2008, £1,000 in the FTSE fell to about £700. The next year it basically made it all up. If the Daily Mail shrieks stock market meltdown in the headlines, consider topping up. The stock market is “On Sale” and cheaper than it was last week. This takes cojones by the way, but is actually quite sensible.

10. Ignore all the waffle and jargon and over-complexity. If the experts could really predict what markets would do they wouldn’t need to work as an expert. Save as much as you can, as often as you can, as early as you can. Pick a simple investment to get started with. Don’t overpay.