Holly's Blog: Woke capitalism and sustainable disillusionment

10 June, 2022

Huge debates raging this month about so-called ‘woke capitalism’ and backlash from Global Big Wigs about having an ESG (environmental social and governance) agenda shoved down their throats.

It seems the goodwill vibes of the Queen playing spoons to We Will Rock You with Paddington (OMG how I LOVED this!) only lasted for 24 hours before we got back into angry disillusionment with politicians, train drivers, fund managers and most people on Twitter.

We can see that the 2020 sheen of sustainable investing has waned. Appetite remains strong but fears of greenwashing have escalated. Who can we trust?

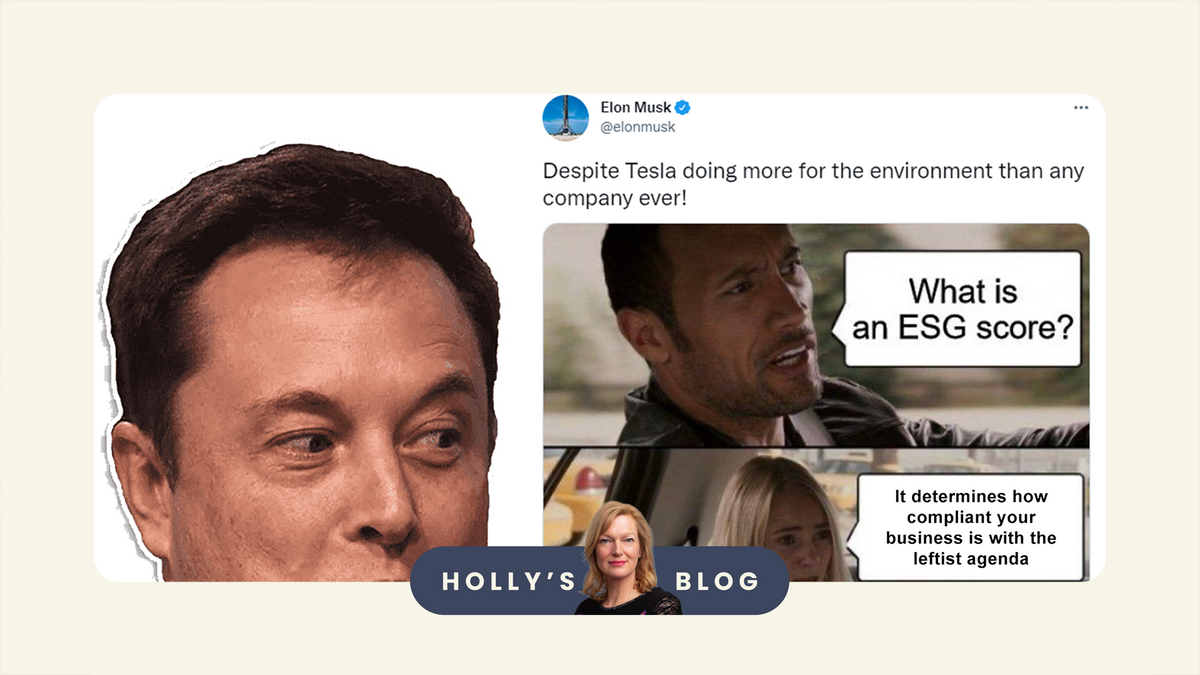

Some undoubtedly smart fund managers have questioned slavish adherence and group think. The former Head of Sustainability, turned whistleblower, at Deutsche Bank said, “ESG is in danger of becoming a bureaucratic tax on investors and shareholders…..We’re living in a world where ESG executives are paid on PR statements and aspirations rather than on actual impactful results.” HSBC has recently suspended its Head of Responsible Investment who claimed that “climate change is not a financial risk that we need to worry about.” And the human loudspeaker that is Elon Musk labelled ESG “ a scam” after Tesla was dropped from the S&P ESG Index, blaming a “leftist agenda”.

I understand the asset managers’ concerns but as for Elon, his complaints about this remind me of a spoiled kid, endlessly adored by his social media parents, who blames the independent teacher who observes that he’s not all that great at everything after all and just maybe the sun does not permanently shine out of his @rse! There’s an S in ESG as well as an E.

Greenwashing or what!!?......

