Pension Transfers: Costs, Timings & How To Do It

By Boring Money

17 Oct, 2025

Your Self-Invested Personal Pension (SIPP) may be one of your most important assets outside your home. You should feel comfortable with how your provider manages the service and the quality you receive. After all, it's your life savings we're talking about! But what if they're falling short? We examine your options if you're thinking about transferring your pension.

Why transfer your pension?

Changing your pension provider isn’t something you do for fun. It usually involves paperwork, can take lots of time, and if you get it wrong, it can cost you. But it can also make a lot of sense and potentially save you a small fortune in fees over the years. Here are three common reasons people decide to switch.

1. You want to consolidate multiple pots

People no longer have a 'job for life.' Many now have multiple jobs, alongside periods of self-employment, retraining, travel or caring responsibilities. This all adds to life’s rich tapestry, but it can play havoc with your pension arrangements!

You may end up with multiple pots from multiple providers, all in different investments. This adds costs and can make it hard to manage your retirement savings. Bringing them all under one roof through pension consolidation can help you stick to a consistent investment strategy and potentially save some money on fees.

8% of pension holders intend to consolidate in the next 12 months alone[1]. However, it's not for everyone and some savers may be better off keeping their pots separate, particularly if you've got a Defined Benefit/Final Salary

scheme. Moving your funds out of this type of arrangement could see you lose valuable benefits.

2. You’re unhappy with your provider

The service may be poor, the charges too high, the technology clunky, or the helpline staff... well, unhelpful. The pensions market is highly competitive, so there’s no need to put up with bad service. We're talking about a lifetime worth of saving, after all!

Poor performance, high fees and poor digital experience were cited as the top three drivers of customer dissatisfaction with their pension provider, according to recent Boring Money research. Many also report having little to no communication from their providers at all.[2]

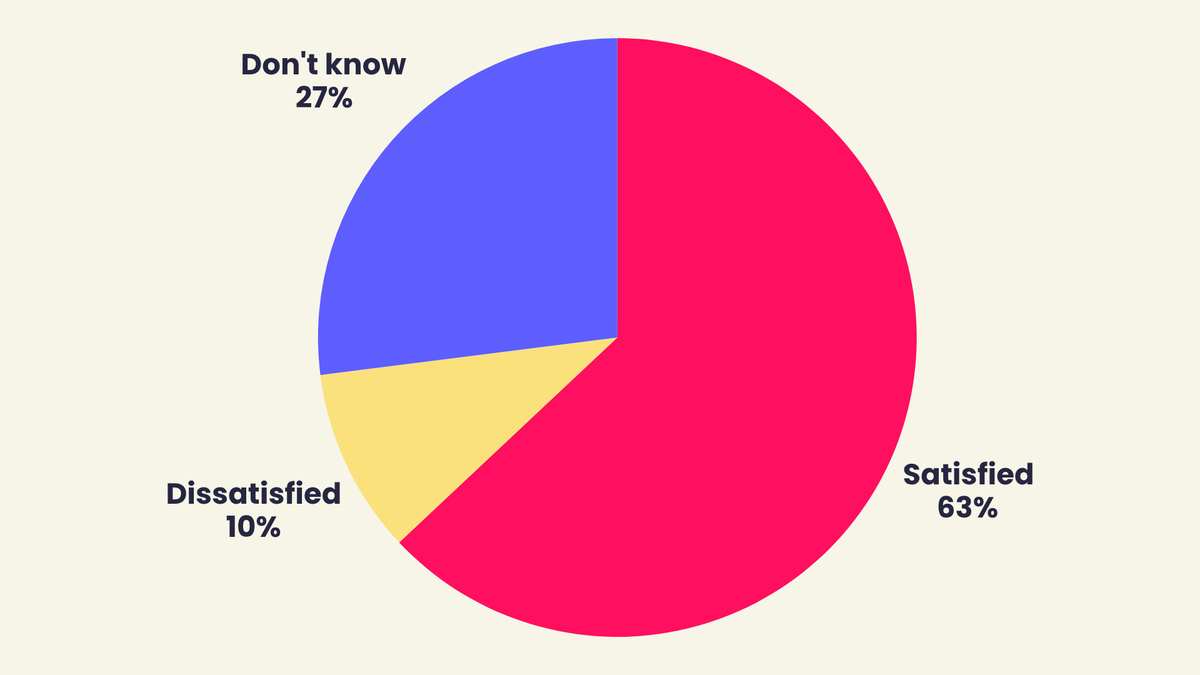

Provider satisfaction, non-retired pension holders

Source: Boring Money, October 2025

3. You want more flexibility with access

When it’s time to start drawing an income from your pension, how you access your money matters just as much as where it’s invested. Not every SIPP gives you the same flexibility, and that can make a big difference to your retirement plans.

Some older SIPPs, for example, don’t offer drawdown services. This means you can’t take a flexible income and you may be forced to move your pot elsewhere if you want to keep your money invested while drawing it down gradually.

