Managing a world of growth opportunities

24 Aug, 2023

Sponsored by Martin Currie Global Portfolio Trust. Written by Zehrid Osmani, Portfolio Manager, Martin Currie Global Portfolio Trust

One benefit of running a global portfolio like Martin Currie Global Portfolio Trust is the opportunity to invest in some of the world’s leading companies, unrestricted by their location.

However, this wide remit presents a challenge – how to narrow down the options to identify the companies that will make a good long-term investment.

An advantage of being focused on a 5-10 year investment horizon, however, is the freedom it affords to ignore the daily market noise which is often sensationalised to satisfy the demands of rolling 24-hour news.

Megatrends – multi-decade growth potential

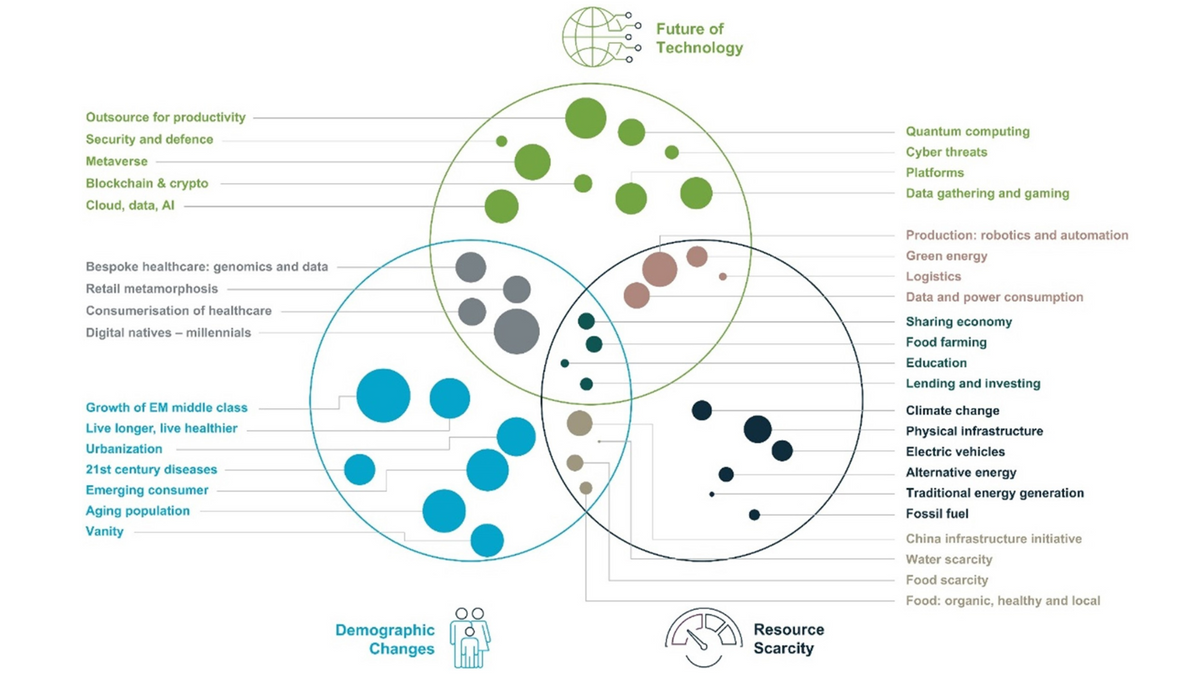

Instead, to focus the mind, we have developed a unique framework built around three growth megatrends that we believe encompass a range of multi-decade growth opportunities.

They are Demographic Changes, Future of Technology and Resource Scarcity.

Think of them as the primary colours of investing from which we develop a palette of sub-themes as outlined in the diagram below.

For example, “Cyber threats” is an important sub-theme classified under Future of Technology.

“Food Farming”, however, is one that sits in a sweet spot and is captured by all three; food and farming are finite resources which must feed a growing global population, and technology may help to develop new solutions.

Example of Thematic framework for Martin Currie Global Portfolio Trust. For illustrative purposes only.

Let’s looks at some examples of companies we invest in that bring this to life.

1. Energy efficient infrastructure

Sizeable government initiatives are backing infrastructure to help decarbonise economies.

Key to this is the need for greener and more energy efficient buildings. This is providing a long-term structural growth opportunity - particularly in the construction sector.

For example, US-based Autodesk produces cutting-edge design and engineering software that helps companies innovate products that optimise resources, minimise energy usage and reduce the environmental impact.

And this theme has an extensive ecosystem.

We also invest in companies that benefit from the trend towards greener buildings and have leadership positions in manufacturing insulation materials. They may also benefit from any tighter energy efficiency regulations introduced.

2. Robotics & automation

We predict rapid adoption of digital technologies and robotics as companies focus on making their supply chains more robust and production capacities more resilient.

Innovative solutions include ‘smart’ factories, automated warehouse monitoring, digitised logistics and remote maintenance.

US firm Ansys develops, markets and supports engineering simulation software solutions for product design and operation. They are a leader in Multiphysics solutions that aim to solve an infinite number of problems via simulation, with wide industrial applications from autos to semiconductors.

Hexagon, a Swedish technology firm, is exposed to the Internet of Things (IoT), providing customers smart solutions for interconnected factories, construction sites and cities.

3. Healthcare infrastructure

Following the Covid pandemic, we predict an increase in healthcare spending and innovation, as governments endeavour to make their infrastructure more resilient.

We also expect personalised healthcare, digitalisation and outsourcing trends to accelerate.

US firm Illumina, is making genetic sequencing more accessible and this opens up a wide range of applications - from tackling infant mortality and vaccine development, right through to agriculture applications and disease resistant crops.

Focused on growth

It’s clear that the global economy is full of potential growth, contrary to the message of many doom-mongers.

What’s more important – and what we see as the key to success as an investor - is a focus on selecting the right companies that will generate sustainable growth.

Our megatrend framework helps us to hone-in on the areas of the economy that we believe offer structural growth opportunities and to focus our fundamental research on identifying the companies that will benefit most.

The information provided should not be considered a recommendation to purchase or sell any particular security. It should not be assumed that any of the securities discussed here were, or will prove to be, profitable.

Further reading

What are the risks?

All investments involve risks, including the possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested.

Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Special risks are associated with foreign investing, including currency fluctuations, economic instability and political developments.

References to particular industries, sectors or companies are for general information and are not necessarily indicative of a fund’s holding at any one time.

Franklin Templeton Investment Management Limited, Cannon Place, 78 Cannon Street, London EC4N 6HL. Authorised and regulated by the Financial Conduct Authority. Telephone: 0800 305 306, Email: enquiries@franklintempleton.co.uk.