Best performing medium risk robo advisers of Q1 2023

Which medium risk robos performed the best?

By Boring Money

21 April, 2023

Every quarter, Boring Money collects performance data from the UK's ready-made portfolio market - in some cases through its own test accounts - to bring you the latest insights into how ready-made portfolios across different risk categories* have performed.

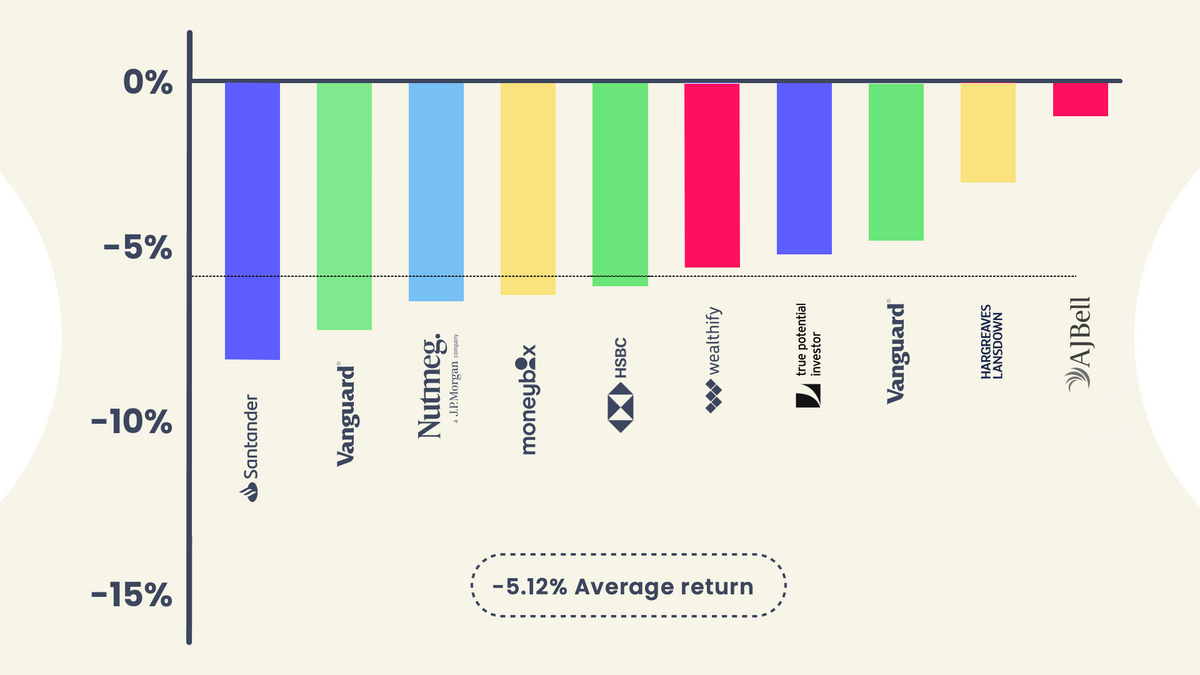

Annual returns to March 2023

Graph illustrating net returns for one year covering April 2022 - March 2023. Data correct as at 31st March, 2023. Returns calculated net of charges.

Our full analysis

Already have an account? Login

How did medium risk ready-made portfolios perform in Q1 2023?

After disappointing results at times during 2022, ready-made portfolios have had a decidedly more positive time of it in Q1 2023. Every single one of the medium risk ready-made portfolios we track booked positive returns between 1 January and 31 March, spanning from just 0.71% (AJ Bell's 'Balanced') to a more substantial 3.60% (Vanguard's 'LifeStrategy 60% Equity Fund').

If you fancy diving into the details, we've rounded up the best performing medium risk portfolios in Q1 2023 and beyond in the table below. They're ranked by their net growth (after charges). Click on each provider in the left-hand column to read more about what we think of them, which of our awards they may have won, and what their customers have to say.

Best performing medium risk ready-made portfolios

Provider | Fund / Portfolio | Risk Level | Q1 2023 Net Growth | 1 Year net Growth | 2 Year Net Growth |

Vanguard | LifeStrategy 60% Equity Fund | Medium | 3.60% | -4.71% | -0.04% |

Vanguard | LifeStrategy 40% Equity Fund | Medium | 3.37% | -6.76% | -5.06% |

Nutmeg | 5/10 | Medium | 3.27% | -6.64% | -3.87% |

Hargreaves Lansdown | Multi-Manager Balanced | Medium | 2.54% | -2.55% | -1.16% |

Santander | Multi-index Fund 2 | Medium | 2.47% | -7.54% | -7.95% |

HSBC | Balanced - Fund 3 | Medium | 2.28% | -5.66% | 1.02% |

True Potential | Balanced | Medium | 2.13% | -4.93% | -1.27% |

Wealthify | Confident | Medium | 2.11% | -5.62% | -2.94% |

Moneybox | Balanced | Medium | 1.36% | -5.83% | 4.98% |

AJ Bell | Balanced | Medium | 0.71% | -1.00% | 5.61% |

Key terms:

Provider

The investment provider that manages your ready-made portfolio.

Fund/Portfolio

The name of the ready-made portfolio that is allocated to you by your investment provider. This will typically include a mixture of cash, bonds and shares at different proportions depending on your chosen risk level.

*Risk Level

The perceived level of risk associated with your ready-made portfolio. There are three main risk categories - low, medium and high - which we assign to each. For the purposes of this exercise, ready-made portfolios with an equity exposure of under 30% are considered low risk, funds with 70+% equity are high risk, and the rest are categorised as medium risk.

Q1 2023

'1st quarter'. The period between 1 January 2023 and 31 March 2023.

Net Growth

The total growth of a portfolio minus charges.