Holly's Blog: Our exclusive robo performance!

28 Jan, 2022

This week we can share our exclusive review of robo adviser performance. At BM HQ we have been collecting data for years and now have a 2-year track record for all major robo advisers. #dizzyingexcitement

How Have They Done?

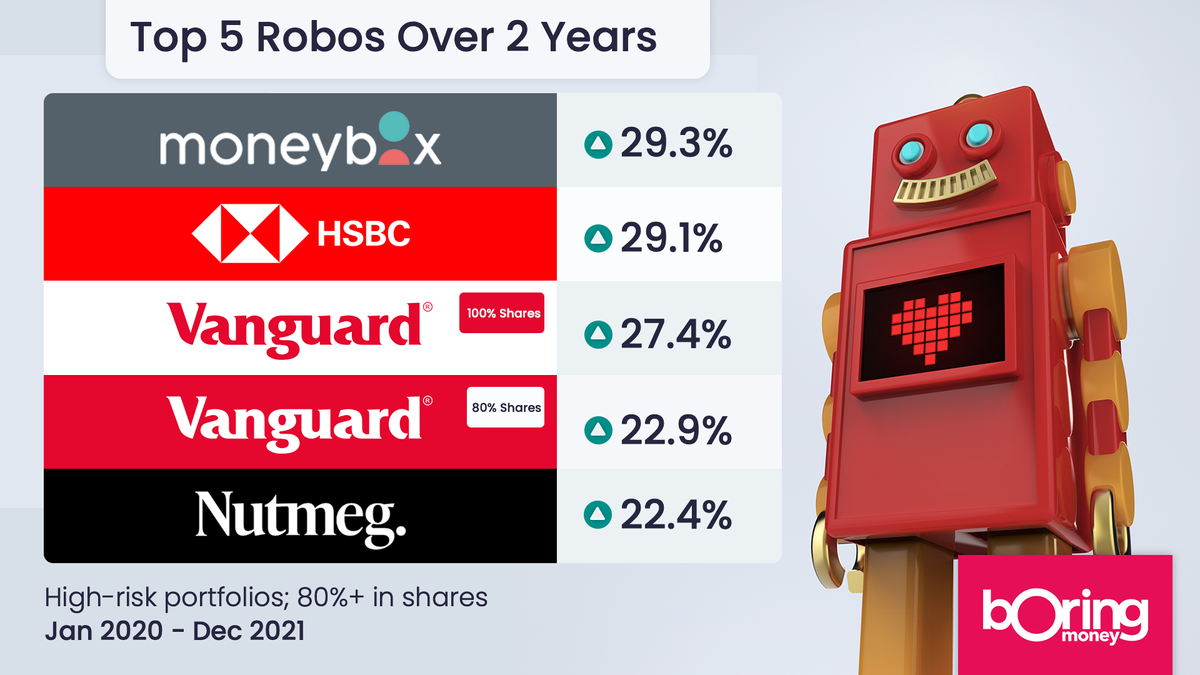

Since January 2020, the best-performing high-risk robo advisers have gone up by a huge 29%. And yes – this is after charges.

High-risk is a quick and arguably lazy way of describing those collections of investments which have more than 80% of the total pie in shares. More volatile stuff. Because let’s not forget that this lovely 29% describes the book-ends at either end of a time shelf which included a market collapse in March 2020 - as a pangolin, a bat and a virus put our lives into freefall. So there was some drama and angst disguised by this 29% headline.

The Top 5 performing robo advisers Jan 2020 – Dec 2021:

You can see the full detail and look at the best performing robos in Higher Risk, Medium Risk and Lower Risk categories here.

One of the reasons investments are so tricky, and make so many people feel frustrated with the lack of clear, simple answers, is that this is all quite nuanced and not a full like-for-like comparison.

First, not all of these guys have the same amount in shares.

An example:

Vanguard LifeStrategy 80% has – guess what!? 80% in shares. (Don’t you love it when the engineers are put in charge of marketing and naming. Their version of hell would have been working at a telco which decided to call itself Orange.)

