Presenting Our Sustainable Disclosure Prototype

31 Mar, 2022

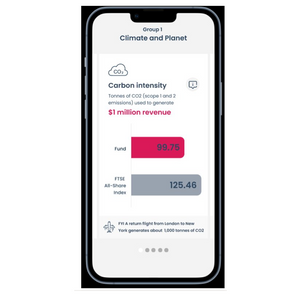

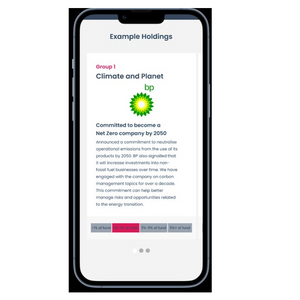

Investor interest in sustainable investing is growing, but so is confusion and concerns of greenwashing. As European regulators wrestle with disclosure, we set out to produce a prototype which shows what good disclosure would look like to the end investor. The ultimate customer of every asset manager.

We engaged with 1,500 fund investors, 120 of our blog readers and conducted 20 deep-dive interviews to co-create a ‘food label’ for sustainable funds. This is a thought-leadership exercise and conceptual only. But too often the investor voice goes unheard.

Our prototype set out to be clear, engaging, useful and – importantly – mobile-first to fit in with the reality of how investors consume information today.

Explore the prototype via the link below. Scroll through the various fund reporting, hear from the fund’s manager and Boring Money’s researched view.

What do you think?

This is a prototype and not a finished piece. Please let us know what you think and share suggestions of what’s missing, how we can improve it – or indeed what you really like about it!?

How did we do this, and what did we find?

Overall, investors felt the prototype would be an improvement on current sustainable communications.

Interviewees like the overview, and feel it is a good level of information with the ability to drill down into further detail if required.

Suggested improvements to consider:

Once they had digested the prototype, people wanted the ability to compare two funds side by side in this framework.

More interactivity within the SDG section – ability to click onto an SDG for more detail.

Develop to be viewed on a desktop for those who prefer researching on a computer or laptop.

More diversity metrics, e.g. BAME people on boards.

Show if the fund is Level 8 or Level 9 under the Sustainable Funds Disclosure Regulation (SFDR)

Be clear that the alignment of funds to SDGs can be subjective – and also clarify if this alignment is based on how any investment operates its business i.e how it is run OR based on its core revenues i.e what it makes or does.

The exploration and creation of this prototype was made possible with the support of these 6 fund managers. They all wanted to understand more about what the end investor wanted to know and see, so that they can continue to enhance their reporting and disclosure. Please do let us know what you think about the prototype.

Useful links and more information

We have used illustrative metrics in this prototype – thanks and acknowledgement to ImpactCubed, FTSE Russell, Morningstar, MSCI, ShareAction.

We have used the United Nations' SDGs:

The United Nations has commissioned seventeen (17) icons and the SDG logo, including the colour wheel, to graphically promote awareness of the Sustainable Development Goals adopted by the Member States of the United Nations by resolutions A/RES/70/1 of the General Assembly of 25 September 2015.

Please click here for more information regarding the Morningstar Sustainability Rating methodology.

For more information about how we designed this prototype, click here.

Post a comment:

This is an open discussion and does not represent the views of Boring Money. We want our communities to be welcoming and helpful. Spam, personal attacks and offensive language will not be tolerated. Posts may be deleted and repeat offenders blocked at our discretion.