Robo performance part 2: Medium risk portfolio

15 Oct, 2021

This is the second article in the series and here we’re looking at medium risk portfolios. If you haven’t already, check out the first in the series, where we explain a bit more about the project and start by looking at the performance of portfolios in the high risk category.

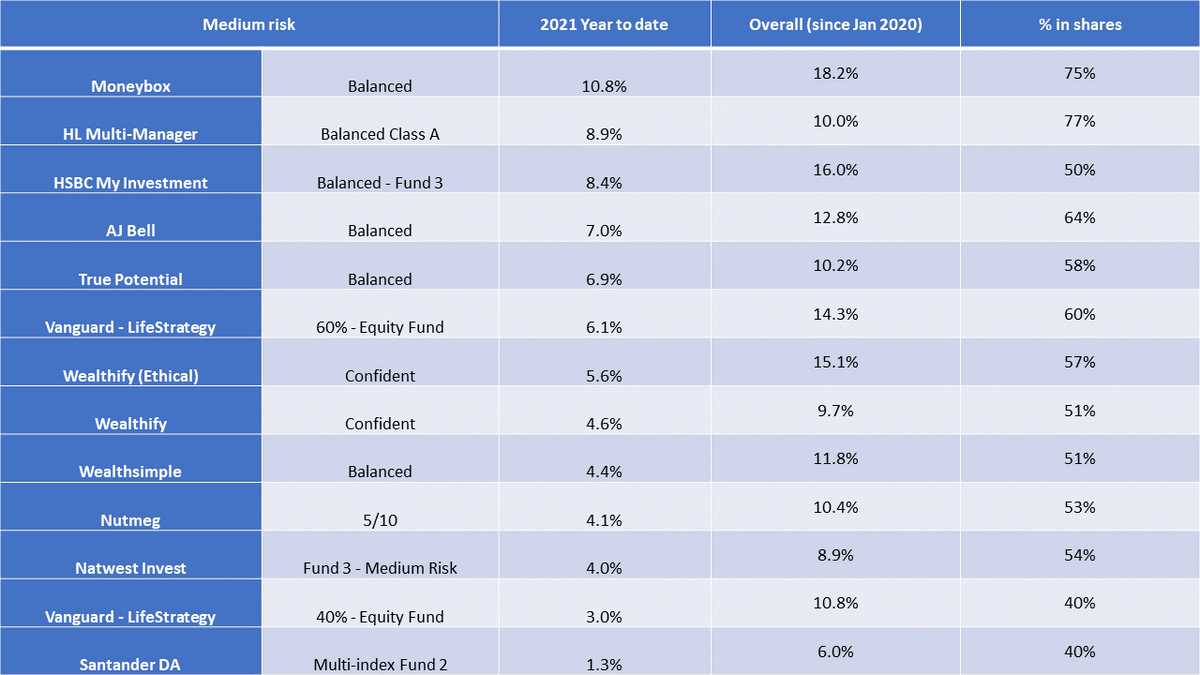

For the year so far, Moneybox’s Balanced portfolio is the top performing robo adviser in our mid risk category of portfolios. After a bumper return of 3.1% for the quarter to the end of September, it has racked up a return of 10.8% in 2021.

Hargreaves Lansdown’s readymade balanced fund comes in second place, at 8.9% for the year after a reasonable quarter. Although not strictly a ‘robo adviser’ (HL is an investing platform that offers shares, funds, and also some readymade multi-asset funds that offer a one-stop-shop portfolio) we include it for comparison here. For investors that are unsure about building their own portfolio and want an off the shelf option, readymade portfolio from the likes of AJ Bell and HL do a similar job to their robo peers.

Moneybox Balanced is also the strongest performer over the 21 months since January 2020, with a return of 18.2%. HSBC comes in second with 16%, and Wealthify’s Ethical Confident portfolio third.

At the other end of the spectrum, Vanguard’s LifeStrategy 40 and Santander’s Multi-index 2 have returned 3% and 1.3% respectively so far this year, although returns since the start of 2020 (shown in the second performance column) illustrate that the story can be different over a longer timeframe. The 10.8% return on Vanguard’s Lifestrategy 40 puts it in the middle of the pack since January 2020.

Shares

Another important point here is that both these portfolios hold just 40% in equities, as shown in the column on the right hand side. We group portfolios with 40-80% in shares together in the medium risk category. That makes it quite a broad church.

Although you can see all the portfolios have similar names like ‘Balanced’ or ‘Confident’; there is still a wide range of different allocations to shares. We saw a similar thing in the high-risk category.

We approach this exercise as normal customers would, investing our own money so that we can report based on real experience. Because of that we also select portfolios from each provider based on what we feel is presented to the customer as the best option for their chosen risk level, rather than trying to game the system and selecting portfolios that offer an identical match in terms of their % in shares. Although that would give more of a like-for-like comparison, we know that most investors are guided by the risk labels so we do the same.

The key take away here is that although the ‘balanced’, ‘moderate’ or ‘medium’ label is a reasonable guide to their status as the supposed goldilocks option – not too hot, not too cold – that only tells half the story.

Investors should think of it like comparing two hatchbacks – they both look pretty family friendly on the outside, but when you lift the bonnet as we do here, you find one has a slow but steady engine while the other has a two litre turbo. To understand how they drive, you need to look beyond the shiny paint and slick dashboard.

What next?

You can also dig a little deeper by taking a look at our compare tables, or check out the latest performance update for the low risk portfolios here.

You can compare providers and review the ones you use here.