At the other end of the scale, some providers still focus on annuities, where you swap the value of your pot for a guaranteed income for life. If you’re not interested in locking in rates and prefer to keep your options open, that setup can feel restrictive.

So, if your current pension provider doesn’t support the access method you want, it might be time to switch to one that does.

Preferences for annuity vs drawdown, pre-retired age 55+

Source: Boring Money, October 2025

How much does it cost?

Previously, exit charges on personal pensions were commonplace. The Financial Conduct Authority (FCA) released a series of rules on early exit charges for SIPPs in 2017, designed to make it easier for savers to access their pension pots.

Here's a summary of the main points:

Exit fees are capped at 1% of the value of a pension for those aged over 55 (57 from 2028)

Providers are banned from increasing the exit fees of policies where the exit fee is already less than 1%

A complete ban on charging exit fees on pensions set up on or after 31 March 2017

You can usually find the details of any exit or transfer charges on your SIPP in your documentation or on your provider's website. If in doubt, contact them directly - it's better to understand than land yourself with a nasty bill you weren't expecting.

The good news is, even if your existing provider does charge an exit fee, many providers will cover some (or all) of the costs associated with transferring a pot to them, usually capped at £500. Some even have cashback deals as well.

You'll need to do the maths on whether any exit fees are worth the cost. If you're transferring to a lower cost provider with greater investment flexibility or better choice at retirement, then it may well be worth the cost.

It's also worth looking at some of the at-retirement benefits with your existing provider. SIPP options vary and it may be that your provider comes into its own with a range of advice and choices when you decide to draw on your pension.

If the cost of switching is high and you're unlikely to see any meaningful benefit, it might not be a good use of your funds.

How long does it take?

If a transfer is unnecessarily long, this could have financial consequences if the delay affects a customer being able to draw benefits or get favourable annuity rates. A delay can also have an impact on investment opportunities and increase administration costs, potentially reducing the transfer’s value.

According to a 2025 survey by the FCA, more than three-quarters of firms completed pension transfer requests within 20 days on average.[3]

In some circumstances, the FCA found that there were delays due "to firms carrying out additional steps and checks to protect consumers from scams." It explained that providers will often reach out to the customer when they are at risk of losing valuable benefits as part of a transfer, advising them to seek professional advice before making a final decision.

Although a hindrance, the regulator concluded that this proactive consideration of the customer's best interests was defensible, stating: "firms should enable and support their customers to make good choices".

How to transfer your pension

Once you’ve considered all your options and decided to go ahead with transferring your pension, there are a number of steps you need to take.

1) Open an account with your new provider

First things first, you’ll need to open an account with your new provider and check that they support pension transfers. If so, you'll need to let them know you want to transfer an existing pension into your new account.

This is also a good early test of how responsive and helpful their customer service is. If they’re slow to answer now, imagine what they’ll be like when you actually need them!

Have your existing pension details to hand (policy number, provider name, type of scheme, etc.). Most providers have an online form or transfer process to get things moving.

2) Request a transfer value statement

Next, contact your current pension provider and ask for a transfer value statement. This shows exactly how much your pension is worth, including any exit or transfer charges. Check this figure carefully - make sure it matches your expectations and you understand any fees or market value reductions that apply. You’ll usually need to give this information to your new provider so they can process the transfer.

3) Choose how you want to transfer

You can transfer your pension as cash or “in-specie” (which means keeping your existing investments).

Cash transfer: your investments are sold, the cash is sent to your new provider, and you reinvest once it arrives. This can take a few days to weeks, during which time your money is out of the market - potentially missing gains (or avoiding losses, depending on timing).

In-specie transfer: your investments move over as they are, avoiding time out of the market. However, it can take longer and not all providers support this option.

It helps to know in advance how you want to invest your transferred funds so your money isn’t sitting in cash for too long.

4) Authorise the transfer

Your new provider will usually handle most of the paperwork from here. You’ll need to complete and sign a transfer authorisation form, either digitally or on paper. Once they’ve got everything they need, they’ll contact your old provider directly to start the transfer.

Transfers can take anywhere from a few days to a few weeks, longer if there are complications or multiple providers involved. Once the transfer is done, check both ends:

Your old pension should now show a £0 balance (or the transferred amount deducted)

Your new pension should reflect the correct transfer value

Keep a copy of all correspondence and transfer confirmations for your records. HMRC doesn’t usually need this, but it’s handy to have proof in case of discrepancies.

5) Reinvest your money (if you need to)

Finally, if you transferred your pot as cash, you’ll now need to decide where to reinvest. Your new platform will likely offer tools, model portfolios, or investment guidance to help you decide. If you’re not confident choosing investments, you might consider a ready-made portfolio or seek financial advice. Just remember: sitting in cash for too long means missing potential market growth... but rushing into unsuitable investments is worse!

---

[1] Boring Money, October 2025