I had an email from a reader this week who was cross because a fund manager with a glossy website stuffed full of pictures of whales and wind farms was actually producing a fund which, when she looked under the bonnet… “I find not just known tax evaders but also oil and gas exploration. Greenwash, or what!!?”

We know that many of our readers experience similar disappointment. The vast majority of funds still only disclose their top 10 holdings (industry – this needs to change!) and our research confirms that this is where many people start their investigations. If they see BP or Shell in a so-called sustainable fund, many feel cheated. Or at the least have questions which are not tackled in an upfront easy-to-find manner.

As investors we need to understand that there are several flavours of ‘ESG’ funds we can choose from and so it’s key that we align our preferences to what the product offers.

If it’s an ethical fund, then it’s all about what is excludes. It’s a No Nasties approach. No fags, weapons, porn , tobacco, booze, fossil fuels etc. So that’s pretty clear cut if your main driver is what NOT to hold..

The ambiguity comes with ‘sustainable’ funds.

These can be thematic in approach. Focus in on one core issue. So take the abrdn Multi-Asset Climate Solutions fund, for example. This fund expressly focusses on climate and as well as screening out fossil fuels, and will positively include clean power, energy efficiency and green buildings as themes. A core metric they measure is the % of green revenues from the fund's holdings – it’s around 79% compared to an average of 8% for a general portfolio of global shares. This fund also gives 20% of net revenues to The Big Issue to support its social causes – it’s an interesting product.

Some sustainable funds are much broader and focussed on all aspects of E, S and G. This is where the ambiguity kicks in. Generally we should expect no more from these funds than being filled with ‘less crap stuff’ than the norm today. It’s general progress rather than radical change. You cannot assume that a ‘Sustainable’ label will equate to your definition of the same.

To engage? Or to exclude? In some of these funds you will find fossil fuels, for example. This is not necessarily greenwashing. It’s really important to work out if an asset manager believes in engagement or exclusion. Some will just say a flat no to fossil fuels. BMO for example takes this approach with their responsible range. Full Stop. Others will say that they need to have a seat at the table to effect change – and starving these businesses of capital and effectively forcing them into private equity hands will achieve worse outcomes, without all the disclosure and scrutiny that fund managers and public ownership bring to bear. It’s a complicated debate.

It’s for all of us to judge if this passionate advocacy for engagement is followed up by meaningful action (as it is by impactful smaller brand Sarasin, for example) or just lazily trotted out by those who want their goody-goody cake and to eat it.

As for ‘woke capitalism’…..

I don’t really know what ‘woke’ means anymore. It seems to be a fluid concept determined by any individual’s specific interpretations of what is stupid avocado-toast-munching-nonsense. Which of course differs radically for us all. If we strip it back, I don’t see how using our capital to back progressive businesses which aren’t run by dodgy people and treat both people and the planet with respect is a bad outcome? They are more likely to still be around in 20 years’ time (remember Enron?), to avoid big law suits (tobacco), to mitigate reputational risk (Facebook), to keep up with changing consumer tastes and trends (electric cars) – yadda yadda yadda.

And if you see the wall of money being put towards carbon transition, there’s a pretty compelling business case behind this too.

I think what went wrong was the fund managers’ fervent desire to jump on a populist bandwagon and try to reinvent themselves in the public eye as zealous corporate Greenpeace warriors, here to save the planet and its populations. And fund managers don’t look that convincing in superhero underpants. (Grim visual image, sorry!)

A more measured dialogue about work in progress, outlining gradual change and progress, would be more realistic. Supported by much clearer labelling of what any given fund is – or isn’t. What are the exclusions? Does the fund exclude or engage? What are the aims? And yes show us the full holdings. And where something jars or looks odd – tell us why?

Fund managers – if you stop making like unlikely superheroes and behave like mere mortals on a gradual capitalist journey and evolution, I think we’d trust you more.

On the flip side of the coin, I think we can all help ourselves by articulating what we want from sustainable funds – is it No Nasties? Climate-focussed funds? Generalist ‘less crap’ funds? And do we believe that engagement is a better solution than exclusion – or not. If you want help with third-party research, investment platform interactive investor probably leads the platform pack on decent fund research here, and global research firm Morningstar has helpful tools and research. Or take our Sustainable Savers quiz to see a shortlist of Morningstar-rated funds which map to your criteria and preferences.

Have a great weekend everyone.

Holly

Stay up to date!

Already have an account? Login