The theory goes that the more shares you have in a mixed bag of investments (which will include shares, bonds and cash) the more you should make. Economists talk about Modern Portfolio Theory. Normal people talk about More Bang For Your Buck. No Pain No Gain. So you would expect a portfolio with 90% in shares to do better than one with 80% in shares. Or why have the bumpier ride and face occasional hernias if there aren’t better results at the end of the day?

So you could well say that Vanguard 80%, which has returned 23% over 2 years, is ‘better’ than Nutmeg, which has returned 22% over 2 years with 93% in shares.

Another more pronounced example can be seen in our Medium Risk portfolios. HSBC’s Balanced Fund 3 has 52% in shares. And has returned 20% over 2 years after fees. Hargreaves Lansdown's Balanced Fund has 75% in shares. So a lot riskier. But has only returned 11% after fees over 2 years. So higher on bang but lower on buck.

Cue bulging Inbox with grumpy providers saying That’s Not Fair!!....

Trouble is that 2 years is not a very long time.

My dog, affectionately known as The Idiot, would stand a good chance of sniffing out a collection of good performing shares for one year. The challenge is to keep it up over time.

In January this year, we have seen tech shares and the tech-heavy US market get a slap. So for example, investor favourite, the Scottish Mortgage Investment Trust, with a hearty serving of tech shares and a 44% allocation to the US is down 29% in three months. Back in the land of ready-made collections of investments and the Vanguard LifeStrategy 80% is down about 3% over the last 3 months. But the Santander Multi-Index 4 fund – which is at the bottom of our full performance chart over a 2 year period - has only lost 0.5%.

Why are some doing better now?

This will be in part because banks are cautious creatures, after collective and historical poor behaviour and ensuing slaps and fines. Once bitten, twice shy, so they will build in more shock absorbers to portfolios and limit the spice. The Santander option has only about 17% in US shares, which is much less than most others in our research. It could be that they fare much better in 2022 if shares, tech and the US have a wobble. So don’t just assume the top three in these performance tables are The Best. They are Good. But not empirically The Best.

Oh Gawd you’re getting Boring..

OK sorry. The bottom line is this:

• These ready-made collections have done pretty well. For those of us managing our own portfolios – are you doing better after all costs? Reeeeallly?? Be honest!

• If you are one of many readers not investing because it’s too hard – these guys do it for you. So that’s not an excuse.

• Too many people make no decisions because they want to make THE BEST decision. Meanwhile, in the messy business that is modern life, the quest for perfection just impedes progress (unless you are Leonardo Da Vinci). Most of the providers we cover here are doing OK. So just get on with it!?

(This assumes the usual - you don’t have expensive credit card/other debt to pay off; you have a cash buffer of 3 months’ salary +; you have timeframes of AT LEAST 3 years for your savings etc.)

• We don’t review dodgy schemes, timber/ shipping/vineyard nonsense or weird crypto alchemy! All these providers offer very diversified mixed bags of decent investments. Which is good.

• BUT. If providers have comparatively little in shares and still do badly then they have some questions to answer and this starts to look ‘a bit dodge’. And the longer the timeframes, the more this becomes officially dodge, not just anecdotally dodge.

Over and out from me. I’ll leave you with 2 things.

First – an invitation to our webinar at 6pm next Tuesday designed for our readers who have hit the big 4-0 and need to get their heads around investments and pensions. I’ll be joined by Aviva’s pension and retirement expert Alistair McQueen and financial planner Justin King – these guys know their stuff! We have over 50 questions so far and 430+ signed up so join us for money fun and frolics. This session will have a mostly ‘How the hell do I sort out a pension and do some sensible things?’ vibe.

Second – some weekend reading. As sustainable investing continues to evolve, you may be interested in this piece from M&G’s Head of Sustainable and Impact Investing who considers how to tell purpose from PR.

Over and out for this week. Have a great weekend everyone.

Holly

Sponsored message:

Why companies need a purpose - and why it can lead to success

"What are we in business to achieve?", company management might ask at a board meeting, usually rhetorically. Rewind the clock 20 or 30 years and the most common answer to this question might well have been to deliver value to a company’s shareholders.